Abstract

We are seeing continued rental growth in the region which is narrowing the historic gap with the West Midlands

.jpg)

We are seeing continued rental growth in the region which is narrowing the historic gap with the West Midlands

Nickel 28 South Normanton being developed by Thorngrove and Richardson

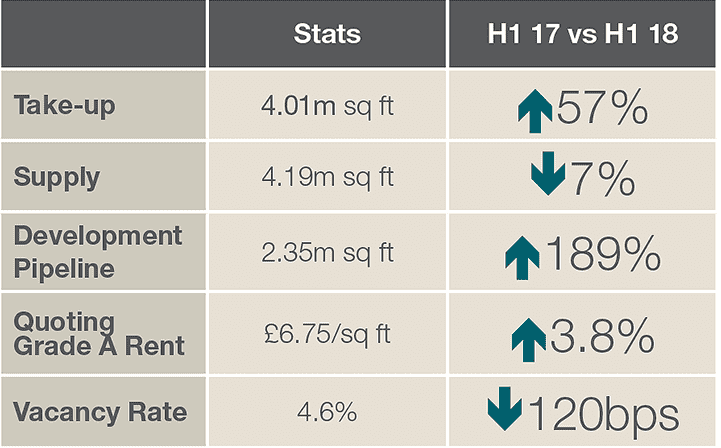

TABLE 2 | Key stats

Source: Savills Research

Supply

.png)

FIGURE 6 | Supply by grade

Source: Savills Research

Take-up

.png)

FIGURE 7 | East Midlands take-up

Source: Savills Research

.png)

FIGURE 8 | Speculative announcements

Source: Savills Research

Development pipeline