Overseas investors continued to dominate transaction activity in 2018, driven by a number of large portfolio deals

Overview

Resilience in the face of Brexit is the key feature of the UK hotel market as we head into 2019.

Transaction volumes increased 25.2% to total £6.6bn in 2018 supported by continued overseas investor appetite. This is likely to continue over 2019, particularly for its tourist markets, as whether the UK is in the EU or not will do little to dent its appeal to international tourists. Structural shifts in consumer spending, with a shift towards ‘experience’ activities such as holidays, will also support demand and in turn operational performance in the face of rising supply. However, going forward, we may see these shifts shape guest preferences when it comes to branding and type of offer.

This year we will also see more investors move up the risk curve in 2019 on the hunt for higher yielding opportunities. As a result we are likely to see a more diverse range of buyers in the management contract space and in the less mature subsectors such as serviced apartments and hostels.

An increasing number of retail to hotel conversions will also emerge this year. While this is in response to the structural shifts in retailing, which is driving retail vacancy, these conversions have the potential to provide a sense of place, supporting the retail that remains.

While the sector drivers remain robust, margin challenges will continue this year. The real change from 2018 will be its influence on investor preferences, to the benefit of operators and subsectors that enjoy higher margins.

Hotel investment volumes grow

2018 was a particularly buoyant year in terms of transaction activity with volumes totalling £6.6bn, exceeding the 2017 total by 25.2%.

Much of this growth was driven by an increase in portfolio deals which totalled £3.5bn, 2.3 times the 2017 total and representing 53.3% of total volumes. This was the third consecutive year of volume growth.

Despite the Brexit uncertainty overseas investors continued to be the most active, in particular those from Europe and Middle East, highlighting their continued confidence in the UK hotel market. Acquisitions by this group reached £3.4bn in 2018, 22.5% up on 2017 and the second highest annual figure after the 2015 peak of £4.3bn. Almost 70% of this 2018 total was accounted for by portfolios. These included Israeli investors Vivion Capital Partners acquiring the 20-asset Holiday Inn and Crowne Plaza portfolio from Apollo Global Management for £742m, with French investors, Covivio, acquiring the Principle Hayley portfolio for a reported £847m.

Investor appetite is set to remain in 2019 with overseas buyers continuing to dominate. However, with fewer portfolios likely to come to the market we may see a slight softening in volume terms with deal count holding.

Overseas investors have contributed to the lion’s share of portfolio transactions in 2018, totalling £2.4bn

Savills Research

UK institutions looking to management contracts in the pursuit of higher yields

An emerging trend has been the acquisition of hotels on management contracts by UK Institutions. Leased assets, particularly those with strong covenants and typically favoured by this buyer group, have seen significant yield compression over the last five years with indicative prime yields now in the region of 3.50–4.00%.

The hunt for higher yielding assets has already resulted in a growing interest in leased assets with weaker covenants. This has now shifted into the management contract space helped by the fact that prime indicative yields are in the region of 150bps higher than those leased on strong covenants. L&G, for example, bought the Hampton by Hilton Stansted Airport hotel in October 2017, with Blackrock acquiring the Hilton Garden Inn Birmingham Airport in September 2018.

.png)

Transaction volumes and prime yield Year-end 2018 volumes topped 2017 totals and exceeded the 15-year average by 59%. This continued investor appetite has resulted in the marginal hardening of yields

Source: Savills Research

London is, understandably, the largest city market in the UK with transaction volumes of £2.7bn in 2018, exceeding the previous 2013 peak by 10.2%

Savills Research

The size of the management contract space (in terms of deal count) is relatively constrained, representing only 6.5% of transactions in 2018. Whereas, leased transactions accounted for a 24.2% share of transactions over the same period. With a broadening buyer pool however, this share will increase improving the range of opportunities available for investors.

The appeal of management contract acquisitions is not just confined to pricing, the ability to benefit from strong operational performance and asset management is an added attraction. But, it does mean more exposure to operational risk, costs and increased complexities due to employee liability.

Despite these relative risks we expect UK Institutions will look to take on additional operational risk in 2019. Yet, it will require much greater deal scrutiny in terms of the asset itself, cashflow and local market dynamics. More importantly it will require working with credible operational partners.

The return of the regions

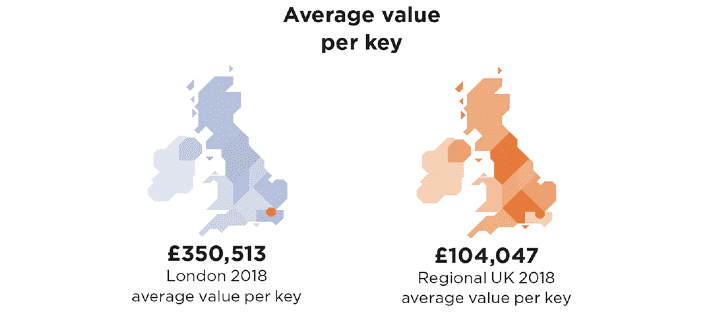

London is, understandably, the largest city market in the UK with transaction volumes of £2.7bn in 2018, exceeding the previous 2013 peak by 10.2%. However, its share of the wider UK market has been softening over the last 5 years due to pricing and availability constraints. Regional volume share was 59.3% in 2018, 3.7% above the 15 year average. While a significant share of this is attributed to portfolio deals, we have also seen significant growth in single asset acquisitions across a number of regional cities.

Investor shift towards leaner business models

This diversification is not just a geographical trend. Acquisitions across grade and subsector has also improved. In 2007 the market was dominated by four and five-star transactions. Last year, while four-star accounted for a sizeable 32%, budget hotels represented 28.1%, up from 11.2% in 2007, and serviced apartments 12% of transaction volumes (albeit this was largely determined by the £360m attributed to UK assets within the SACO portfolio acquired by Brookfield, the most substantial serviced apartment deal in the UK to date).

This diversification partly reflects the increased availability of stock within these sectors, for example 51% of new stock delivered over the last 10 years has been budget. In the case of the budget sector, it has also been supported by strong investor appetite for leased assets that are more prevalent in this segment.

This trend may also reflect an emerging investor preference for leaner business models in the face of mounting margin pressures.

The big issue for hoteliers over the last 18 months was shrinking margins due to rising costs, largely in response to the introduction of the living wage in 2016, and in London the Business Rates revaluation that came into effect in April 2017. Going forward these margin pressures are likely to intensify in response to staff availability constraints after the UK exits the EU.

As noted in our 2018 report, the potential halt of free movement into the UK could reduce access to labour for a sector where 34.1% of staff are EU nationals (BHA 2017 survey). Staffing constraints are already apparent in vacancy with the latest data from ONS (November 2018) pointing to a 4.1% vacancy rate in the accommodation and food services sector, the highest of any subsector classified by ONS, and exceeding the all sector average of 2.8%. This is now starting to feed into wage costs, placing further pressure on margins. For example, CV-Library revealed that advertised salaries for jobs in the hospitality sector grew 7.1% over 2018, the second highest of any sector

.png)

Hotel investment volumes by grade Budget hotels and serviced apartments have considerably increased their market share of investment volumes

*Note: excludes mixed grade portfolio transactions

Source: Savills Research

Shift towards leaner business models

Margin pressures have already led operators to improve efficiencies across their businesses. We expect it will also lead to greater investor focus on those parts of the market, and operators, that can deliver enhanced margins particularly where assets are being purchased on management contracts.

This will further support investment into the serviced apartment, budget and hostel subsectors as they tend to enjoy higher margins. Serviced apartments, for example, typically operate with margins of 50-70% as opposed to an equivalent hotel which can be between 10-20% lower.

Could recent stock market uncertainty further support current pricing?

2018 saw yield hardening in some parts of the market with Prime indicative yields for leased assets on unproven covenants and those on turnover leases hardening by 25 basis points (bps), driven by growing investor appetite for higher yielding assets. Prime indicative yields for institutional leased assets on strong covenants, which are the lowest, continued to hold at their 2017 level last year. On certain selective deals, however, there have been some record yields recorded.

Downward pressure on prime yields across the board largely dissipated over the second half of 2018. Some of this was in response to rising Bond yields, shrinking the spread to property yields, due to a strong run in the equities market. However, stock market uncertainty towards the latter end of 2018 has seen a ‘flight’ to more secure assets such as Government Bonds and Gold, with Bond yields now under downward pressure as a result. A trend that is set to continue going into 2019 due to slowing global growth.

This recent compression has marginally opened up the yield spread to UK hotels, which remains above the long term average of 275 basis points (bps). While this increasing spread will help to support current pricing, rising investor appetite for ‘income security’ in the face of slowing Global growth and volatility in the equities market could enhance the appeal of property as part of a wider portfolio strategy in 2019. With hotels enjoying strong demand fundamentals it is likely to benefit from increased property allocations, potentially leading to further yield hardening in some parts of the market.

.png)

Hotel yield spread to Government Bonds Stock market uncertainty has placed downward pressure on Bond yields, widening the risk free rate to hotels

Source: Savills Research; MSCI; BoE