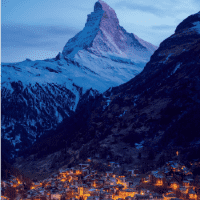

▲ Méribel, France

How have recent political events in Europe affected Alpine resort markets?

Paul Tostevin (PT) Alpine ski resorts are characterised by low transaction volumes and are slower to feel the impact of external factors than high-turnover, urban markets.

However, wider events still have influence. In France, the Macron government has boosted sentiment, fuelling activity, with both French and foreign buyers now more confident to make a move. The wider Italian residential market is entering a period of stability, while new tax incentives, introduced to attract wealthy individuals, could impact positively on the major Italian resorts.

Brits have historically been an important buyer group in the Alps. Is Brexit having an impact?

PT The international buyer base in the Alps is much broader than it was a decade ago, so Brexit’s impact has been modest. While some British buyers have postponed plans, others have actively sought non-sterling assets to diversify their portfolios, or are taking advantage of a stronger euro and are selling to repatriate funds.

There are many challenges facing the industry, how are resorts responding?

JR The volume of money being invested in new projects and infrastructure is testament to confidence in the future of the mountain economy. Crans-Montana, for example, is now actively promoting itself as a ‘city in the mountains’, with dual-season activities, new restaurants and a recently opened British International boarding school. Courchevel recently opened Aquamotion, a €65 million indoor watersports centre; Val d’Isère is to build a €200 million hotel, retail and commercial centre, while Verbier is benefitting from extensive investment from global hotel brands. New lift investment is particularly concentrated in the Alps, too (see map, Braving the elements).

From a property perspective, planning consent for development of all sizes is increasingly difficult to obtain across the Alps. Macro policies, such as Lex Weber in Switzerland, will help to address the recent supply/ demand imbalance in the medium to long term, as will zoning controls in the French and Austrian Alps.

.png)

.png)

.png)