“We expect the market to return to growth in 2019-20, as employment, wage and GDP growth swing back towards trend levels. But, in the longer term, we will face the impact of interest rate rises”

Lawrence Bowles, Savills Research

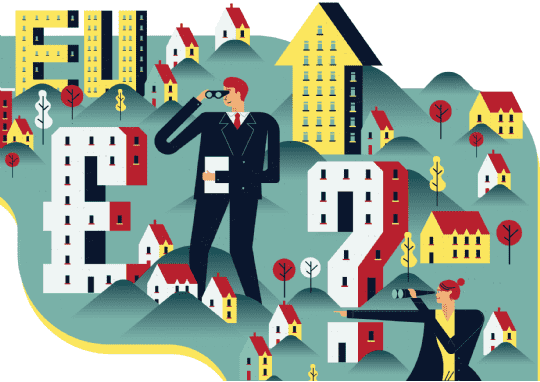

Lawrence Bowles assesses growth prospects for the UK housing market against a backdrop of economic and political pressures

We expect house price growth to slow next year as uncertainty weighs down the market. There is capacity for growth later on, but this will be tempered by interest rate rises. This means that we expect UK house price growth to be limited to 14% in total over the next five years, half the level seen over the last five.

What’s holding back growth?

Right now, uncertainty. With the UK’s future relationship with the EU up in the air, we’ve seen the UK’s credit rating downgraded, the pound weakened, and the economy subdued.

Inflation has cut into people’s earnings, with the ONS reporting that incomes fell by 0.4% last year in real terms.

Against this economic backdrop, there are no strong drivers for house price growth over inflation next year.

What about the following year?

We expect the market to return to growth in 2019-20, as employment growth, wage growth, and GDP growth swing back towards trend levels. But in the longer term, we will face the impact of interest rate rises.

Any rise in the Bank of England base rate, no matter how gradual or limited, will increase the cost of borrowing for households with a variable-rate mortgage. It will also hit households looking to agree a new mortgage: lenders must apply an interest rate ‘stress test’ to make sure their borrowers can afford repayments should rates rise. These new tests will push mortgage availability out of the reach of more households.

This is what limits our growth forecasts for 2021 and 2022. With mortgage affordability increasingly constrained, any house price growth will be driven by earnings growth.

If everything is so uncertain, how do you know this is what’s going to happen to the market?

We base our forecasts on what Oxford Economics estimates is the most likely Brexit scenario: that the UK will have an interim EU deal from March 2019, then move to a free trade agreement. Clearly, other outcomes are possible; each having an impact on price growth. We also assume no major Brexit-related job losses and a Conservative minority government until 2022.

How do the different regions compare?

Price growth will be most sluggish in areas where affordability is most stretched; particularly London and the commuter belt. Affordability in the capital is already more stretched than the rest of the UK, putting a brake on growth. But areas beyond the Home Counties have potential for growth: incomes have grown more in line with house prices, aiding affordability.

That’s why we expect the North to outperform London and the rest of the country. The North West, in particular, has a robust economic outlook and strong employment growth. And house prices sit at a modest multiple of average incomes: 5.6 times in the North West, compared with 12.9 times in London.

But these are trends for diverse regions. London contains ultra-prime Kensington and Chelsea, and up-and-coming Waltham Forest. The North West has affluent markets such as Trafford, along with less wealthy areas, such as Burnley.

In general, we’d expect price trends to follow the same pattern we predict at a regional level. Prices will grow fastest in areas that are well-connected to markets with stretched affordability.

.png)

TABLE 1Mainstream house prices Our five-year forecast

Source: Savills Research | Note: These forecasts apply to average prices in the secondhand market. New build values may not move at the same rate

.png)