London housing delivery slowed throughout 2017 - will it continue to downward trend?

There are numerous sources for housing supply figures in London but between them there is a fairly consistent trend - housing completions peaked in Q1 2017 before slowing over the rest of the year. Yet, the most up-to-date indicators suggest this slump may be short lived, with both Energy Performance Certificates (EPCs) and Molior showing an uptick in delivery following a Q1 2018 low.

Data from the GLA for ‘Net Conventional Completions’ show that housing delivery in London reached a high of 41,371 completions as at Q1 2017. The most recent official MHCLG statistics on national housing delivery are ‘Net Additional Dwellings’ and cover the 12 months to March 2018. Although they have consistently differed since 2013 compared to the official GLA figures, they are the most recent official government figures on housing delivery in London and are a fair indicator of trend. The MHCLG numbers indicate that in the 12 months to Q1 2018 the number of new additions to housing stock totalled 31,723 homes, a decrease of 20% on the previous year.

A significant component of this decrease is the fall in the number of permitted development conversions. In the 12 months to March 2018 there were just 3,178 conversions to residential – a drop of 51% on the previous year.

EPCs issued for new homes are an unofficial leading indicator of housing delivery, with the latest EPC data to Q3 2018. EPCs show a similar trend to the official government data, with the number of certificates for new homes peaking in Q1 2017 at 40,896 before slowing over the rest of last year. EPCs for new homes bottomed out in the first quarter of 2018. Significantly colder-than-usual weather could potentially explain the marked drop in construction output over this period, though there was a less obvious effect on national numbers.

Going beyond the reporting date of the ‘Net Additional Dwellings’ data, Q2 2018 and Q3 2018 saw the number of EPCs issued picking up again, suggesting that the slowdown culminating in the Q1 2018 low may have been a short-lived dip rather than a more fundamental change of direction.

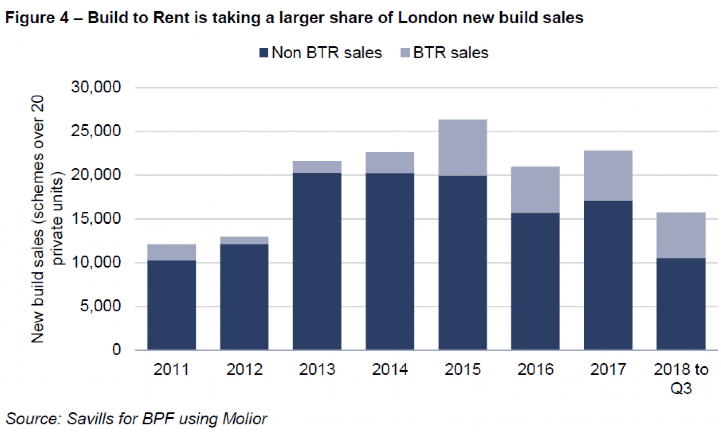

Molior data for gross completions on private schemes over 20 units, also released to Q3 2018, shows a similar profile of delivery to the EPCs. According to Molior, whilst private completions show an upward trajectory over the previous two quarters, delivery peaked in Q1 2017.

.png)

.png)

.png)