- Japan’s social, political and economic stability, combined with low interest rates, continues to attract international capital.

- The populations of Japan and Tokyo are not forecast to see major changes over the next decade and should provide a steady foundation for the economy.

- Multiple large-scale developments are in the pipeline for completion by 2030, and they are expected to enhance the appeal of central Tokyo and attract more office and residential tenants.

- Other major cities across Japan have their own large-scale development plans and are likely to thrive as regional hubs.

- Technological game changers such as the proliferation of electric vehicles and autonomous driving could impact the economy and transform property demand.

- Potential concerns for Japan include the country’s high public debt levels, natural disasters, and geopolitical tensions.

- The country’s safe-haven status, alongside the depth and liquidity of its real estate markets supported by some of the region’s best infrastructure, will ensure the enduring appeal of Japan among international real estate investors.

Steady growth in Asia’s largest real estate market expected to 2030

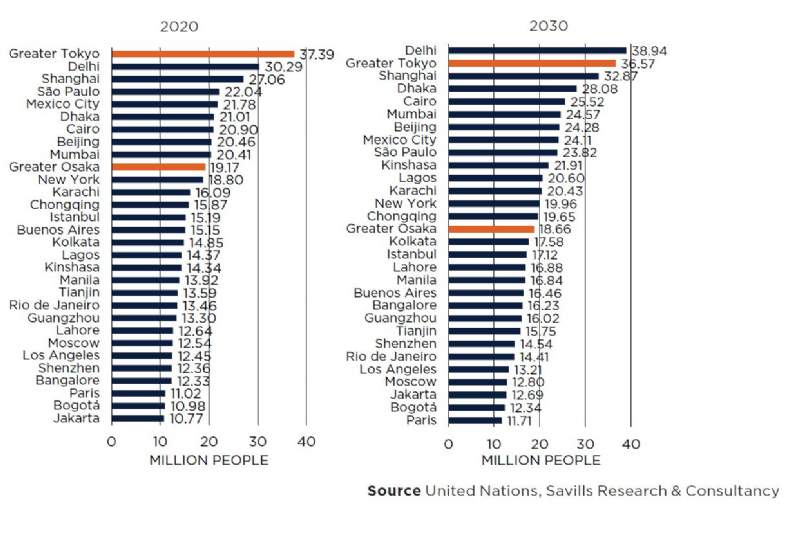

Graph 3 | Most Populated Cities, 2020 and 2030

Japan remains a popular destination for international real estate capital due to its stable government, the resilience of its large economy and its attractive funding conditions. The country typically accounts for the largest share of real estate transaction volumes in the region, supported by a strong domestic investor base. While the country’s population is ageing and shrinking, this is occurring at manageable levels, at least over the next decade. Looking ahead, the depth and liquidity of the Tokyo market is increasingly being mirrored in other cities including Osaka, Nagoya, and Fukuoka, offering a more diverse choice to investors.

Savills Research & Consultancy