With a number of factors conspiring to bring cost and timescale increases to a halt it is pleasing to see our S.P.E.C.S indicators reflect market conditions

S.P.E.C.S score continues to fall

- As the summer Parliamentary recess has ended the news-flow relating to Brexit has increased, albeit with little further clarity. Many real estate markets are performing strongly, both on the occupational and investment side, meaning the dynamics surrounding build costs and programme length seem to have reached a status quo.

- Faced with a backdrop of continued uncertainty, tit-for-tat trade tariffs being imposed in the USA, Europe and China, along with a muted construction pipeline, G&T have left their tender price inflation forecasts unchanged at just 1% for 2018/19.

- Whilst nearly all sectors are reporting static costs and timescales, the office sector both within London and Regionally has seen pressures on costs increase since our last survey, which we examine below.

- However, this may be the calm before the storm as the retail and logistics sectors are reporting that upwards pressure may return in the second half of the year, mainly due to labour availability.

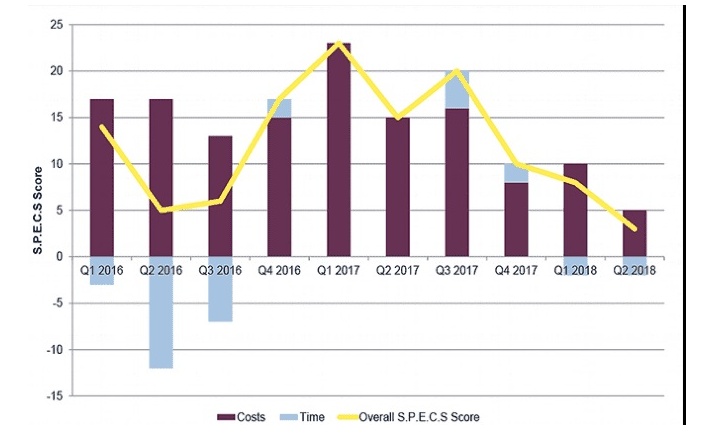

- This is reflected in our S.P.E.C.S index for Q2 2018 with a score for of six, which is the lowest quarterly score since the start of our survey, however given the lack of activity in some sectors programmes overall are starting to get quicker.

GRAPH 1 | S.P.E.C.S Q2 2018

Source: Savills Research

With a number of factors conspiring to bring cost and timescale increases to a halt it is pleasing to see our S.P.E.C.S indicators reflect market conditions. However the known unknown of how the labour market will react could see upward pressure in all sectors later in 2018

Simon Collett, Head of Division

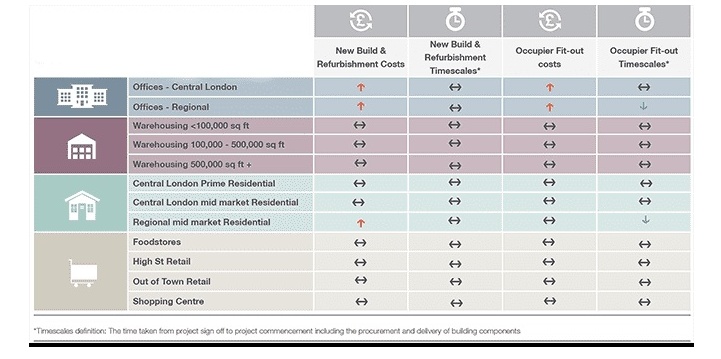

TABLE 1 | Q2 2018 S.P.E.C.S Indicators

Source: Savills Building and Project Consultancy

Strong regional market fundamentals may see costs increase further

- A continued lack of grade A space in regional office markets coupled with strong occupier fundamentals has meant investors and developers are working within a window of opportunity to bring forward new schemes or refurbishments. Skilled labour availability however is now starting to create a pinch point in many programme timescales and budgets.

- This is however a trend that investors and developers are going to have to continue to contend with and may have to amend their future expectations in relation to costs and timescales.

- This is due to the fact that occupier demand remains strong with 2017 seeing 6.8m sq ft of take-up recorded in the big nine regional office markets, setting a new record almost half a million sq ft higher than the 6.3m sq ft that was achieved in 2015.

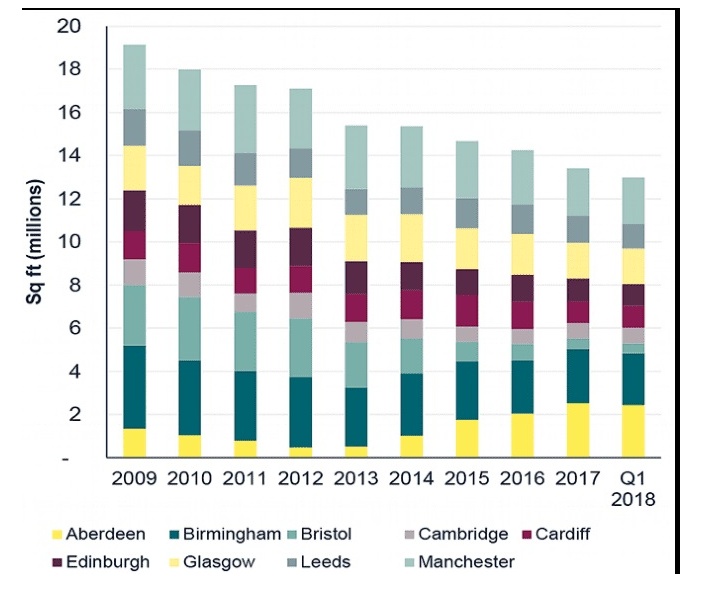

- Supply and pipeline also remain constrained. For the tenth year in a row the supply of vacant office space has decreased and now stands at 12.9m sq ft, 33% lower than the 2009 peak of 19.1m sq ft. Moreover, of the speculative construction pipeline of 7.4m sq ft 55% is already pre-let.

- And whilst the concept of "Northshoring" has been mooted recently for many office occupiers recent evidence from the ONS also supports that populations may be starting to follow. To June 2017 every age bracket over the age of 30 has seen net outflows away from London.

- With this in mind refurbishments of secondary office stock has recently allowed developers and landlords to deliver grade A stock to the market. Regional disparities in the pool of available, and quality of, contractors has recently started to have an impact on timescales and costs.

- However, most regional Cat A refurbishments are undertaken by local contractors who have grown substantially and increased project size accordingly in the same period. Whilst varying contractor performance is a national issue some contractors that have expanded with this market are getting stretched too far, performing very poorly and potentially damaging their financial positions in the race to grow.

GRAPH 2 | Regional office supply falls again

Source: Savills Research

Poor experience is leading to a restricted pool of appropriate contractors for projects and getting the right contractor can mean project delay or very early engagement and negotiation with a single contractor

Gary Bulloch, Director, Offices