Foreword

Pricing and demand exceed 2011 peak. Foreign buyers are back, but domestic demand continues to drive growth

Pricing and demand exceed 2011 peak. Foreign buyers are back, but domestic demand continues to drive growth

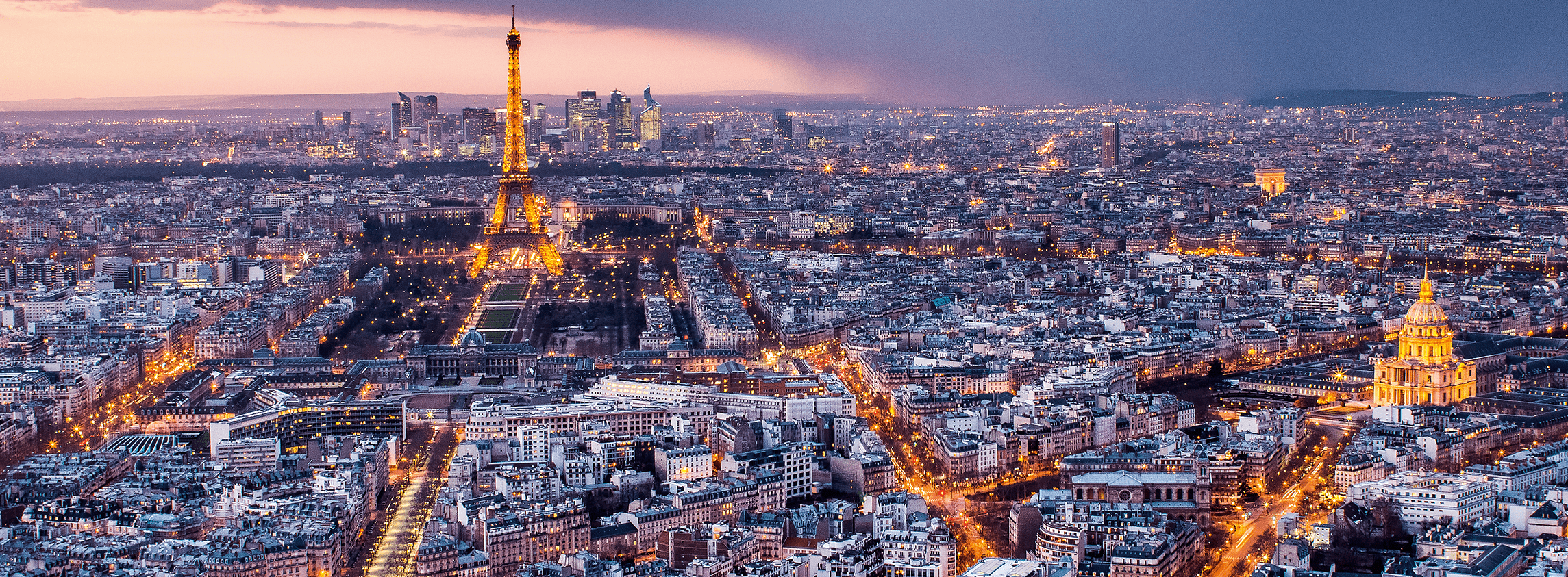

Renewed confidence in France has driven the prime Paris residential property market to new highs. The election of Emmanuel Macron in May 2017 accelerated the recovery of the market, and a pro-business agenda coupled with tax reform has boosted France’s appeal as a place to invest and do business. This has stimulated the market for international buyers.

However, Paris’s prime residential market remains a domestic one, so it is French buyers who have driven this growth. Prices reached record highs last year, and transactions are at their highest volumes since 2011.

The top prime districts of Paris – characterised by the highest prices and best-quality stock – have all returned to growth in the last two years, but it is the less-established arrondissements that have performed best. The 3rd and 10th are the two stand-outs – where prices have outperformed the top districts from a lower base.

Prime Paris still offers value on the world stage, too. After 10 years of underperforming against its global rivals, a period of catch-up is to be expected.

Highly land constrained, only tiny amounts of new stock are added through conversions, and restricted supply will sustain prices over the long term.

In spite of rising international demand, price growth is likely to increase at moderate levels, given the reliance on domestic wealth.

Summary

HOW WE DEFINE PRIME PARIS RESIDENTIAL

Prime Typically priced between €2 million and €4 million, or €12,000 to €20,000 per sq m, prime property is usually found in the 1st, 2nd, 3rd, 4th, 5th, 6th, 7th, 8th and 16th arrondissements – though it can be anywhere given the right neighbourhood.

Ultra prime Typically priced over €4 million, or above €20,000 per sq m, ultra prime covers the most exceptional properties in the prime arrondissements. They may enjoy a special view, benefit from large outdoor spaces or be in buildings of the highest architectural quality.

Read the articles within this publication below

5 article(s) in this publication