Tech & Media demand remains strong as Serviced Office Provider take-up picks up

Market comment and notable deals

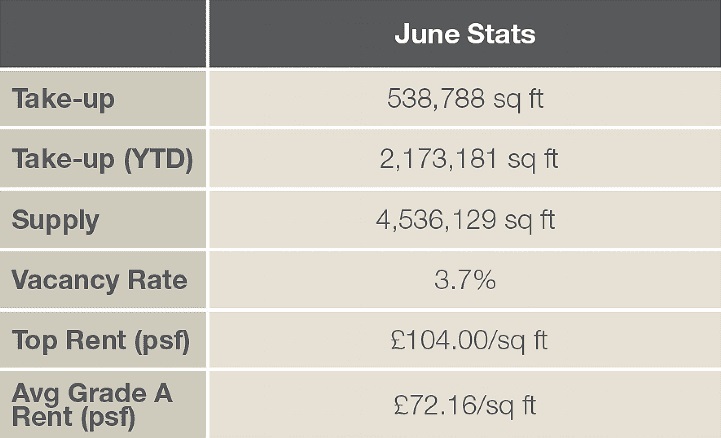

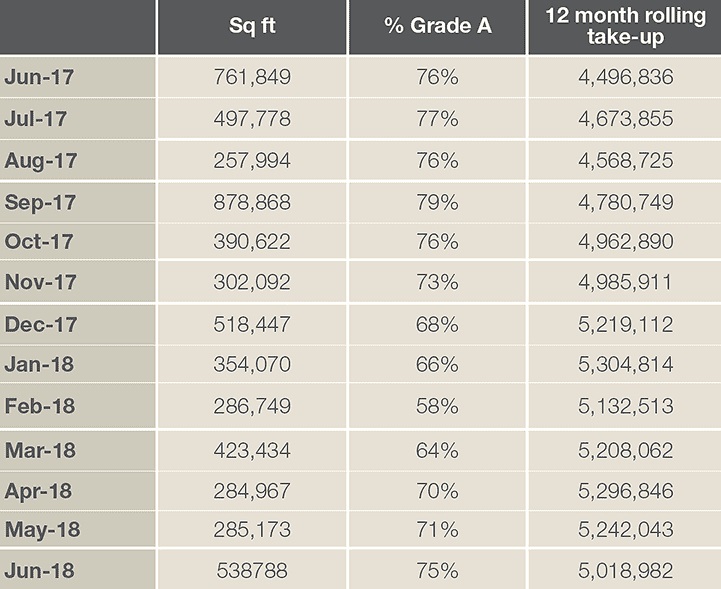

- Take-up in June reached 538,788 sq ft across 33 transactions. This was the highest monthly take-up since September 2017 and brought take-up for the first half of the year to 2.1m sq ft.

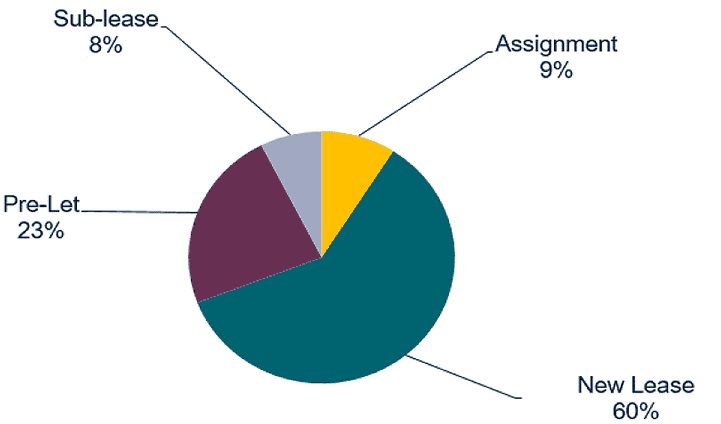

- Whilst year-to-date take-up was down 12% on the same period in 2017, it was up 7% on the long-term average as pre-letting activity continued to boost take-up.

TABLE 1 | Key June stats

Source: Savills Research

- June saw the first and only transaction so far this year over 100,000 sq ft, with WeWork pre-letting Aviation House, 125 Kingsway, WC2 on a 20 year lease at £60.00 per sq ft. The other notable pre-let to complete was at the Brunel Building, W2, with Sony Pictures taking the part 9th, 10th - 13th floors, on a 15-year lease at a rent believed to be in the region of £70 - £75 per sq ft.

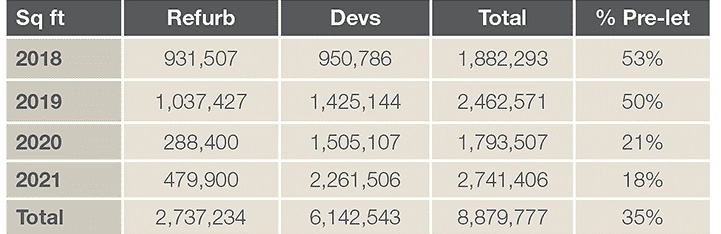

- Pre-lets have accounted for 507,607 sq ft transacted over H1 2018, just shy of a quarter (23%) of leasing activity. Around 3.1m sq ft (35%) of the development pipeline scheduled for delivery between now and 2021 has already been pre-let and 15% (800,000 sq ft) of the remaining speculative space is under offer.

GRAPH 1 | H1 2018 take-up (sq ft) by lease type

Source: Savills Research

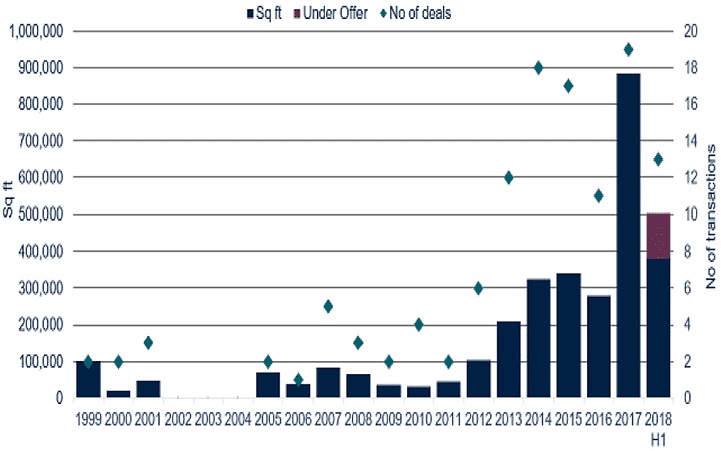

- Serviced Office Provider take-up picked up over the month, with 222,718 sq ft leased out to the sector, bringing take-up for the year so far to 359,731 sq ft. Serviced Office Provider take-up has already overtaken every year prior to 2017.

- Whilst the Serviced Office Provider sector led take-up over the month with 46% share, the Tech & Media sector continued to dominate sector take-up for the year so far with a 30% market share. The Tech & Media sector's market dominance is set to continue with Facebook close to completing on 600,000 sq ft at King's Cross.

- The Insurance & Financial sector followed with a 22% share of take up over the first half of the year, followed by the Serviced Office sector with 20%.

GRAPH 2 | Serviced Office Provider take-up

Source: Savills Research – June 2018

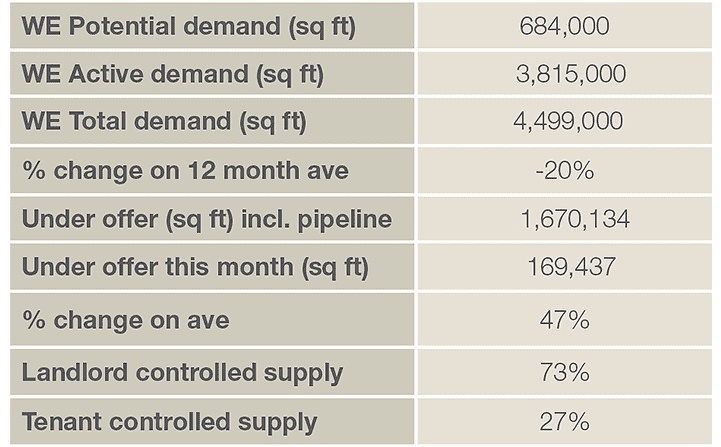

- We are currently tracking 4.49m sq ft of West End and central London requirements, 40% of which is from Tech & Media sector occupiers. The Insurance and Financial sector currently accounts for around 10% of West End and central London tracked requirements.

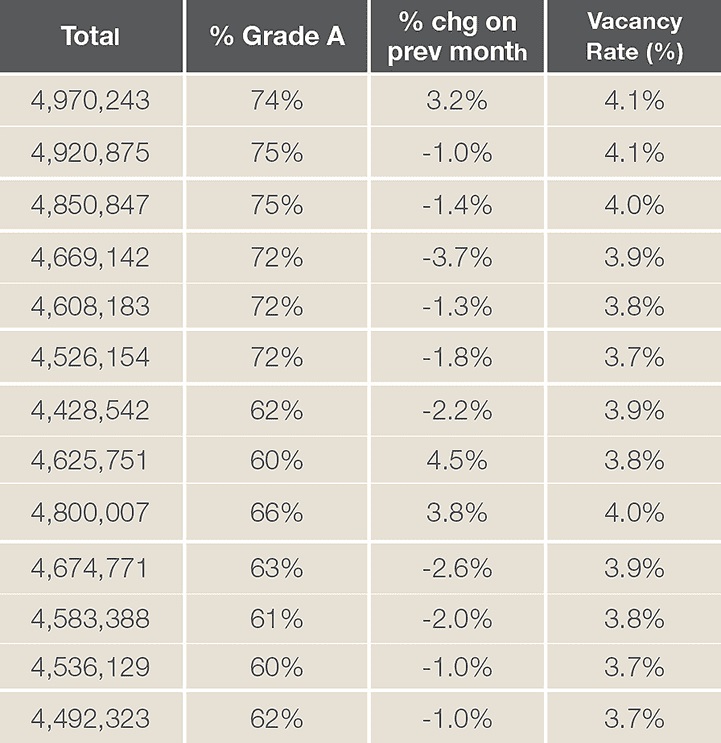

- Supply held steady with the vacancy rate remaining at 3.7% at the half year. In total 62% of the 4.49m sq ft that is available is of Grade A standard.

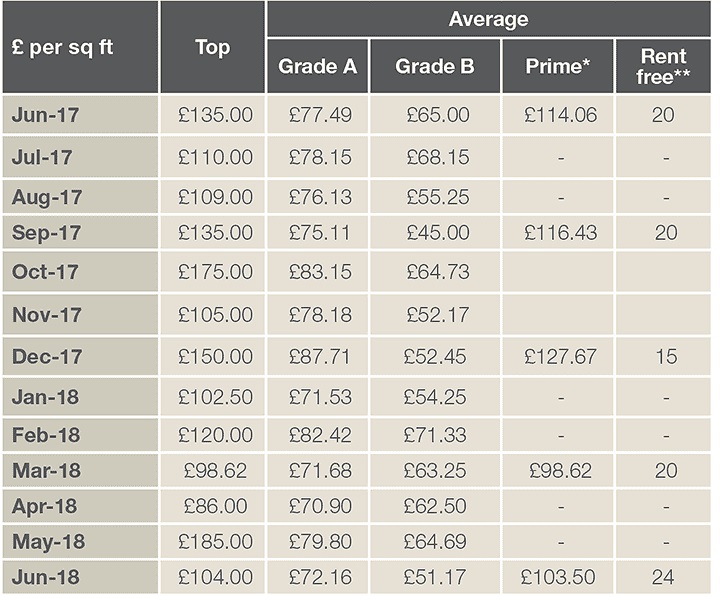

- The average prime rent at the end of Q2 stood at £103.50 per sq ft, down 9% on this point last year and the average rent free period (on a straight 10-year lease) was around 22-24 months.

- Whilst last year we anticipated an increase in tenant controlled space, the proportion of supply this accounts for has remained the same as it was this time last year at 27%.

Analysis close up

TABLE 2 | Take-up

Source: Savills Research

TABLE 3 | Supply

Source: Savills Research

TABLE 4 | Rents

Source: Savills Research

TABLE 5 | Demand & Under Offers

Source: Savills Research

Demand figures include central London requirements

TABLE 6 | Development pipeline

Source: Savills Research

Completions due in the next six months are included in the supply figures

*Average prime rents for preceding three months

** Average rent free on leases of 10 years for preceding three months

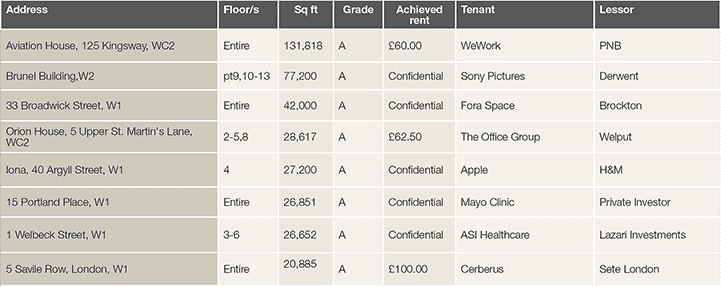

TABLE 7 | Significant June transactions

Source: Savills Research

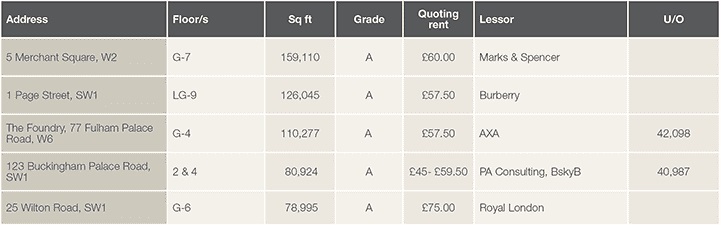

TABLE 8 | Significant supply

Source: Savills Research

.jpg)