Rental values begin to find their level

Over the past three years, landlords of prime residential property have faced a number of challenges. As such, rents have steadily fallen over this period. In the third quarter of this year, they fell by a further 0.3% across all of prime London, leaving values 2.0% lower than they were a year ago.

However, for the prime central London markets, these falls have eased for the first time since September 2015, with average rents staying flat over the past three months.

While much of the market continues to have high levels of supply, there are certain locations and price points, such as the prime markets in Canary Wharf and Wapping, where limited stock has led to marginal price increases. These areas also benefit with strong demand from young professionals.

Across the board, demand continues to be seen from those with a ‘try before you buy’ approach, particularly people who are moving to a new area.

The political and economic uncertainty surrounding the UK’s vote to leave the EU means that some rental demand is also coming across from would-be buyers who have put purchasing plans on hold.

.png)

Prime rental values to September 2018 Values continue to stabilise in prime central London

Source: Savills Research

Price monitor

.png)

Key statistics for house price growth

Source: Savills Research

Focal points

.png)

Rental news and analysis in brief

Source: Savills Dealbook 2017-18

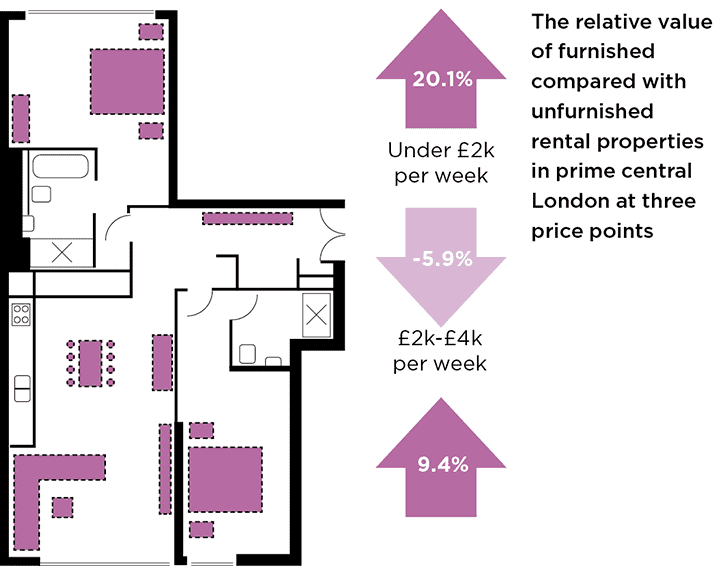

Convenience pays

Furnished properties appeal to some tenants in the prime central London market – but not all.

For those at the lower end of the market, such as young professionals, the convenience of a furnished property adds to its attractiveness and, as such, they’re willing to pay a premium.The same goes for super-prime renters, who prefer properties they can move into straightaway.

The mid-market, however, shows a different trend. These prime renters have started, or plan to start, buying their own furniture, so furnished is in less demand than unfurnished.

Source: Savills Research

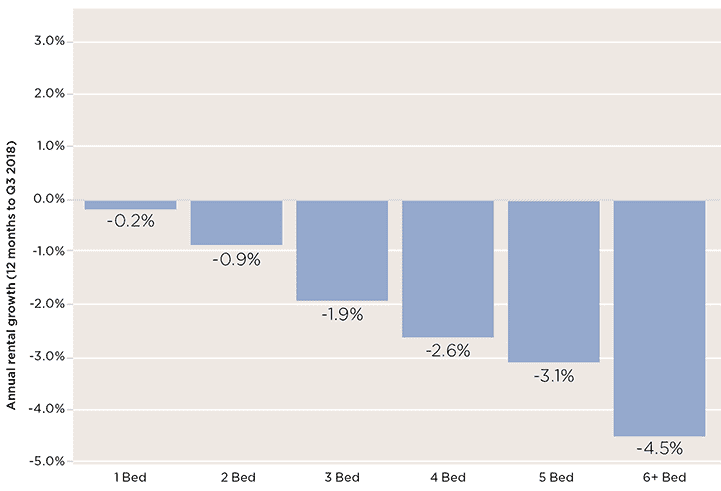

Diminishing returns

(Smaller properties, such as one-bedroom apartments, are proving more robust in terms of rental growth in the prime markets)

Source: Savills Research

Outlook

The 3% stamp duty surcharge for additional homes and recent cuts to tax relief for interest payments means some mortgaged investors have been re-evaluating their portfolios. We anticipate that this trend will continue and may limit the amount of secondhand stock coming to the market.

In addition, the appeal of lower- value, higher-yielding properties may have an impact on the availability of family homes to let.

For the prime new build market, completion levels are expected to peak over the next two years, and though much of this stock will have been sold off-plan, some units will be coming to the rental market.

This will likely limit rental growth by providing more choice for tenants.

In order to stand out, landlords of secondhand stock will need to ensure their property is in immaculate condition.

We are forecasting that rental value returns are likely to be lower than capital value returns for prime London landlords over the next five years. Landlords will need to be realistic on their asking rent and more flexible in their terms.

.png)

Source: Savills Research | Note: These forecasts apply to average rents in the secondhand market. New build values may not move at the same rate

.png)