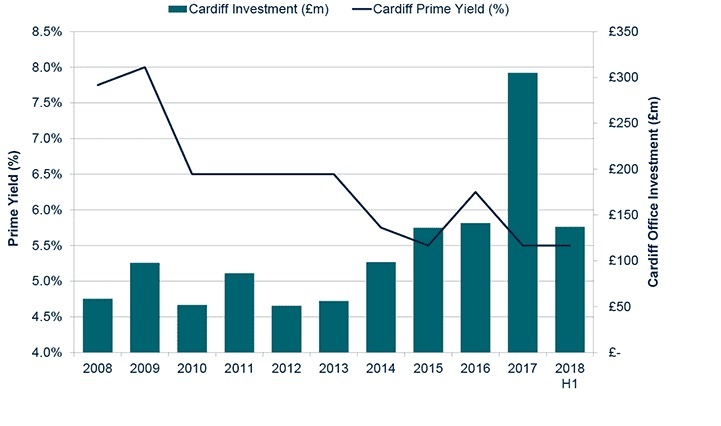

The investment market has performed strongly in H1 2018 with good levels of demand for prime offices from institutional, overseas and private investors

Summary

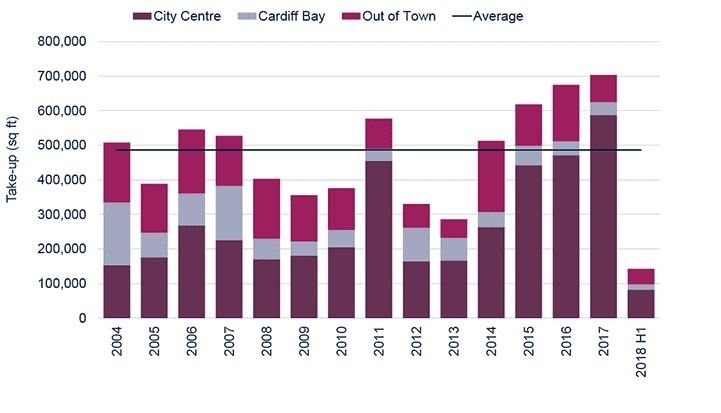

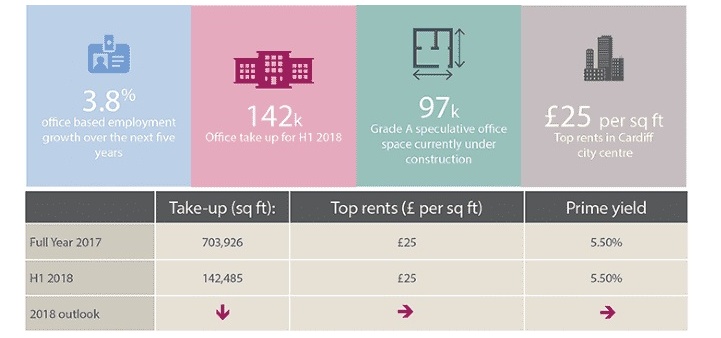

- Cardiff's occupational market has been relatively subdued whilst the investment market has been buoyant. Take-up in H1 2018 reached 142,000 sq ft, which was 33% below H1 2017. We do, however, forecast take-up to be almost on par with long term average at 400,000 sq ft with several large requirements in the market.

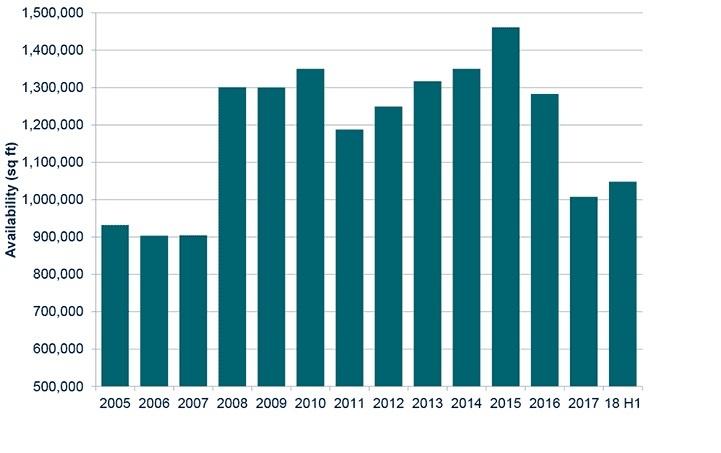

- Supply has marginally increased from 2017 although the supply constraints that were present in 2017 have remained. The lack of large available Grade A buildings will continue to hamper take-up in the short-term. There is one building under construction which is 4 Capital Quarter which will slightly alleviate the supply constraints. There are however two large sites where speculative development is set to commence, which will boost Grade A supply in 2020–21.

- Prime rents have remained at £25 per sq ft and we don’t expect a rise in 2018 due to the lack of new Grade A space in core city locations available in the market.

- The investment market has experienced a strong half year of activity with investment volumes reaching £143 million in H1 2018. This has been driven by four deals over £10 million. Prime yields have remained at 5.5%.

Savills sold No 2 Callaghan Square for Thompson Estates

The occupational market has been relatively subdued whilst the investment market is set to be the second highest year on record following 2017.

Occupational Market

The Cardiff office market has been relatively subdued in H1 2018 with take-up totalling 142,000 sq ft. This represented a fall of 33% when compared with H1 2017. We forecast take-up to reach 400,000 sq ft by the end of 2018. Whilst this is a fall from 2017, if the GPU letting is excluded from 2017 take-up, then 2018 take-up will be almost on par with 2017. Looking towards H2 2018 there are several large requirements in the market, which will help boost take-up in the second half of the year. We are aware of several requirements over 10,000 sq ft looking to relocate within the city.

GRAPH 1 | Take-up subdued after record 2017

Source: Savills Research

There has been only one occupational deal above 10,000 sq ft in Cardiff in H1 2018, this was Which? Limited leasing 11,550 sq ft at 3 Capital Quarter. Which? Limited paid £24 per sq ft which was the highest rent achieved to the south of the train station highlighting that occupiers are willing to pay higher rents outside the traditional city core market area for Grade A office space. The average deal size in H1 2018 was 3,574 sq ft which highlights that the majority of occupiers who are active in the Cardiff market are small and local businesses. We expect the average deal size to remain below 5,000 sq ft throughout 2018.

Supply in the market has marginally increased from 2017 and currently stands at 1.05 million sq ft, this is still the second lowest amount since 2007 highlighting the supply constraints that are present in the market. There are only three existing Grade A buildings that can accommodate requirements of over 20,000 sq ft. There is good levels of occupier demand for Grade A space in the market, the remaining space available at St Patrick's House is under offer, and there is strong interest at 3 Capital Quarter.

GRAPH 2 | Supply constraints still persist in the market

Source: Savills Research

Following on from the completion of 3 Capital Quarter, JR Smart are well progressed with the construction of 4 Capital Quarter, the last of the offices within the Capital Quarter development. This is expected to complete in March 2019 and will provide 96,780 sq ft. A planning application has been submitted on behalf of the Metro Delivery Partnership for the development of the Interchange Building, which will include around 100,000 sq ft of office space, part of which is rumoured to already be pre-let. The building could be ready for occupation by mid 2021. Furthermore Rightacres' mixed-use scheme Central Quay has planning consent for a 250,000 sq ft office building called The Ledger Building, which is also planned to be speculatively developed. These mixed-use schemes highlight the developer confidence in the Cardiff market, they will provide an amenity rich environment which will appeal to occupiers and their staff and potentially attract footloose occupiers on a national scale.

Investment Market

The Cardiff office investment market has experienced a strong H1 2018 with £137 million transacted. We expect 2018 to be the second highest year on record for office investment following 2017, underlining the strong investor demand present in the market. This has been driven by four deals over £10 million, the largest being Cardiff Waterside which was sold by Aviva to Global Mutual for £84.5 million. The other three buildings that were sold for above £10 million were St Patrick's House, GE Healthcare and 2 Callaghan Square.

Overseas investors have accounted for the largest proportion of investment in H1 2018 although this was only across one deal at Cardiff Waterside. In terms of deals recorded UK property companies and private investors have been the most active purchasers which is reflective of the smaller lot sizes that are traded in the Cardiff market. This was exemplified at 31-33 Newport Road, which was bought by a private property company for £5 million. There is still institutional interest in the market, Schroders acquired St Patrick's House and the Daily Mail Pension Fund acquired 2 Callaghan Square. We envisage institutional interest remaining strong for prime assets.

There was only one office investment transaction in Q2 2018 when compared to six in Q1 2018. The new stamp duty increases from 5% to 6% for purchasers became effective from the 1 April 2018. We believe this will have a negative effect on the market as the cost of investing in Welsh commercial property will increase. There has been a notable decrease in all asset classes with investment in Q2 2018 being 93% below Q1 2018.

GRAPH 3 | Office investment set for second highest year ever

Source: Property Data

Outlook

An ongoing trend in the occupational market is occupiers taking less space, which will result in the average deal size falling. Occupiers are utilising their space more efficiently with greater occupational densities and more remote working resulting in the size of requirements decreasing. This trend is set to continue as flexible working will become a requirement from staff and occupiers will have to respond to this demand.

We expect record rents to be achieved at Rightacres’ Central Quay and The Interchange schemes with both expected to achieve rents in excess of £27 per sq ft. Furthermore we expect rental growth on Grade B buildings as well. There is lack of good quality Grade B buildings available in Cardiff, landlords who opt to undertake a moderate refurbishment of the common parts could achieve rents between £18-£20 per sq ft and capitalise on the shortage of good quality Grade B space. We anticipate demand for Grade B space increasing notably from cost sensitive occupiers who could face their rent bill doubling if they moved into Grade A space.

The media sector is growing in Cardiff following BBC Cymru Wales decision to relocate their new headquarters to Central Square. A notable example is Splice who recently leased 6,461 sq ft at 101 St Mary Street. They decided to open their first regional office in Cardiff predominantly because of the synergies they could gain by locating near the BBC. We expect further inward moves from media companies who are able to access a young skilled talent pool and fast transport connections to London. Cardiff has been shortlisted by Channel 4 for a new creative hub.

We expect 2018 to be the second highest year on record for office investment with Capital Tower recently completing, it was acquired by Trinova and the Admiral HQ on 1 David Street is currently under offer. We expect UK institutions and overseas investors to continue to chase prime Grade A offices in the market. Furthermore in the next few years we expect strong investment volumes if Rightacres’ decide to sell individual buildings at their two new mixed-use schemes Central Quay and The Interchange.

Headline stats

THE RISE OF THE DEFURB

Gary Carver, Director of Business Space highlights his key thoughts

The rise of the defurb has been gathering pace in London and other regional office markets in recent years. It is a style of refurbishment that involves an exposed surfaces style finish, which provides a “cool” feeling that appeals to occupiers who feel that image aligns with their business ethos. While these types of refurbishments have been common throughout the rest of the UK they have been limited in Cardiff. Kames Capital and V7 Asset Management bought 101 St Mary Street last year. This had one defurbed floor and this has just been let to Splice a media company who leased 6,461 sq ft in the building and will use the space as a post-production facility. Boultbee Brooks purchased Park House in 2017 and are in the process of undertaking a defurb of the vacant offices together with a wholesale refurbishment of the common parts.

Media and technology businesses have traditionally been the occupiers who are attracted to defurbished space and these are two sectors we expect to expand in the Cardiff in the short term. Furthermore co-working operators have been attracted to this type of space throughout the UK and we expect good demand from this sector going forward. There is a strong start-up community in Cardiff with over 3,000 start-ups registered in the city, which is a 10% increase from 2015 which highlights the growth of small businesses in Cardiff. Landlords could take advantage of this community and could operate their own co-working facility in space which they have defurbished. Corporate occupiers are also attracted to this type of space, in other regional markets corporates such as HSBC and BDO have leased space in a defurbished building.This should give investors and developers comfort if they are considering a defurbishment as it will appeal to a variety of business sectors.

Landlords should note that a defurbishment, can actually be more expensive than a traditional refurbishment. However in Cardiff we have seen rents at 101 St Mary Street rise from £13 per sq ft to £16.50 per sq ft, which highlights the rental growth opportunities after a building has been defurbished. There is clear occupier demand for this space and landlords can capitalise on the lack of supply of this type of space in the market if they proceeded with a defurbishment.