What measures should Glasgow's landlords take to futureproof their offices?

Tech Transition

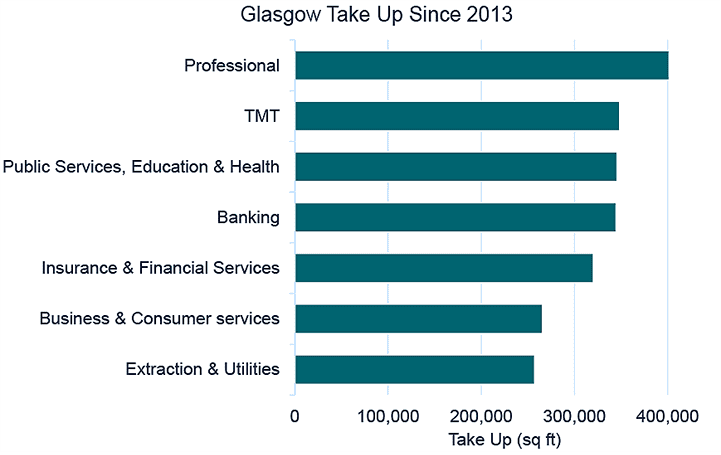

Glasgow's well established technology, media and telecoms (TMT) sector continues to thrive and has been the city's second largest contributing business sector by take up over the last five years, taking 349,000 sq ft (Graph 1). This has led Glasgow's digital workforce to become increasingly data hungry – Savills What Workers Want survey shows that 74% of Glasgow's workers consider good quality wireless technology to be of high importance, up from 50% in 2013. However, of these workers, only 30% are satisfied with the quality of wireless technology, the lowest proportion in the UK.

Several landlords have responded by ensuring their properties have the best fibre connection using infrastructure providers such as CityFibre who are now live in the city. Many landlords are now demonstrating their buildings' connectivity and resilience by getting them WiredScore certified, providing a transparency of connectivity information to tenants.

GRAPH 1 | TMT has driven Glasgow's take-up

Source: Savills Research

The Hunt for Talent

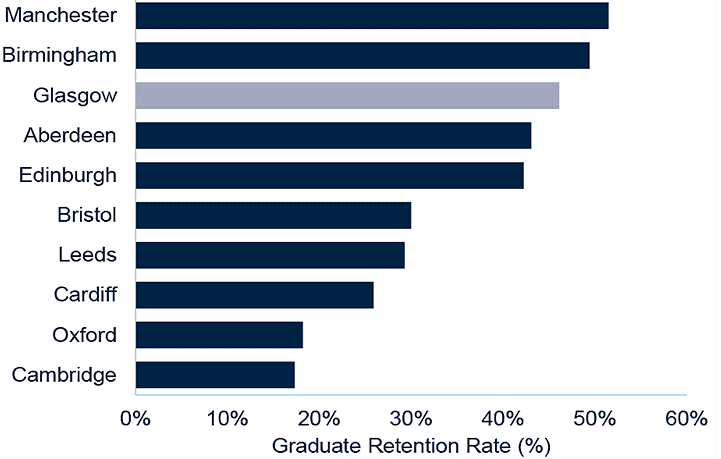

One growing concern for landlords across the UK regions is the availability of talent for its tenants. Glasgow retains 46% of its graduates upon graduation, the third highest city in the UK regional cities (Graph 2). However, developers must provide the right space to ensure occupiers can attract and retain younger staff. Currently, 40% of UK workers in serviced offices are between the ages of 18 and 34, whilst in traditional offices, only 26% of workers are in this age band. Younger workers are more attracted by the collaborative workspace in serviced offices and landlords must adapt to this change.

Only 1.3% of Glasgow's workers commute to work by bicycle, the lowest proportion of the key regional cities, according to the latest Census data. However, landlords have recognised the importance of providing cycle and shower facilities to attract workers. For example, FORE Partnership's Cadworks (pictured above) will provide 94,000 sq ft of Grade A space in Glasgow on its completion in 2020 and will mark Scotland's first cycle-in office.

GRAPH 2 | Graduate retention rates by city

Source: Centre for Cities

Landlord and Tenant

In a trend which continues to grow outside London, Glasgow’s office occupiers are now willing to spend more on their fit-outs to personalise office space to their needs. Each occupier’s requirements from office space are different and more landlords are now considering Shell and Core schemes, offering occupiers the option to complete their own fit-out or offer a selection of finishes that tenants can select.

For the landlord, this can improve both sustainability and delivery time. But, a Shell and Core fit-out could require a split in the delivery contract which could increase the landlord's overall project costs. The landlord must also decide on the baseline specification it will deliver for a tenant or which the tenant must deliver, should it do the fit-out, and this sets the base rent. Many landlords are trying to provide a menu of options which in practice relates to the ceiling finish and the extent of the M&E installation. The challenge for a landlord is how much flexibility there can be in the menu offered.

For the tenant, this means a saving in fit-out costs, no need to remove the landlord's Cat A fit-out, and improvements in timescales for delivery of the fit-out. The challenge will be the flexibility that a landlord can actually offer a tenant and the potential for the rent to be higher where the landlord delivers a very bespoke fit-out. There could also be challenges around reinstatement depending upon the base specification agreed.

It is no longer just tech companies who are choosing 'back to basics' fit-outs, or defurbished space. However, some occupiers have been put off by signing for 'back to basics' space and cannot visualise the potential in “unfinished” buildings.

Average lease lengths across the UK regional office markets fell by 6% on the previous year as occupiers demanded more flexible lease terms. The challenge for landlords now is to create a community where workers want to stay and tenants want to renew. If the tenant has already invested in their fit-out, they will be less likely to leave on their break date, assuming they are using their space efficiently and employees are enjoying the environment.

Flexible Floorplates

Despite large floorplate deals underway, Glasgow faces a structural shortage of good quality, smaller floorplate stock. There is currently only 168,000 sq ft of space available in lot sizes below 5,000 sq ft, though over the past five years, take up in lot sizes below 5,000 sq ft has averaged 148,000 sq ft, indicating around 14 months of supply remaining in the market.

Landlords should consider subdividing their floorplates in order to accommodate tenants in search of smaller lots, otherwise, tenants in search of Grade A space will have no choice but to move into serviced offices. For example, at 58 Waterloo Street, Castleforge subdivided the floor into two smaller suites to cater for tenants in search of smaller space.

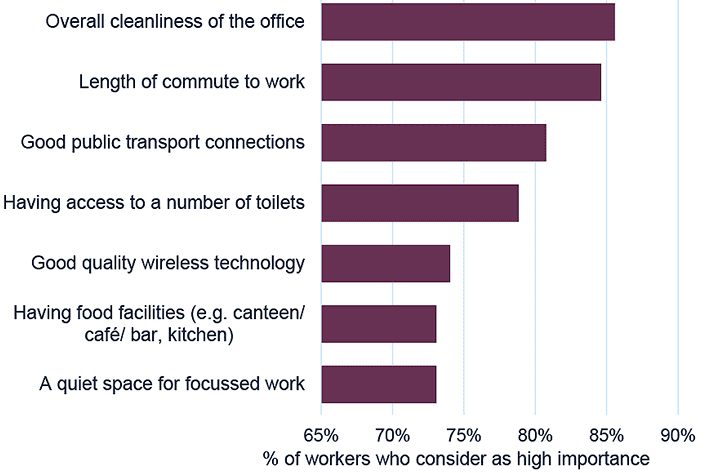

Glasgow's workers want to reduce their commute

Savills What Workers Want survey (Graph 3) indicates which factors Glasgow's workers consider most important. 84% of workers consider length of commute to work to be of high importance, whilst 81% considered good public transport connections to be of high importance. Offices located in close proximity to Glasgow Central and the redeveloped Queen Street stations will achieve the strongest rents.

GRAPH 3 | What do Glasgow's workers consider most important?

Source: Savills Research, What Workers Want