- In Greater Tokyo, even strong demand has been unable to keep pace with the elevated new supply levels, and vacancy rates have loosened again to 2.5%.

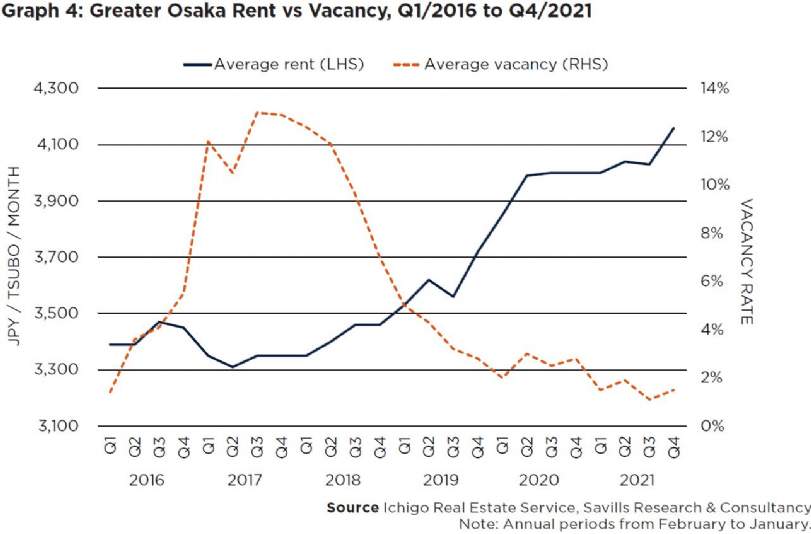

- On the other hand, vacancy rates have shrunk to 1.5% in Greater Osaka, as the region continues to experience robust demand.

- Rents in Greater Tokyo have risen by 4.8% year-on-year (YoY) and now average JPY4,620 per tsubo.

- Rents in Greater Osaka have also seen notable growth of 4.0%, and now stand at JPY4,160 per tsubo.

- In 2021, investment volumes in the logistics sector were lower than 2020 levels, but this was due to the exceptionally high levels seen in the previous year. Interest in the sector remains robust.

- While logistics real estate has performed well in recent years, investors should understand the key characteristics of the sector including low land values and the rising operational costs of tenants.

- Supply in both 2022 and 2023 is expected to surpass the record levels seen in 2021, suggesting that with the increased competition, logistics facilities that are older and poorly located may struggle.

Sector remains strong but latent risks emerging

Graph 4 | Greater Osaka Rent vs. Vacancy, Q1/2016 – Q4/2021

Logistics real estate has maintained its popularity, and cap rates have compressed even further as more capital has been poured into the sector. Leasing markets have also fared well despite the rapidly growing supply over the past few years. However, potential risks have started to emerge as fierce competition for acquisitions continues.

Savills Research & Consultancy