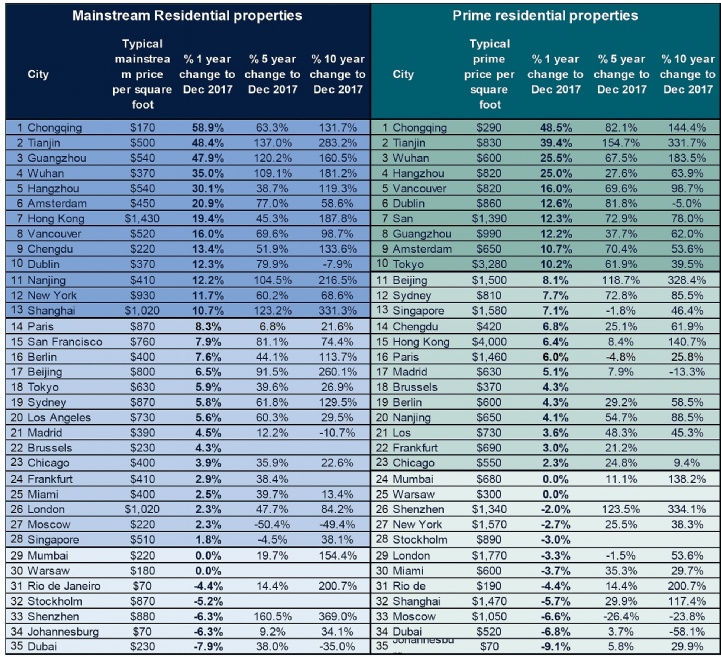

A ranking of cities by prime residential price growth was also dominated by Chinese cities, with the top four recording price growth of at least 25 per cent in the year.

Rates of mainstream house price growth exceeded prime market growth in most cities in the Savills World City rankings. Only 10 cities, half of them in China, saw prime market price growth of over 10 per cent, while a third of the cities analysed saw prime values stall or fall. The fallers include some of the world’s most established global cities, most notably New York, Stockholm, London and Moscow where average prime city house prices fell -2.7 per cent and -6.6 per cent.

“This outperformance by the mainstream housing markets across key world cities is part of a longer term global trend,” says Yolande Barnes, head of Savills world research. “Prime values rose first and fastest after the global financial crisis, but some are now hitting a high plateau. It’s now the turn of the mainstream markets to play catch up.

“Prime residential markets around the world reacted quickly to quantitative easing by central banks and the consequent yield shift in line with low interest rates. This was a one-off yield shift and expectations are that central banks are moving towards raising rates, reducing the potential for price growth.

“Importantly, while some cities have recorded small falls, we generally don’t expect these to become significant, but we do expect prices to remain relatively stable, on a high plateau for some time, though we will continue to see volatility in oil dependent economies, for example.”