South Korean investment in the City of London market to top £3 billion in 2018

Market comment and notable deals

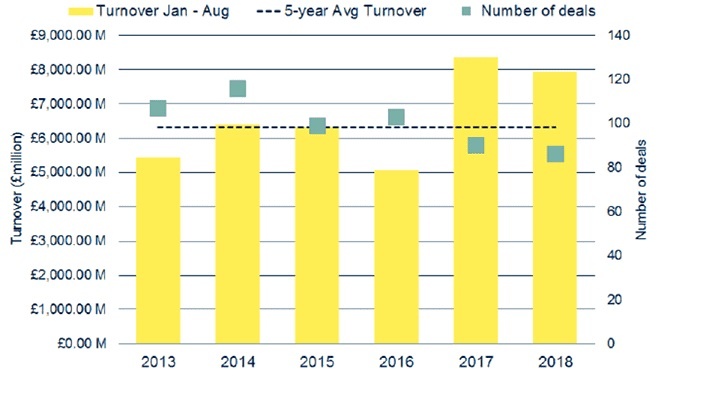

- Investment volumes in August totalled £1.72bn across 11 transactions, the second highest month of turnover in 2018. Overall investment for the year now stands at £7.92bn, 5.4% down on 2017, but 26% up on the five-year average for turnover up to August (£6.3bn).

TABLE 1 | Key deals in August 2018

Source: Savills Research

- Transaction volumes are undoubtedly being driven by the larger lot sizes, with 17 deals trading at over £100m this year, with a further eight totalling approximately £2.25bn currently under offer.

- In the largest transaction of the year, The National Pension Service of Korea (NPS) acquired the freehold interest in Goldman Sachs' new HQ at Plumtree Court, EC4 for £1.16bn, reflecting a net initial yield of 4.1% and a capital value of £1,404 per sq ft. The Kohn Pedersen Fox Associates designed scheme, sits on a 4.2 acre site and provides 826,008 sq ft of Grade A office accommodation. The property was sold by way of a sale and leaseback from Goldman Sachs for a term of 25 years (with a break in the 20th year) at an initial rent of £49.2m per annum.

- Another notable transaction for August saw Deka Immobilien acquire The Cursitor Building, Chancery Lane, EC4 for £86m, reflecting a net initial yield of 4.71% and a capital value of £1,165 per sq ft. The freehold building provides 73,793 sq ft of office, retail and ancillary accommodation. The property is fully let to five tenants at a passing rent of £4,327,401 per annum reflecting an overall rent of £58.64 per sq ft, c. 75% of the income is let to WeWork. CBRE and Savills advised Deka Immobilien.

- Frogmore also completed the sale of their freehold interest in Weston House, 242-246 High Holdborn, WC1 to Sidra Capital for £94m, reflecting a net initial yield of 5.23% and a capital value of £1,056 per sq ft. The building was comprehensively refurbished in 2016 to provide 89,007 sq ft of office, retail and ancillary accommodation. The property is multi let with 73% of the income leased to Mischcon De Reya LLP, and produces a rent of £5,005,268 per annum reflecting £56.23 per sq ft overall. The weighted average unexpired term certain is over eight years.

GRAPH 1 | City investment volumes (up to August)

Source: Savills Research

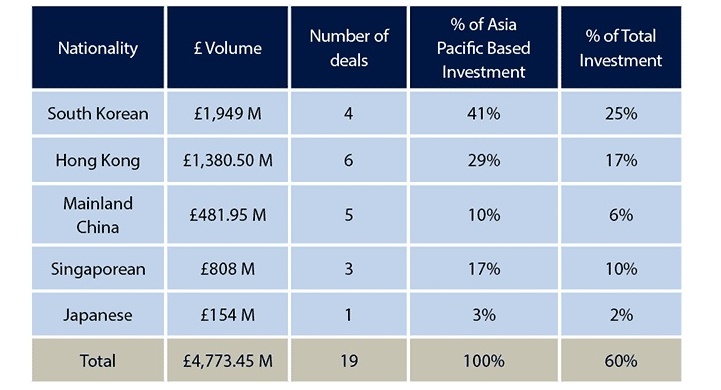

- The acquisition by NPS is the fourth by a South Korean investor in the City of London market this year, and takes investment from the buyer group to £1.95bn, which reflects a quarter of all investment into the City. Interestingly in terms of Asia Pacific based investors, South Koreans account for 41% of all transactions, with Hong Kong investors, who have lead the way in recent years accounting for £1.38bn (29%) worth of investment this year.

- South Korean investors, although not new to the City of London market, have increased their investment levels this year, having acquired only four buildings between 2013 – 2017 totalling £979m. With a number of further transactions known to be under offer to South Korean investors, we expect investment by this buyer group to reach £3bn by the year end.

TABLE 2 | City 2018 turnover by Asia/Pac investors

Source: Savills Research

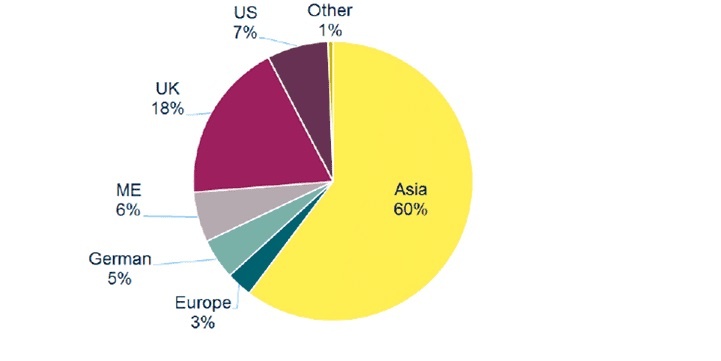

- Asian investors continue to account for the largest share of investment into the City, with 60% of all transactions totalling approximately £4.77bn in 19 deals. Asian investors dominate the £100m+ market, and have acquired nine of the 17 transactions above this mark so far this year, totalling £4.2bn.

- UK investors have acquired 38 buildings this year, double the number of Asian buyers and account for 18% of total volume to date. This group have predominantly focused on the smaller lot sizes, acquiring 30 buildings and accounting for 51% of all sub £50m transactions.

GRAPH 2 | City turnover by purchaser nationality

Source: Savills Research

- Our prime City yield remains at 4%, which compares with the West End prime yield of 3.25%.