Abstract

The value of land continues to increase in the Midlands and Scotland. Housing associations are looking to develop more homes, while housebuilders are becoming more active in the Midlands

.jpg)

The value of land continues to increase in the Midlands and Scotland. Housing associations are looking to develop more homes, while housebuilders are becoming more active in the Midlands

In the past year, house prices in Scotland have risen by 5%, making it the strongest-performing part of the UK. This, in turn, has supported land price growth

Savills Research

During Q2 2018, greenfield land values grew most strongly in the Midlands and Scotland. Greenfield land values in the East (East Midlands and East of England), West (West Midlands and South West) and Scotland increased 1.6%, 0.9% and 2.0% respectively.

House price growth was also strong. In the East Midlands, West Midlands and Scotland, house prices grew 1.5%, 1.3% and 1.3% respectively, compared with 0.9% nationally.

More builders in the Midlands

Growth in the Midlands has been driven, in part, by more demand from housebuilders. With increased growth in this region, demand for land is expected to be maintained.

The Berkeley Group has created a new brand in the West Midlands, called St Joseph, and is actively seeking land for development in Birmingham, Solihull, Warwickshire and Stratford-upon-Avon.

Crest Nicholson has also been growing its presence in the region. Set up in 2017, the new Midlands division has acquired seven sites and is expected to complete its first homes this year.

Miller also opened a West Midlands region in 2017. With the growth of the region, it is planning to increase completions nationally by 48% to 4,000 per year.

Scottish growth

In the past year, house prices in Scotland have risen by 5%, making it the strongest-performing part of the UK. This, in turn, has supported land price growth. The highest annual house price increase was in Edinburgh and Midlothian – with growth of more than 10% in the year to March 2018. In Aberdeen, the land market is showing the first signs of growth since 2014 as sentiment becomes increasingly positive.

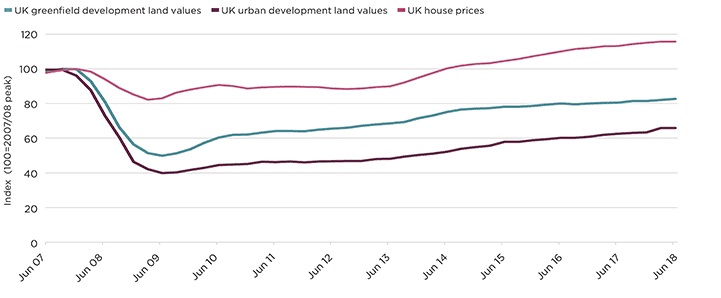

In Q2 2018, land values in the UK increased by 0.8% for greenfield sites, but remained flat for urban land.

Although there is growth in parts of the Midlands and Scotland, land values have stayed relatively constant across much of the country. This is partly the result of a continued increase in the supply of permissioned land. In 2017, 391,320 new homes were granted planning permission in Britain, according to the HBF Housing Pipeline report. This was a 21% increase on 2016.

While some housebuilders are reducing their land pipelines and buying land selectively, others are expanding significantly and need land to do so.

In Taylor Wimpey’s new strategy, it plans to increase volumes while reducing the length of its pipeline of land to 4-4.5 years. Barratt aims to maintain a 4.5-year pipeline on an expanding delivery programme.

FIGURE 1 | Growth continues for greenfield land, while urban values flatten

Source: Savills Research, Nationwide

Demand for land is not just from the housebuilders. Housing associations are planning to build increasing numbers of homes with less reliance on Section 106 and therefore require more land.

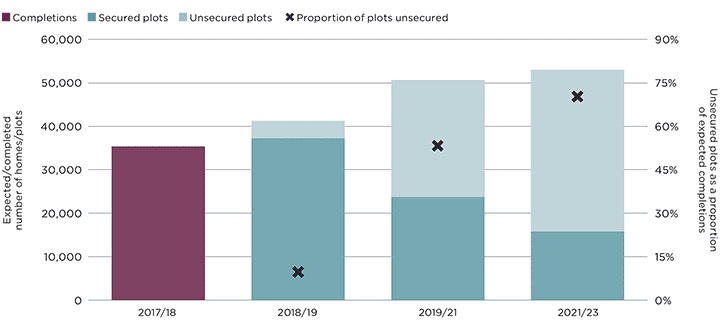

The top 50 housing associations expect to increase completions by 50% during the next five years from 35,000 to 53,000 homes per year. To achieve this, they need to secure an additional 138,000 plots. Around 4,000 plots are needed to deliver the homes expected in the next year, with a further 27,000–37,000 plots per year over the next four years.

Homes England has also announced the first wave of strategic partnership deals with eight HA partners. This is to deliver an additional 14,280 affordable homes by March 2022. A funding package of £590 million during the period has been announced to support the partnerships with emh group, Home Group, Great Places, Hyde, L&Q, Matrix Partnership, Places for People, and Sovereign/Liverty. As part of the agreement, the eight partners have committed to delivering 23,500 additional homes across all tenures, reinforcing their need for land.

Housing associations are also turning to strategic land (land without planning permission) to take a longer-term stake in their land pipelines. In our annual survey of housing associations (The Savills Housing Sector Survey 2018), we found 26% of those who didn’t own strategic land were looking to acquire this type of land in 2018, double that of last year. Some 35% currently own strategic land; the same as last year.

FIGURE 2 | Expected completions and land requirements for the top 50 housing associations

Source: Savills Research using Inside Housing data on top 50 housing associations

In its Land Development and Disposal Plan, Homes England has listed the sites it intends to bring to the market in the next year. Of these, 127 of the 221 sites are suitable for residential development. Some 29% of these sites have outline or detailed planning permission, 30% are not yet allocated or proposed to be allocated in a Local Plan.

The draft analysis of the Letwin Review concludes that build-out rates on very large sites are limited by the homogeneity of product. It calls for more variety in product type and tenure to deliver homes more quickly. In large part, this means delivering more affordable homes and those for rent as well as for sale.

The Build to Rent sector is growing, supported by institutional investment. The sector now has 125,000 units in the pipeline, 22,400 of which are complete. London is no longer the primary focus, there are now 21,600 Build to Rent units under construction in the regions compared with 15,900 in London.

In order to fund the affordable homes needed with grant, we calculate that at least £7 billion is required each year (see Savills Spotlight 2017: Investing to solve the housing crisis).

The Homes England deals with housing associations (a funding package of £590 million) are a positive step towards filling this gap.