Destination trips

In previous reports we have discussed the polarisation of shopping trips between ‘destination’ and ‘local’ retail journeys. Local shopping trips represent a ‘needs’ based retail journey, while destination trips represent a ‘want’ based journey.

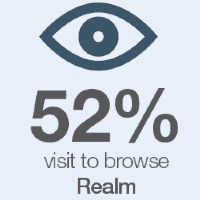

For destination retail trips the overall experience is paramount in order to draw people from distance for long dwell times. This allows for browsing and comparison of goods or services. Visitation is less frequent and consumers are typically prepared to spend more.

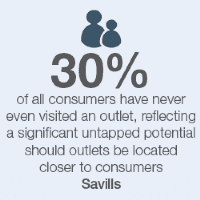

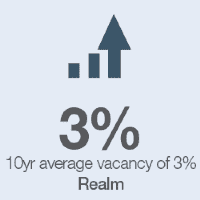

However, an increase in both the significance of local shopping trips and the growth of ecommerce means that destination retail has to work harder to compete for a reduced share of consumer spend. Where destination schemes have combined with other retail and leisure offers, or another consumer draw such as an arena or tourist attraction, footfall has remained high. The challenge is providing a point of difference in a market flooded with choice, value and experience.

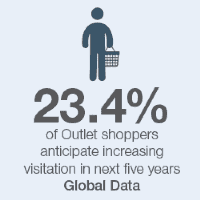

Like regional malls and major city centres, visitation to outlet centres is typically destination driven and an evolution of the offer has been on the agenda of many operators and developers in the sector in order to remain in-tune with current consumer demand.

What continues to drive consumer visits to large retail schemes, is the notion that non-essential shopping trips are essentially a leisure pastime. Shopping has evolved from being considered an activity in its own right to part of a wider leisure experience. As such, many retail led schemes have become more of a hybrid between the retail and leisure offer.

.png)

.png)

.png)