Housing associations have a vital role to play in solving the housing crisis...

...But they need to increase their housing output by a factor of four if they are going to deliver the sub-market rental homes we need. This isn’t helped by limits on grant or the rent cut (-1% each year for four years from April 2016).

The last year has seen an impressive effort by associations to minimise the impact of the rent cut on operating margins and development capacity. But as the rent cut continues, the difficulty of maintaining investment in new homes will grow.

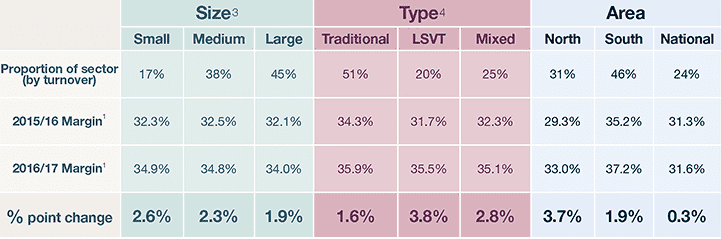

Core margin1 across the sector2 increased by an average of over two percentage points in 2016/17 – from 32.3% in 2015/16 to 34.5% – despite being the first year with a 1% rent cut.

This performance was delivered by a small increase in receipts – with newly built homes more than offsetting the impact of the rent cut – along with reductions in cost per unit. And it was broadly achieved across the whole sector, with LSVTs and northern-based associations delivering particularly large gains, but limited patterns regarding size of organisation.

While this appears to be good news, there’s a big ‘but’. Many in the sector have highlighted that there were some one-off, large efficiencies to be made, to offset the rent cuts and protect development programmes in the short term. This low-hanging fruit can only be picked once, so future cost-cutting is likely to be more difficult.

FIGURE 1 | Core margin improvements across the sector 2015/16 to 2016/17

Source: Savills Research using published accounts of 202 housing associations

Inflationary pressures

Further inflationary pressures are also on the horizon. Brexit could have a significant impact on staff availability and construction costs. National Living Wage legislation could push up staff costs, particularly in the care sector. Post-Grenfell, safety and quality will have to be further prioritised over new build or regeneration projects.

So, where could margins go from here? We have set out two scenarios to project the financial position of the sector forward to the end of the rent cuts in 2020 (note that both assume that development of new homes continues at the current rate).

If costs simply increase by forecast inflation over the next three years (6.0%, according to Oxford Economics), this would add almost £1bn of operating costs across the whole sector, reducing the average social housing lettings margin from 34.5% to 28.5%.

To keep the average social housing lettings margin at 34.5% would require cost per unit in 2020 to be 2.4% lower than today – in nominal terms.

Margin matters

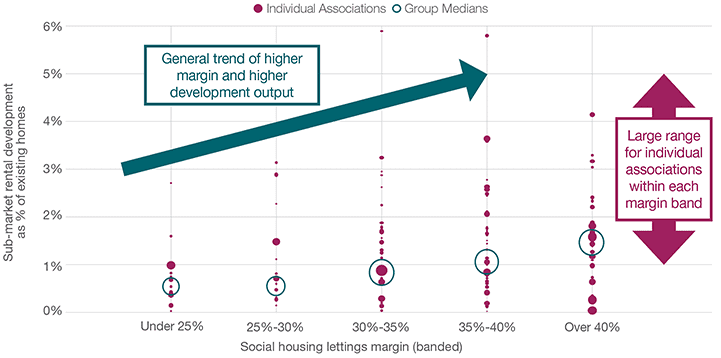

Why does it matter if the margin on the core lettings business of an association is eroded? Our analysis (see graph below) shows that associations with a higher social housing lettings margin generally develop more sub-market rental homes (adjusted for size of organisation). Those with a core margin under 30% delivered new sub-market rental homes equivalent to 0.7% of their existing general needs stock. This rate doubled to 1.4% for those achieving above a 35% margin.

While there are many other factors and constraints affecting housing associations’ ability to deliver larger volumes of new homes, an efficient core business appears to be a good starting point, so protecting them in light of the remaining rent cuts is likely to be very important (see ‘Inflationary Pressures’).

FIGURE 2 | Relationship between core margin and development output, 2016/17

Source: Savills Research using published accounts of 202 housing associations, size of dot scaled to size of organisation/group

Solving the housing crisis

Housing associations delivered about 23,000 new homes at sub-market rents in 2016/17, a percentage addition to their existing general needs stock of about 1.1%. The 300,000 new homes of all tenures required each year in England each year to improve housing affordability is equivalent to adding 1.3% to existing housing every year, so more needs to be done to deliver a ‘fair share’.

Around 100,000 of the annual total housing need is for sub-market rental homes (as we highlighted last year5), equivalent to 2.5% of all general needs stock. Assuming an optimistic forecast of council housebuilding at 10,000 homes per year (compared to the 2,800 delivered in 2016/176, but activity is increasing) leaves 90,000 more homes for HAs to deliver. This is 4.4% of existing stock - four times the current rate of delivery.

Only six associations out of the 202 in our sample delivered new homes at or above this rate in 2016/17, illustrating the scale of the housing challenge we need to meet.

1 ‘Core’ margin refers only to social housing lettings, excluding market and shared ownership development and other social programmes.

2 ‘The sector’ as represented by 202 associations for which we have analysed financial reports, representing over 95% of all stock owned.

3 Size bands (small = under 10k units, medium = 10-30k, large = over 30k units).

4 Types as defined by HCA SDR (specialist providers not included).

5 'Investing to solve the housing crisis'

6 Excluding joint ventures with private developers.