We look into the needs of first time buyers as they increase their share in the new homes market

A key buyer group for new homes

In recent years, a series of government-led initiatives have been introduced to help people take their first step on the property ladder. As a result, first time buyers form an increasingly important buyer segment for new build homes.

According to UK Finance, first time buyers were responsible for more than 50% of all new residential mortgages issued across the UK in the first quarter of 2018. This translates to 81,000 mortgages with a value of £13.2 billion, a 6% increase on the first quarter of the previous year.

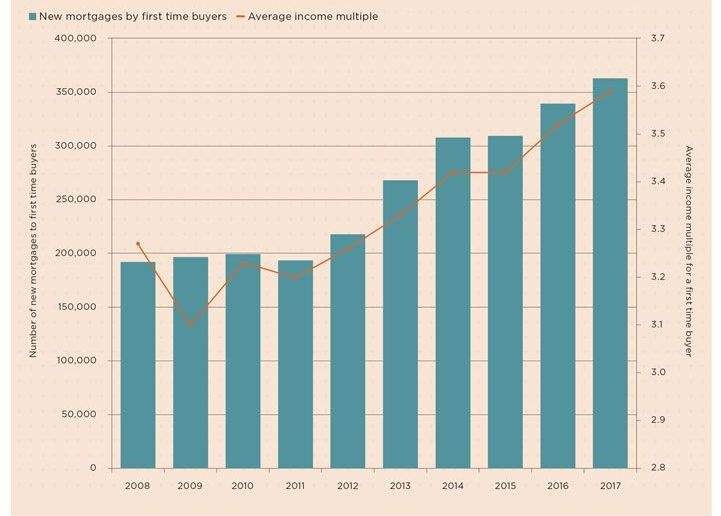

Around 365,000 first time buyers completed on a mortgage in 2017 – the highest number since 2006. Reflecting this, first time buyers of Savills new homes have increased their share of the market by 4% during the past two years. But as the number of loans to first time buyers has increased, so has the income multiple, as people increasingly stretch themselves to get onto the ladder.

Since 2009, the average income multiple for a first time buyer mortgage has increased 16% from 3.1 times the average income to 3.6 times. According to UK Finance, the average household income for a first time buyer is now £41,760.

With affordability a major driver for many first time buyers, ensuring new homes hit the right price point and deliver the right product is key to maximising demand from this important group of buyers.

FIGURE 1 | Growing buyer segment First time buyers have increased their share of the market, but are being limited by affordability

Source: Savills Research, UK Finance

Affordability: the limiting factor

The constraint of affordability, both in raising a deposit and securing a mortgage, is impacting the kind of home first time buyers can afford and the age at which they can buy.

During the past three years, 59% of Savills new build first time buyers were under 29. But there is significant regional variation. In the South East and East of England, 41% of first time buyers were aged between 30 and 39, reflecting the longer time it takes to save a deposit in markets where house prices are much higher than incomes. In the South West, only 14% of first time buyers were in this age bracket. The longer it takes to save means that many first time buyers already have children by the time they buy their first home. This clearly has an impact on the kind of home they look for.

Our recent survey, in collaboration with the NHBC Foundation (Beyond location, location, location: priorities of new home buyers), found that 29% of first time buyers who had bought a new home in the last four years already had children. They were, on average, buying a home with more than three bedrooms, while first time buyers without children were more likely to buy a home with fewer than three.

Likewise, 15% of first time buyers believed being close to a nursery was a very important reason for buying their home, compared with just 8% of all buyers surveyed.

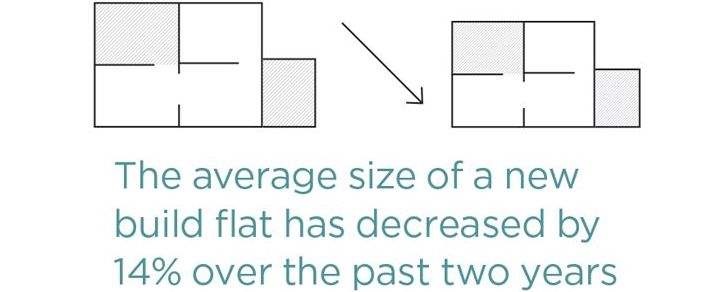

People are increasingly looking to future-proof their homes as moving becomes more expensive. But current affordability constraints are limiting the size of homes many can afford. In 2015, the average new flat bought by a Savills first time buyer was 700 sq ft. By 2017, this had decreased by 14% to just over 6oo sq ft. During the same period, the average purchase price of a flat bought by a first time buyer increased 22% to stand at £263,000.

As the profile and priorities of first time buyers change, the products on offer must adapt to remain in demand.

The importance of Help to Buy

Our survey with the NHBC Foundation highlighted Help to Buy as the top priority for first time buyers purchasing a new build property, with 58% rating it as a very important reason for buying their home.

The Help to Buy scheme was launched in 2013 to help those struggling with affordability issues to step on to the property ladder with the support of an equity loan. Since then, Help to Buy has supported 36% of new build home sales in England, with 81% of these sales going to first time buyers.

Help to Buy, and exemption to stamp duty for most first time buyers, can provide a solution to future-proofing by allowing buyers to purchase larger homes while only requiring a 5% deposit. When the scheme launched in 2013, 22% of purchases were for detached homes, but by 2017 this had increased to 31% of all sales supported by Help to Buy.

Help to Buy: beyond 2021

The uptake of Help to Buy has been highest in the North East, the region with the lowest average house prices in England. The markets with lower levels of Help to Buy sales are typically those which are at the higher end of the affordability range for first time buyers. In London, for example, although take up has increased since the introduction of the 40% equity loan in 2016, much of the stock delivered is above the £600,000 cap. However, we estimate that of those units eligible for Help to Buy, 29% were sold using the scheme, underlining how important it is for buyers taking their first step on the ladder.

Looking forward, it is important that the sales strategies for new homes recognise the importance of first time buyers as a group and deliver homes of the right size and price point to maximise demand. Smaller units aimed at younger buyers may not capture all of the market potential, and Help to Buy should be considered for larger family units where appropriate.

Help to Buy continues to grow. The number of loans issued in 2017 using Help to Buy increased by 20% on the previous year, with the total value of these loans increasing by 39% over the year.

The projected end date of Help to Buy is 2021. The Government should confirm its future plans for the scheme to provide certainty for both developers and prospective home owners.