Outlook points to yield stability for all but retail

Negative newsflow tempering confidence in retail

- There was a marginal softening in average yields of four basis points (bps) in May, following a hold in April, with the outward shift originating in retail.

- Out-of-town retail parks, both open A1 and restricted, reported 25bps softening in prime yields. Leisure parks also saw a 25bps outwards shift. While yields for shopping centres and high street held, there is mounting outward pressure on pricing.

.png)

TABLE 1 | Prime yields

Source: Savills Research

- Clearly the negative newsflow surrounding retail in light of recent CVAs and the structural shifts related to the growth in online is tempering investor confidence.

- However, this may offer opportunities to investors confident in the longer term fundamentals of prime and strong convenience focused retail. For example, forecasts suggest that online growth is slowing with online expected to account for 19% of retail sales by 2022, with the online penetration rate for some retail segments far lower. Also, while a number of legacy retailers are rationalising store portfolios, there are still retailers who are expanding.

- The reality is that it is not a case of offline vs online. Rather the store is increasingly seen as a key tool in driving online sales. Given the evidence we have seen we believe the winning locations of this strategy will be prime destinations and strong convenience focused locations.

- For non-retail sectors the outlook points to relative yield stability for the remainder of 2018, despite a backdrop of rising interest rates. IPE's annual survey of the world's 100 largest real estate investors found that Europe, including the UK, remains a key target market. Considering investors, on average, remain c.130bps below their target allocations and with 62% stating that they expect to remain net buyers in 2018, supporting current prime pricing.

.png)

GRAPH 1 | Top 100 investment intentions

Source: PE Real Estate Investors Survey 2018

Polarisation between prime and secondary retail widening...

- All parts of the retail market are exposed to the structural and operational challenges facing the sector, yet there are certain types of locations that are faring better than others.

- Destination and strong convenience led locations would appear to be faring better with this prime end of the market continuing to report rental growth. In contrast secondary and weaker retail locations have been the most exposed. Indicative secondary retail reported vacancy of 14.4% in Q118 up on the currently standing at 14.4%, up on the 11.6% reported in Q1 2017.

- Vacancy on secondary retail has meant that rental growth has barely moved into positive territory since the GFC, with Q1 2018 reporting an annual decline of 1.2%. In contrast prime retail reported annual growth of 2.0% highlighting the polarisation between both ends of the market.

- Prime retail, while still reporting rental growth, has seen the rate of growth slow over the course of 2017 and we expect there will be further downward pressure over the remainder of 2018. Our forecasts point to rental growth of 0.5% for All UK Retail in 2018, with growth picking up again in 2019. Between 2019 and end 2022 growth is forecast to average 1.0% per annum driven by growth in prime and strong convenience led locations.

- While the future of secondary weak retail locations looks bleak this is not to say they wouldn't work with some smaller element of retail, repurposing redundant retail space for other uses. This could include logistics, co-working, healthcare and residential, subject to viability and planning constraints, uses that could add value to the retail that remains.

.png)

GRAPH 2 | Rental growth polarisation between strong and weak retail locations

Source: Savills Research; MSCI (*Note: Indicative prime and secondary based on yield quartile performance within the MSCI databank)

..and the South East is not immune

- The polarisation of prime and secondary is not necessarily a simple reflection of geography. For example, London and the South East does not automatically equate as prime.

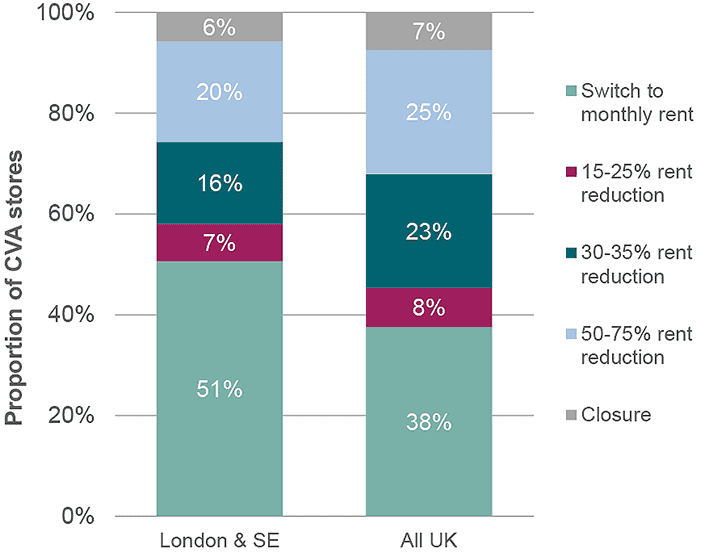

- This is apparent in the geography of recent CVAs. Savills have analysed the store profile of CVAs, from Group 1 (switch to monthly rent) through to those stores identified for closure, in terms of type of retail location and geography.

- Within London and the South East the largest share of CVA stores (51%) reported no reduction in rents with a switch to monthly rents. Yet, 6% of CVA stores in the region were identified for closure, with a further 20% pursuing rent reductions of 50-75%.

- The demographics and international visitor profile of London and the South East remain a massive draw to retailers. But, even against this backdrop the specifics of the location remain key as is store profitability particularly in the wake of the rating revaluation.

GRAPH 3 | CVA profile in London & SE vs All UK

Source: Savills Research