Extensive visitor growth outlook for the three key tourist demand pools is accelerating hotel requirements across Saudi Arabia

Overview

Recent tourism growth in Saudi Arabia has been driven by three key demand pools – leisure, pilgrim and corporate visitors.

Each demand pool has played a pivotal role in the growth of the country’s tourism industry. This has been complemented by various government-led initiatives, broadening KSA’s tourism offer.

The introduction of luxury resorts, entertainment centres as well as key international events have added to the tourism offer of the country.

As a result, KSA has considerably increased its hotel inventory, with rooms in construction set to expand current supply levels extensively.

Saudi Arabia’s large population bodes well for additional hotel supply growth, with domestic tourism levels expected to rise significantly.

Domestic travel will become an increasingly popular option given the range of luxury resort developments underway, coupled with various entertainment projects planned across the nation.

Numerous high-profile transport infrastructure projects currently in development will ease travel both domestically and internationally, improving Saudi Arabia’s overall connectivity.

Demand drives hotel growth

Saudi Arabia has dramatically increased its hotel offering in recent years following growing interest from international hotel groups. Hotel supply in terms of rooms grew by 13% over 2017 with rooms in construction set to increase current stock levels by 51.4%, with over 48,000 rooms, according to STR.

This accounted for a 37.9% share of all rooms in construction across the Middle East, according to STR as of October 2018. While cities such as Riyadh, Jeddah, Makkah (Mecca) and Madinah (Medina) continue to lead the way, considerably increasing their hospitality offering, a number of smaller destinations are beginning to rise as attractive opportunity markets, such as Dammam and Jazan.

Rooms in construction are set to increase current stock levels by 51.4%, delivering over 48,000 new rooms

Savills Research

An expansive tourism sector is attracting a number of international brands

A rapidly emerging tourism sector has boosted hotel requirements across Saudi Arabia, driven by the three key demand pools of corporate, leisure and religious visitors. Travel and tourism alone accounted for 9.4% of the country’s total GDP over 2017.

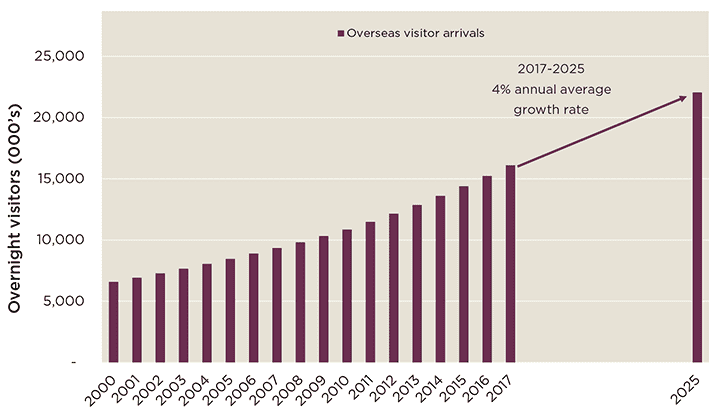

Total international overnight visitor arrivals in Saudi Arabia topped 16.1m in 2017, alongside a 10.5% year-on-year increase in expenditure to $14.8bn. This encouraging growth is forecast to continue, with international arrivals due to increase on average by 4% per annum to 2025 to reach 22.1m according to the World Travel and Tourism Council (WTTC), which would exceed Dubai’s current level of visitor arrivals by almost 40%.

This has sparked significant levels of interest amongst some of the world’s largest hotel groups. For example, Marriott International opened the country’s first two Aloft hotels in Riyadh and Dhahran in 2016. 2017 saw Rocco Forte Hotels open the Assila hotel in Jeddah and in 2018 both Hilton and Swiss-Belhotel International each opened three hotels over the course of the year. Groups including Accor and InterContinental are also looking to expand into new locations across the country.

International Arrivals Overnight arrivals in Saudi Arabia are expected to reach 22.1m by 2025

Source: Savills Research, WTTC

International visitor arrivals in Saudi Arabia topped 16.1m in 2017, alongside a 10.5% increase in expenditure to $14.8bn

Savills Research

Luxury resorts in construction will widen choice for both domestic and international visitors

The Kingdom of Saudi Arabia (KSA) has an array of large-scale leisure-focused developments in the pipeline, to meet the needs of a growing number of visitor arrivals.

This includes the Public Investment Fund (PIF) backed Red Sea Development project, set to include over 2,500 rooms across 40–50 hotels – enticing a number of global brands, including Intercontinental Hotels Group. This giga-project is due to complete in 2022 and forecast to attract an estimated one million visitors annually.

Amaala, a new ultra-luxury tourism megaproject, will consist of developing 2,500 luxury hotel keys alongside 700 villas and marinas by 2028. While attracting millions of overseas visitors, projects like the above will undoubtedly appeal to domestic visitors, who have historically spent a great deal of money travelling overseas.

.png)

Prospects for domestic demand are also positive

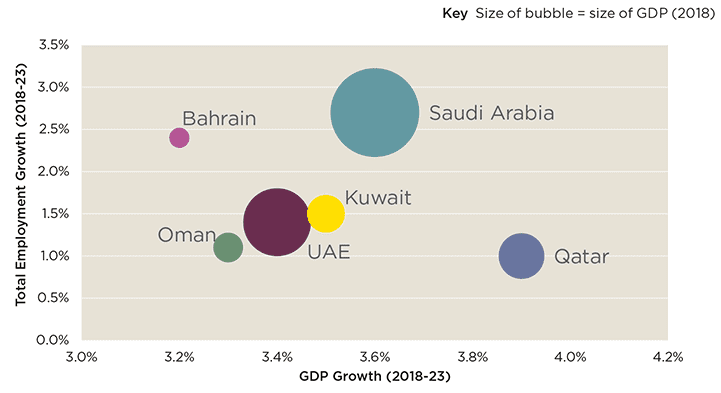

KSA has a significantly large population, accounting for 59.5% of the total population of all Gulf Cooperation Council (GCC) countries. In GDP terms, Saudi Arabia is the largest in the Middle East and 1.7× that of the next largest from the GCC countries (UAE).

Economic growth in Saudi Arabia also shows no sign of abating, with GDP forecast to grow by an average of 3.6% per annum over the next five years. This is particularly strong when compared to other GCC nations, outperforming the likes of UAE and Kuwait.

The government has existing plans, under the Vision 2030 implementation, to capitalise on this domestic demand having set aside $64bn to invest in culture, leisure and entertainment projects over the next decade. One major example of this is the multi-purpose entertainment resort of Qiddiya, due to welcome the world’s largest Six Flags theme park and estimated to attract 17m visitors per annum by 2030.

In line with this, Riyadh now plays host to various key international events. This includes the likes of the International Half Marathon, Time Entertainment’s Comic-Con as well as the first Formula E event held in the Middle East, in December 2018. This was also the first event to introduce the Sharek international events visa, allowing overseas visitors to easily obtain a 30-day electronic visa.

GDP Outlook vs Employment Growth Saudi Arabia is one of the largest and fastest growing economies of the GCC

Source: Savills Research, Oxford Economics

Hajj and Umrah visitor are set to draw 30 million visitors by 2030

Perhaps the cornerstone of KSA’s inbound tourism are the annual pilgrimages of Hajj and Umrah, which drew 2.4m and 6.5m visitors respectively over the two most recent events – forecast to increase to 30m visitors collectively by 2030. A 30-day visa extension available for Umrah visitors has undoubtedly contributed to the increase in average length of stay from overseas visitors (from 9.7 days in 2016 to 11.3 in 2017). This, alongside recent restrictions on the use of non-hotel accommodation in Makkah during Hajj (such as home-stays) has helped to boost hotel occupancy levels in the area during this period.

Upgrades to cultural sites across the country will improve access and capacity for pilgrim visitors. The Grand Mosque of Makkah is currently undergoing restoration, increasing its capacity to 2.5m with the city constructing the first new Islamic Faith Museum of Makkah just 7km away. This is alongside the Jabal Omar Project, which is expected to see over 12,000 hotel rooms introduced across 15 international hotels (with the likes of Marriott, Hilton and Hyatt Regency).

.png)

Investment into alternative sectors will drive growth in corporate demand

While there has been a historic reliance on the oil sector in KSA, the Vision 2030 initiative focuses on investment opportunities in alternative industries. Not only will this broaden the country’s corporate profile, it will also widen and drive corporate traveller demand which will become key for Saudi Arabia’s hotel market.

This broadening in corporate demand will be supported by projects such as the $500bn NEOM project, also financed by PIF and due to open in 2025. It is a cross-border sustainable economic city focusing on a number of alternative industries including energy, biotech, tourism and media. While accommodating a number of permanent residents, the project is set to attract both domestic and overseas corporate travellers on a regular basis.

Riyadh has become an international hub for business visitors, arising as a focal point for trade and travel within the Middle East. For example, 52.8% of tourist spend in Riyadh is accounted for by corporate visitors alone, according to the WTTC’s 2018 report. The impacts of this were felt in September 2018 with the city experiencing a 33.4% rise in hotel demand (rooms booked) following four major events held at the Riyadh International Convention & Exhibition Center. This triggered a 10.7% year-on-year increase in RevPAR figures.

In general across KSA, recent stock growth has caused some headwinds in terms of RevPAR performance, however we expect these impacts to wane over the longer term when taking into account the strong economic outlook (when compared to other GCC nations), coupled with high levels of growth in both arrivals and spend across the three key demand pools.

A diversification of Saudi Arabia’s economy has provided a boost for employment and its GDP outlook

Savills Research

Various expansion projects to transportation hubs continue to increase connectivity

The growth in hospitality is being supported by widespread investment into travel infrastructure.

Airport connectivity has significantly improved across KSA, which has led to a boost in passenger numbers. Last year, airport passenger numbers increased by 7.7% to 91.8m across all airports in KSA, according to the Saudi Arabian General Authority of Civil Aviation.

Saudi Arabian Airlines now serves over 70 international locations, while smaller airlines in KSA continue to expand. Flynas, for example, are extending current stock significantly while passenger numbers in 2017 increased to 6.4 million.

The recent opening of the Haramain High-Speed Rail, linking major hubs of Makkah and Madinah via Jeddah, is rumoured to transport 60m passengers per annum when in full use. The connection will open opportunities for domestic leisure and pilgrim visitors alike, allowing travel between the two key historic cities within 3 hours.

EXTENDED STAY OPERATORS EYE GROWTH OPPORTUNITIES

The extended stay market has recently become a well-established sub sector in hospitality globally, with a number of international operators expanding into new emerging geographies.

The expanding corporate sector across Saudi Arabia continues to provide widespread investment opportunities for extended stay operators. However, many brands could just as easily capitalise on the increasing leisure and pilgrim visitor markets, which is generally characterised by families travelling together – well suited to more cost-effective extended-stay options. Saudi Arabia’s largely young, and increasingly more cosmopolitan, population unlocks further opportunities for lifestyle-focused operators.

A number of global extended-stay providers have taken advantage of the opportunity to open apartments within Saudi Arabia’s relatively undersupplied market, with the likes of Frasers Hospitality opening their first site in the country with a 95-key aparthotel in Riyadh in February 2018. Likewise, both Citadines and Staybridge Suites have introduced sites to Jeddah over the past two years.

.jpg)