UK investors are 13% more acquisitive in 2018

Stronger than expected office occupational story renews UK investor confidence and activity

- The average UK commercial property prime yield remained stable at 4.56% in July, the same level as at October 2017.

- Upward pressure is expected to continue in the following months on most retail sectors, and the average prime yield across all retail segments is now 5.05%, compared to 4.90% a year ago.

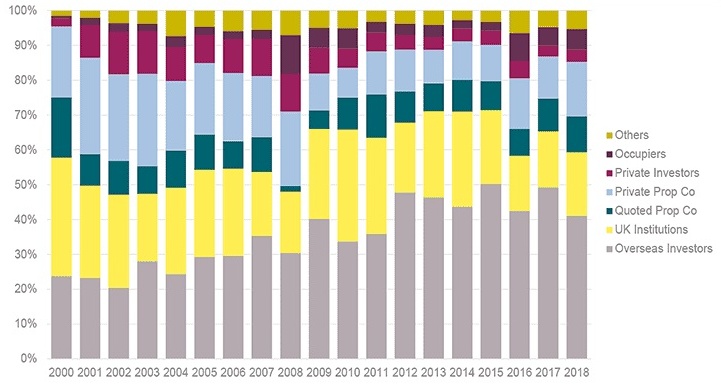

- The most notable change in the market in recent months has been the return of domestic investors to the field. As Graph 1 shows, domestic investors have accounted for 59% of all acquisitions this year, the highest proportion since 2011.

GRAPH 1 | Domestic investors have accounted for 59% of acquisitions this year

Source: Savills Research, Property Data

TABLE 1 | Prime yields

Source: Savills Research

- In volume terms this is an increase of 12.9% year-on-year, compared to a 21% fall in non-domestic investor activity.

- We believe that this change is being driven by a number of factors. Firstly, is the continuing strong occupational story in the logistics market, and a better than expected occupational trend in the office market.

- Secondly, there has been a comparative lack of larger assets on the market that would typically attract the most international investor interest. There have been only 56 deals of over £100m in the first seven months of 2018, compared to 70 in the same period last year.

- Finally, the recent increasing speculation around a rising probability of a hard Brexit has caused some non-domestic investors to question the outlook for the UK.

- Looking ahead to the remainder of 2018 we expect that domestic investors will remain the most active buyers, though the largest prime assets will still predominantly attract non-domestic attention.

Local authorities keep buying, though remain a small part of the overall market

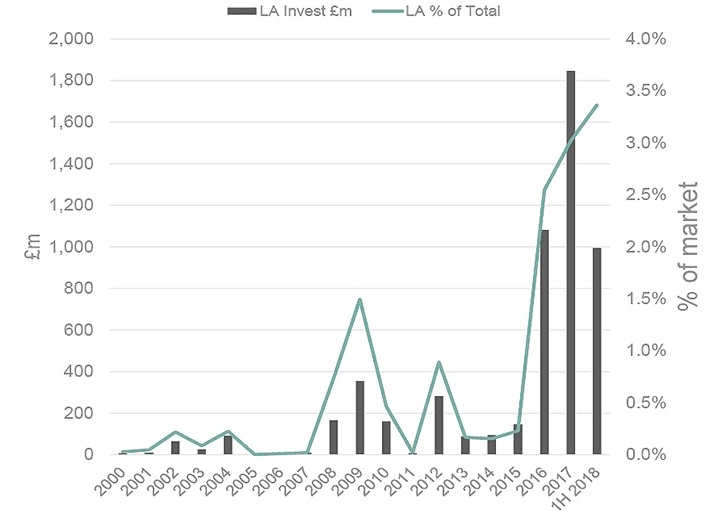

- One group of investors that garnered a disproportionate amount of media comment in 2017 were the local authorities.

- As Graph 2 shows, they look on track to exceed 2017's level of activity this year, having already invested nearly £1bn in UK commercial property so far this year. However, this group of investors still accounts for only 3.4% of the total market, and as such are hardly providing it with a dramatic boost, or exposing it to a potential fall should they withdraw.

GRAPH 2 | Local authority investment into UK commercial property

Source: Savills Research

- Much of the recent comment on this group of investors has been around whether they 'should' be investing in property when local authority spending is being tightened. However, this avenue of comment is rather weak as the fundamental reason why they are investing in income-producing assets is to plug the gap that has been created by the reduction in income from central government.

- Investment in commercial property can deliver both an income return and a social return for local authorities, and we see no credible argument for discouraging or limiting their investment activity in this sector so long as it is well-informed, transparent, and benchmarked. Furthermore, while the proportion of investments by local authorities that are outside their operational area has risen to 39% this year, we believe that this is justifiable in the context of spreading investment risk.

Should the recent base rate rise be a cause of concern for property investors?

- With the markets having finally called the timing of an interest rate rise correctly, the inevitable questions are being asked as to what this means for UK commercial property.

- As far as the macro-economy (and hence consumer spending and GDP growth) goes, we expect the impacts to be limited. Relatively few households have a variable rate mortgage and thus we do not expect this rise, or the prospect of further gentle rises to have a dramatic impact on the economy.

- There is also the question of whether the interest rate rise will impact on property investor's cost of debt. Again we expect this to have a limited impact, as the prospects of a rise had been priced into the debt market for some time.

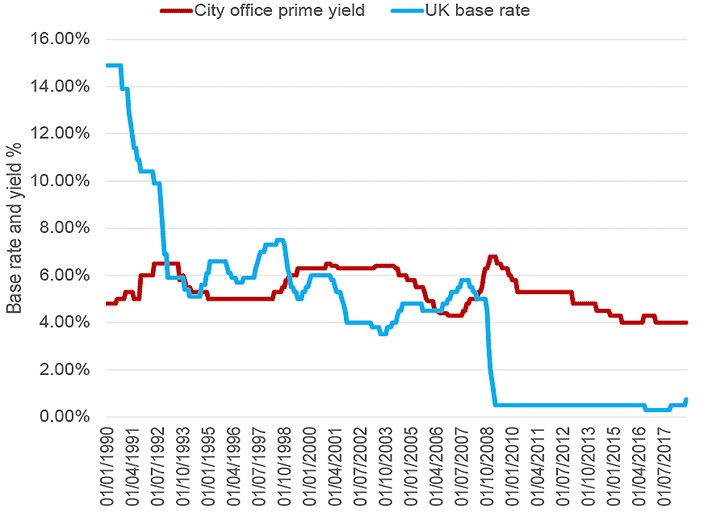

- Finally, there is the question of whether there is any relationship between the base rate and property yields. Traditionally it has been broadly understood that the property yield should be in part a function of the risk-free rate of return. However, the last decade has seen less of a relationship due to lower LTV's and the increasing amount of non-domestic investor activity in the UK .

- Indeed, as Graph 3 shows, only two of the last five periods of rising base rates have coincided with a rise in the prime property yield. We expect that this next phase of "gradual" and "limited" rises will see market fundamentals driving the yield, rather than the base rate.

GRAPH 3 | Limited correlation between the base rate and prime property yield

Source: Savills Research, Bank of England