Landlords taking advantage of falling yields to not chase high rents

Market snapshot

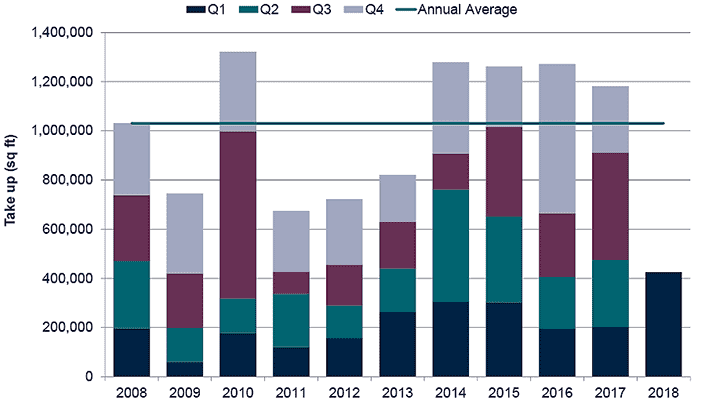

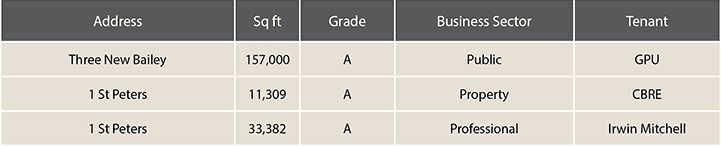

■ Take-up in the first quarter of 2018 reached a record level for the last decade, with 424,792 sq ft leased in the City centre and 674,894 sq ft in total across our market area.

■ As is always the case with a very strong quarter, one large letting contributed to the out-performance. However, even without the 157,000 sq ft pre-let to the GPU at Three New Bailey the first quarter of 2018 would have been a positive one.

GRAPH 1 | City centre take-up by quarter

Source: Savills Research

■ Tenant demand remains broad-based with no particular over-reliance on one industry for demand at a particular grade or price point. However, we do expect to see serviced office operators accounting for an even higher proportion of 2018's take-up than the 10% that they took last year.

■ Other notable requirements that could land this year include Amazon (who are looking for 70,000 sq ft regional HQ), and Handelsbanken who are looking for a new City centre office.

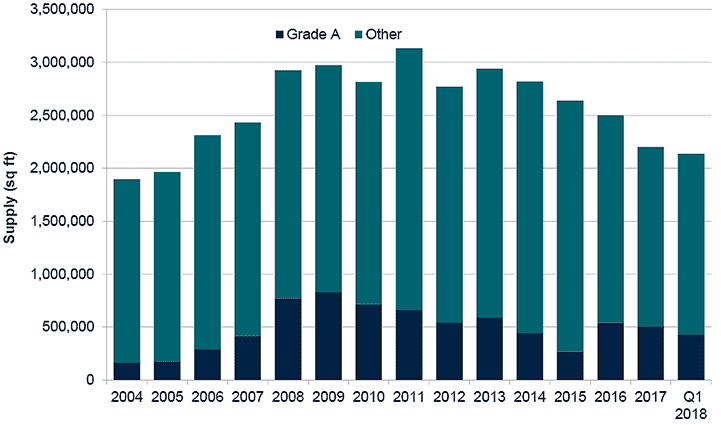

GRAPH 2 | Availability

Source: Savills Research

■ Supply continues to fall in the City, both of prime and good quality refurbishments. The development pipeline remains very restrained, with only 8 First Street due for completion this year, and only two planned completions for 2019.

■ The refurbishment pipeline is a little more active, and while the rental gap between new build and refurbished properties has continued to close we believe that high quality refurbishments in the edge of core submarkets will remain popular with cost or image conscious tenants.

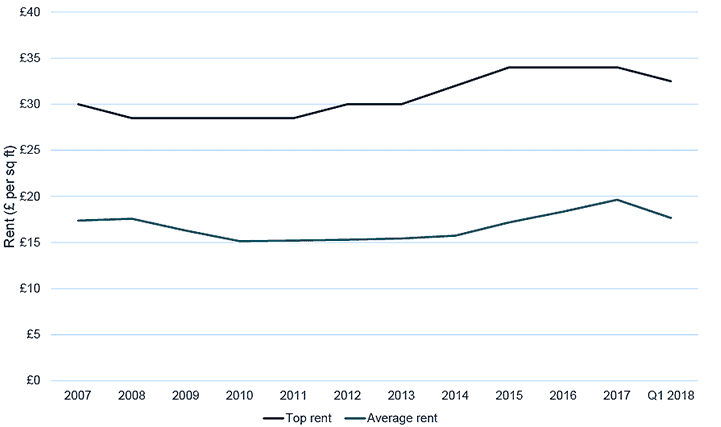

■ Looking ahead, the continued closing of the gap between new-build and refurbished office rents will remain a theme. However, a recent interesting trend that has emerged is that while rents are rising on refurbished space, they have stabilised on the best new-build space. Indeed, schemes that we were predicting could set new rental highs for the City have failed to do so.

■ This trend is not reflection of tenants being unwilling to pay high rents, but has more to do with risk-averse landlords choosing not to push rents in favour of letting their schemes as fast as possible. These landlords are able to be more competitive on rents and terms because prime office yields have hardened from more than 5% to 4.75% over the last 12 months.

GRAPH 3 | Rents

Source: Savills Research

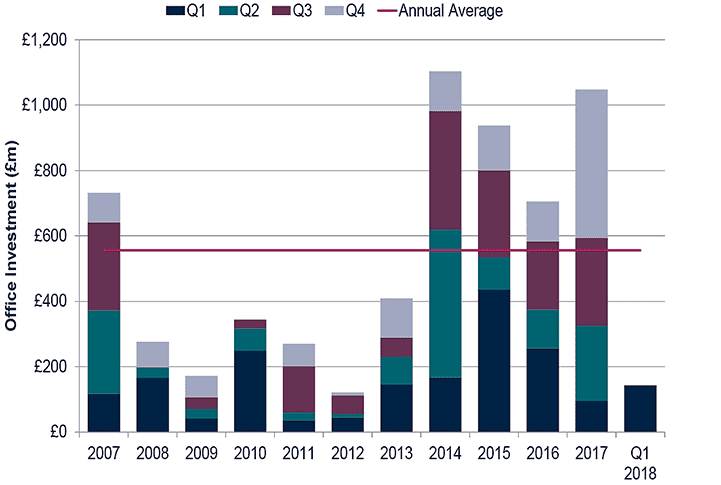

■ Investor demand for prime Manchester offices is expected to remain strong, though deal volumes in the first quarter of 2018 have been hampered by a lack of stock. Indeed, we believe that buyer's definition of prime has widened in recent months to include buildings with some vacancy or shorter leases - a reflection of confidence in Manchester's occupational outlook.

GRAPH 4 | Manchester & Salford office investment

Source: Property Data

■ Given the current strength of investor demand for the City, the tightening yield spread to London, and the slowing rental growth story in the occupational market, now may well be the time for vendors to achieve the best prices of this cycle.

TABLE 1 | Significant occupational deals in Q1 2018

Source: Savills Research