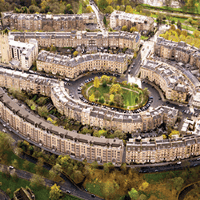

The number of residential transactions in the hub of Edinburgh fell by 3% during the year ending June 2017, which is the first annual drop in six years. However, the market between £400,000 and £750,000 bucked the trend, with a 10% increase.

There was an increase in the number of properties being launched onto the market in this price bracket during 2016 compared to 2015, which was reflected in the rise in transactions. On the other hand, the number being launched onto the market above £750,000 fell during 2016 compared to 2015. As a result, there was a drop in transactions above this level during the year ending June 2017.

Meanwhile, demand remains strong, with current selling times averaging six weeks across all price bands, compared to nine weeks earlier this year.

Mixed performance across prime hotspots

Within Edinburgh, the number of prime transactions above £400,000 in the central hotspots of the Grange, Morningside, Merchiston, Inverleith and Stockbridge reached a five-year high. The attraction of good schools continues to underpin these areas. However, the prime market is still catching up in the West End, Ravelston, Murrayfield and Trinity. In the New Town, prime activity up to £1 million is on par with the level last year. Above £1 million, the recovery last year has not continued, with only five transactions taking place in the first half of 2017 compared to 13 in the first half of 2016. Further afield, the number of prime transactions in Barnton and Cramond reached its highest level in five years, fuelled by new build activity. On the other hand, a reduction in new build activity in Colinton led to a slight drop in prime transactions. However, the second hand market in Colinton, particularly above £1 million, has slightly recovered.

Lack of fresh prime stock as taxation bites

Stock shortages are now impacting the prime second hand market, which will suppress transaction levels going forward. There were 11% fewer properties launched onto the market so far this year above £400,000 compared to the same period in 2016. This is mainly due to LBTT, with people staying for longer in their homes, rather than moving. This trend is likely to continue, unless there is a change in taxation rates (see Figure 1).

.jpg)