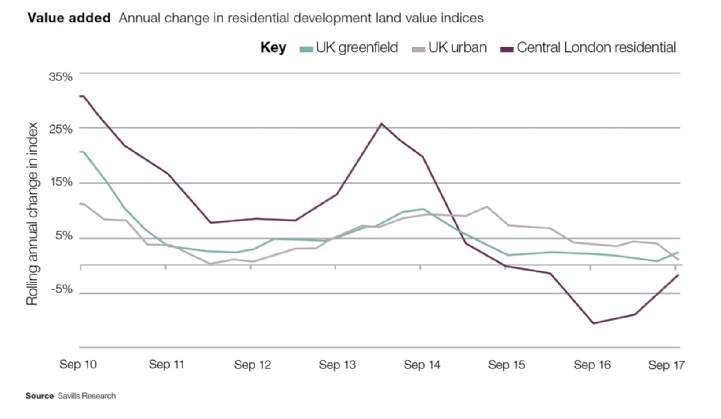

■ In the last quarter, greenfield land values grew 1.1% – as much as they had in the year to June 2017. This brings annual growth to 2.2%. For urban sites, land value increased 0.7% in the quarter, 4.7% in the last year.

■ An additional £10 billion will be invested into the Help to Buy Equity Loan scheme. This is a positive step to support housebuilding in England.

■ In central London, the values in land for residential development continue to fall – by 2% in the last six months. Drops in residential land values reflect falling house prices in the prime markets, particularly in the higher value, central and western areas of central London.

■ Office land values in central London also continue to fall – by 1.7% in the last six months. Rising build costs coupled with occupational risk and more difficult access to finance have all been factors.

Open for business

Housebuilders continue to expand and have opened, or plan to open, offices in new regions. These include national housebuilders such as Barratt, Persimmon, Crest Nicholson and Miller, as well as regional concerns such as Wainhomes in the Bristol area and Story Homes in the Manchester area.

Some are reopening offices in areas they left following the global financial crisis, while others are branching into new territory to diversify and mitigate against regional fluctuations in prices and demand.

Rising completions have facilitated this expansion. According to their annual reports, completions by Redrow and Linden (Galliford Try) are up more than 10% on last year (year ending June 2017). Meanwhile, medium-sized housebuilders are buying more land and building more homes (see UK Residential Development Land, July 2017). House price growth in the Midlands and north of England has also made these areas more viable to build in.

Growth in greenfield value

On a UK-wide basis, greenfield development land values increased by 1.1% in the third quarter, bringing annual growth to 2.2%. This is as much as values had grown in the year to June 2017.

Meanwhile, urban development land values increased by 0.7% in Q3 2017 with annual growth of 4.7%.

.png)