Savills forecast 825,000 sq ft of office space will be taken up during 2018

Market snapshot

Take-up in the Birmingham office market reached 148,000 sq ft during the first quarter of 2018, 14% above the 10 year first quarterly average (Graph 1). Savills forecast a total of 825,000 sq ft to be leased this year.

.png)

GRAPH 1 | Take-up by quarter (sq ft)

Source: Savills Research

The key recent deal was engineering consultant, WSP signing for 46,100 sq ft at Brockton Capital's The Mailbox. Savills acted on behalf of the landlord and the mixed-use scheme is now fully let.

Large contractors linked to the HS2 supply chain have seen this as an opportunity to consolidate their regional office presence. Arcadis also signed for 23,000 sq ft at Cornerblock last year. With HS2 enabling journey time to Euston in only 42 minutes by 2026, competition among tenants for large floorplate stock will further intensify.

Contractors in search of more flexible lease terms are supporting the rise of the serviced office market, as Orega signed for 11,300 sq ft of space at the Colmore Building during Q1 2018. Excluding the Government Property Unit (GPU) deal last year, serviced offices has been the most active business sector in the city centre over the past 18 months, with 219,000 sq ft taken, 18% of the market. In the out of town market, Bizspace signed for 24,000 sq ft at Zenith House, Solihull during Q1 2018.

Strong occupier demand for the very best space has left Prime Grade A supply now standing at only 153,000 sq ft (Graph 2). This will continue to support top rents on their upward trajectory, which could achieve as high as £34 per sq ft by end 2018 (Graph 3).

.png)

GRAPH 2 | Prime Grade A availability (sq ft)

Source: Savills Research

.png)

GRAPH 3 | Top rents (£ per sq ft)

Source: Savills Research

There remains strong demand from occupiers looking to pay around £23-25 per sq ft for refurbished schemes in close proximity to New Street Station as the Birmingham office demand is witnessing a "flight to connectivity", with some of the strongest office rental uplift coming from mixed-use schemes.

Ballymore's Three Snowhill (420,000 sq ft) and Argent's Two Chamberlain Square (160,000 sq ft) will ease the supply shortfall upon their arrival in Q1 2019 and Q4 2019 respectively. One Axis Square, 103 Colmore Row and One Centenary Way all have detailed planning permission, and could satisfy future requirements towards 2020-21.

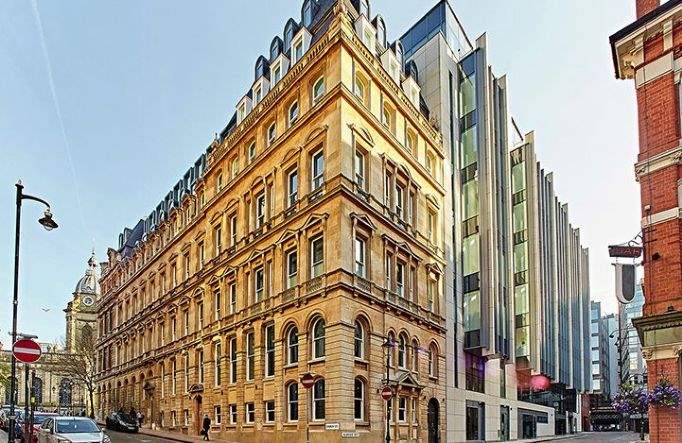

Birmingham's office investment volumes reached £169 million for the first quarter of 2018 (Graph 4), 71% above the 10 year quarterly average of £99 million. This was in part driven by TH Real Estate's c.£98million acquisition of 55 Colmore Row (pictured above). Overseas investors have now accounted for 44% of office investment in Birmingham since 2016.

.png)

GRAPH 4 | Birmingham office investment by quarter

Source: Savills Research, Property Data

Prime yields for the best space remain at 4.75%, in line with Manchester and 75 basis points above the City of London. We expect tightening occupational markets, rising overseas interest and a shortage of openly marketed stock to hold yields firm through 2018.

.png)

TABLE 1 | Significant occupational deals in Q1 2018

Source: Savills Research