Traditional offices still have an important role to play, although the hybrid working model continues to proliferate across multiple industries.

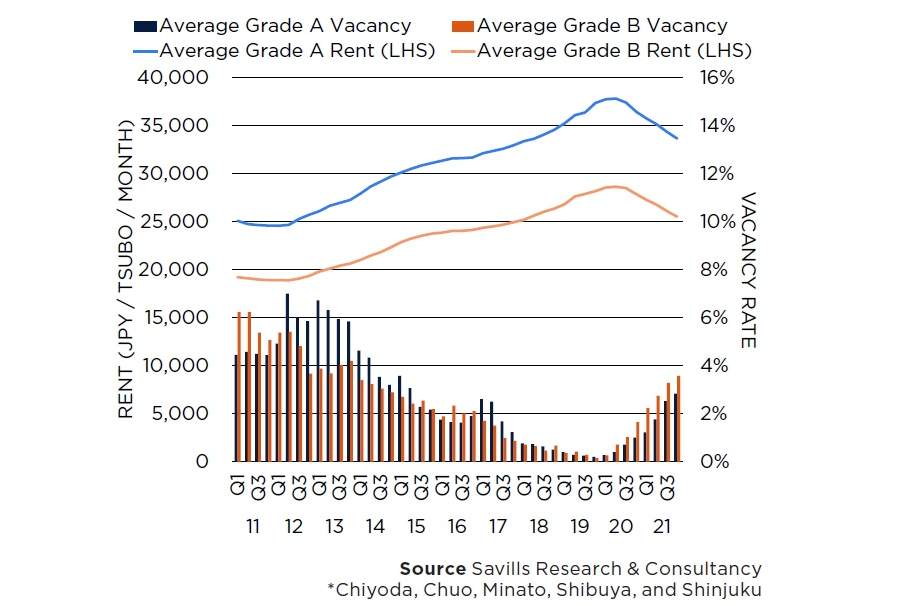

- While the pandemic has calmed down significantly, the prolonged lukewarm market sentiment has continued to impact office rents and vacancy in the central five wards (C5W).

- Average Grade A office market rents in the C5W fell 2.0% quarter-on-quarter (QoQ) and 7.6% year-on-year (YoY), and now stand at JPY33,681 per tsubo per month.

- The average Grade A office vacancy rate in the C5W increased by 0.3 percentage points (ppts) QoQ and 1.8ppts YoY to 2.8% in Q4/2021.

- Average large-scale Grade B office rents declined to JPY25,532 per tsubo per month – a contraction of 2.2% QoQ and 8.4% YoY.

- The average vacancy rate in the Grade B market loosened 0.3ppts QoQ and 1.9ppts YoY to 3.6%.

- With the pandemic in a manageable state and high vaccination rates, companies are considering gradually increasing office attendance while maintaining some level of remote work.

- Tenant preferences for easily accessible, larger, and newer offices persist, and some companies are changing their office layouts to support a hybrid working model.