High stock levels, particularly at the top end, make for a price-sensitive market

Prime rents in the commuter belt fell by 1.2% over the third quarter of 2018, leaving them 1.4% below where they stood a year previously. Average prime rents are now below where they were five years ago.

This trend has been driven by the suburbs and inner commuter zone. Meanwhile, the markets up to an hour from the capital – in the outer commuter belt – have grown 5.2% over the past five years.

.png)

Rental values to September 2018 High stock levels are limiting growth

Source: Savills Research

Demand for properties close to amenities

High stock levels, particularly at the top end of the market, continue to limit rental growth. Accidental landlords, who are renting out their homes while the sales market remains uncertain, are a key source of rental stock. With tenants given more choice, landlords have had to be realistic in their pricing.

An ongoing trend across the commuter belt is for properties in cities and towns to see stronger rental growth than those in villages and rural locations. This has been particularly driven by demand from young professionals and families who are new to an area and are looking for properties with easy access to local shops, train stations and schools. Demand from the latter group has tended to favour well-connected towns and cities such as Sevenoaks, Harpenden and Cambridge.

.png)

Focal points The prime rental market in numbers

Source: Savills Dealbooks 2017-18

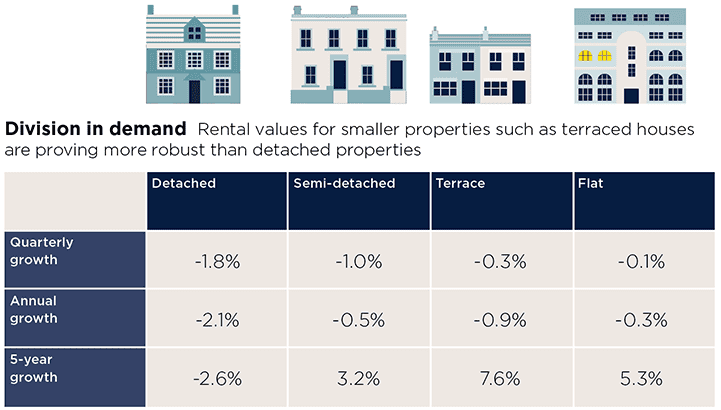

An imbalance between supply and demand is impacting the rental value of detached houses more than other property types. This trend reflects a divide in the market between needs-based renters, who are looking for smaller properties, and big-budget tenants looking for prized properties, who represent a much smaller proportion of the market.

Demand from professional couples and young families, looking for flats and small houses, is more robust.

Many tenants who aren’t yet ready to purchase are choosing to rent on a ‘try before you buy’ basis.

Source: Savills Research

Across the prime commuter belt markets as a whole, we expect rents to rise by 8.2% over the next five years, outperforming the prime London market

Savills Research

Value in the commuter belt

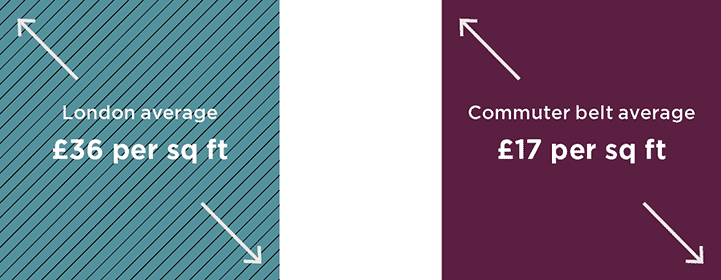

The price differential between prime London and the commuter belt is a key driver of demand from tenants.

Across the commuter belt, the average price is £17 per sq ft, in comparison with the prime London average of £36 per sq ft. This highlights the value that can be found outside the capital.

Outlook

We expect the imbalance between supply and demand in the current market to hinder any substantial rental growth during the next year. Yet, demand will remain for those properties that are in the most popular locations and which offer easy access to amenities, good schools and transport links to the capital.

Stock of the highest condition is continuing to outperform the wider market, as tenants are happy to pay for quality and above-standard finishes. Landlords will need to remain competitive on rental prices and flexible on terms, as well as ensuring that properties are presented in the best condition to ensure they attract tenants in the long term.

Across the prime commuter belt markets as a whole, we expect rents to rise by 8.2% in the five years to 2022, outperforming the prime London market.

.png)

Source: Savills Research | Note: These forecasts apply to average rents in the secondhand market. New build values may not move at the same rate

.png)