Based on the current market-delivery model, our analysis shows that London’s residential development market has reached capacity. To meet strong demand from London’s growing economy and workforce, more affordably priced homes are needed. To achieve that, there needs to be change.

More Build to Rent and a strengthened Affordable Housing programme are part of the answer. But in order to increase delivery in the sectors of the market where it is needed most, further changes are needed to the way in which land is brought forward. It requires much greater public-sector land release. It points to a review of the green belt. It also means exploring ways of effectively capturing the uplift in the value of development land to fund infrastructure and affordable housing delivery, without killing the market.

Delivery not matching demand

When appointed London mayor, Sadiq Khan made the city’s shortage of homes his number one priority. He will be encouraged by the housing delivery figures for 2016. Leading indicators suggest 41,000 homes were completed. This is the highest number of new homes built since the 1930s and close to the London Plan minimum target of 42,000 per year.

But there’s no room for complacency. These numbers are a long way short of the 64,000 new homes per year required to support forecast employment growth.

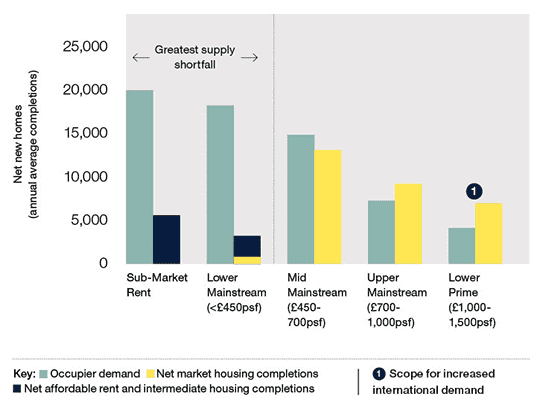

Current delivery does not match the shape of demand, given a failure to meet targets in lower-priced markets. We estimate that 58% of demand is for homes costing less than £450psf, whereas only 15% of the five-year build forecast is expected at these values.

Building unsold homes

For the majority of the last five years, new-build sales and starts have outpaced completions in London due to a very strong off-plan sales market. However, in 2016 new-build sales slowed – much in line with the secondhand London market.

In the mainstream markets below £1,000psf, transaction levels have been affected by the continued affordability squeeze and a fall in domestic buy-to-let purchasers following a range of tax changes. Help to Buy (H2B), which has supported new-build sales across the rest of the UK, has been far less popular in London, where it is capped at £600,000. There have been just 5,700 sales since the scheme was launched in 2013 which means H2B has supported less than 10% of market sales. There was a distinct increase when the 40% equity loan was introduced.

Although uncertainty around Brexit and high stamp duty have had an impact above £1,000psf, total sales volumes have stayed fairly level due to international demand. Of more concern is the ratio of starts to sales – in this £1,000psf+ market, there have been 1.6 starts for every sale during 2015 and 2016. Together this has meant that 25,000 of the 60,000 market homes under construction in 2016 have not been sold. This represents the highest number of unsold homes that are under construction since Molior began recording new home supply data in 2009.

.png)

.png)

.jpg)