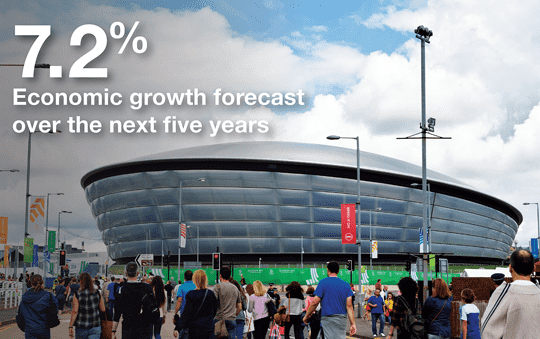

A sporting, retail and cultural powerhouse

Home to the largest sporting infrastructure, boosted by Glasgow’s 2014 Commonwealth Games legacy, as well as the SSE Hydro; the third busiest entertainment arena in the world, Glasgow can truly be classed as a cultural powerhouse.

The largest retail centre in the UK outside London, Glasgow’s shopping provision attracts a catchment of around 90 million each year, with average annual consumer expenditure comparatively high at £2,480 per person, according to data from CACI.

Glasgow’s music, food and sport offering confirms the city’s reputation as an international destination. The tourism industry brought 2.3 million visitors to the city in 2012, generating £495 million of income for the city. This is set to grow to £771 million by 2023, bringing an additional 6,600 jobs.

Start ups and creative industries

Glasgow is home to a diverse start up scene and in recent years, the city has attracted a number of digital media and tech start up companies.

One result has been the employment growth of the technology, media and telecoms sector, which has grown by 11.5% over the last five years. This industry is set to see a further 4.8% growth over the next five years, supported by the introduction of ultra-fast fibre network internet in the city. Download speeds will exceed one gigabit per second, making Glasgow one of the best connected cities in the UK.

The regeneration of the area around Port Dundas has created a new ‘cultural hub’, through the provision of collaborative workspaces, such as the Whisky Bond, along with event and exhibition space.

The expansion of Glasgow School of Art’s campus to include the previous Stow Campus site, alongside RSAMD’s increased studio provision will increase footfall to this area, connecting Cowcaddens and Garnethill.

Office market

Available Central Glasgow supply of all grades of office stock stood at 1.8 million sq ft at the end of 2016, which equated to a vacancy rate of around 13.7%. This has increased recently due to the availability of refurbished office space.

Central Glasgow supply of Grade A space (including new build and top refurbishments) stood at circa 400,000 sq ft at the end of 2016. With circa 53,000 sq ft of new Grade A stock currently under offer there is less than 13 months of Grade A supply remaining, which Savills classify as a shortfall.

Uncertain levels of demand due to perceived economic challenges has resulted in no speculative space under construction and we do not expect to see any new Grade A office development until 2020, at the earliest.

.png)

.png)

.png)

.png)