Half year investment volumes point to another strong year

Fifth consecutive year of above average half year volumes

- Following twenty consecutive months of either no movement, or an inward movement, in the Savills prime yield series, we have now two consecutive months of marginal outward movement. Following a 4bps shift in May and a 2bps shift in June the average yield now stands at 4.56%.

TABLE 1 | Prime yields

Source: Savills Research

- The continued negative newsflow surrounding the retail sector is clearly tempering investors confidence. May saw outward movements of 25 bps for Out-of-town retail parks (both open A1 and restricted) along with Leisure parks and the trend has continued into June with shopping yields shifting outwards by 25bps also.

- This sentiment has also filtered through into the investment volumes in the shopping centre sector with volumes currently standing at £400m, 40% down on last year. However, with 10 schemes currently under offer we expect the sector to have a stronger second half of the year.

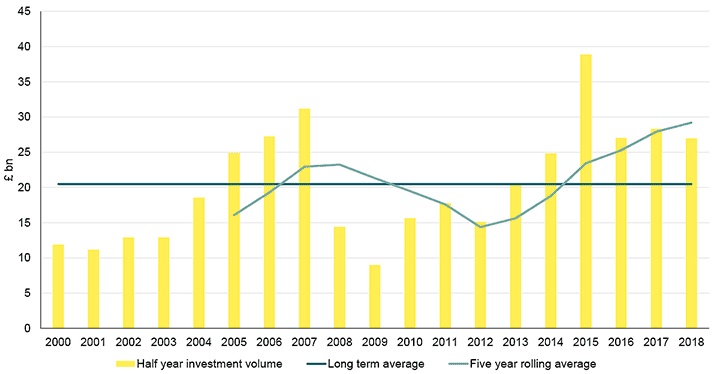

- The wider investment market continues to perform well, with half year investment volumes standing at £26.9bn, in line with the last three years and almost 32% higher than the long term average.

- Whilst the industrial and logistics sector continues to attract investor interest a lack of investment product has meant half year investment volumes stand at £3.7bn, accounting for 14% of the market, compared to £7.1bn in the second half of 2017, making up 19% of the market. Given the lack of stock supply and the continued strong investor interest we expect further downward yield pressure in the remainder of 2018.

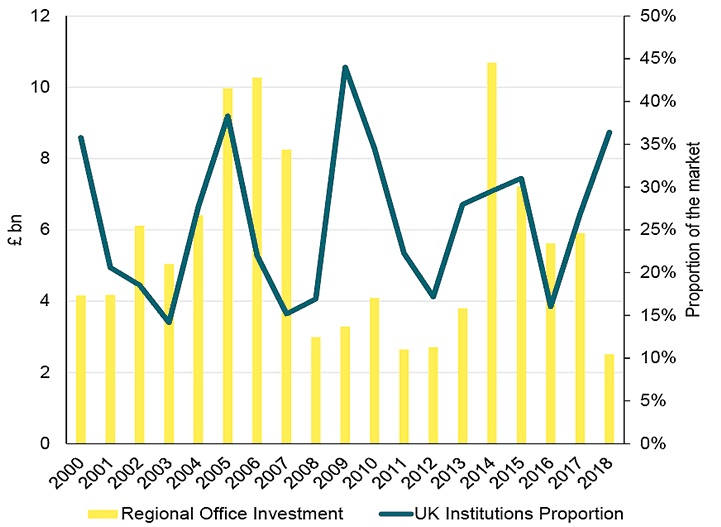

- UK institutions searching for value have begun to turn their attention to the regional office market with accounting for 35% of investment transactions in 2018, a trend we examine in more detail below.

GRAPH 1 | Half year investment volumes above long term average

Source: Savills Research, Property Data

UK institutions aim for less congested markets

- UK institutions, with significant amounts of capital to deploy, have seemingly begun to look at the regional office markets to make investments of significant value. In 2018 so far £2.5bn has been invested into the regional office market with UK institutions accounting for 35% of the total volume, the highest level since 2009.

- A number of factors have combined to push UK institutions into less congested markets. Firstly, the industrial and logistics market is still very much in vogue with the range and number of buyers is pushing down pricing for already limited stock.

- Secondly, local authorities remain aggressive bidders, both within and outside of their jurisdictions and across multiple sectors; as they seek to make significant income producing investments to bolster their own spending budgets. This position may change in due course however as the results of the Department for Communities consultation covering the investment code and use of funds from the Public Works Loan Board become known.

- This has been highlighted by a number of recent transactions for prime schemes in regional markets such as M&G acquiring The Haymarket site in Edinburgh for £49.1m where planning is in place for 350,000 sq ft of grade A office space and a further 40,000 sq ft of retail and leisure. Leeds has also benefited from this trend where 1 Park Row was sold to CCLA for £35.6m, reflecting a net initial yield of 4.43%.

GRAPH 2 | UK institutions increase exposure to regional offices

Source: Savills Research, Property Data

- Investors have been drawn to these markets as many key fundamentals remain strong. For example, occupier demand remains robust with 2017 seeing 6.8m sq ft of take-up recorded in the big nine regional office markets, setting a new record almost half a million sq ft higher than the 6.3m sq ft that was achieved in 2015.

- Supply and pipeline also remain constrained. For the tenth year in a row the supply of vacant office space has decreased and now stands at 12.9m sq ft, 33% lower than the 2009 peak of 19.1m sq ft. Moreover, of the speculative construction pipeline of 7.4m sq ft 55% is already pre-let.

- These localised supply and demand dynamics are expected to continue pushing rents with Realfor forecasting five year rental growth per annum of 2.1% in Birmingham, 2.6% in Cardiff, 2.4 in Manchester and 2.1% in Bristol.

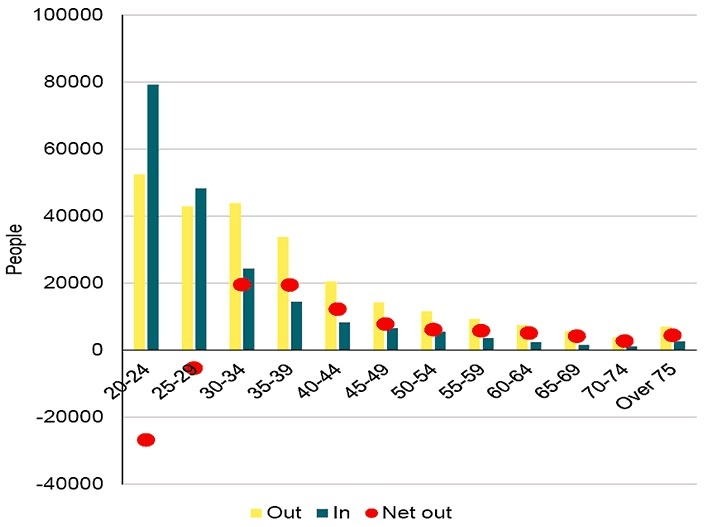

- And whilst the concept of "Northshoring" has been mooted recently for many office occupiers recent evidence from the ONS also supports that populations may be starting to follow. To June 2017 every age bracket over the age of 30 has seen net outflows away from London, as demonstrated in Graph 3.

- This trend may have longer to run as key infrastructure projects start to impact both occupier and individual behaviour. With HS2 construction expected to start in early 2019 and the electrification of the Great Western line to set to finish in late 2018 key regional markets such as Bristol, Birmingham, Manchester and Leeds will all be set to benefit further.

GRAPH 3 | Population flows out of London by age group

Source: ONS

.jpg)