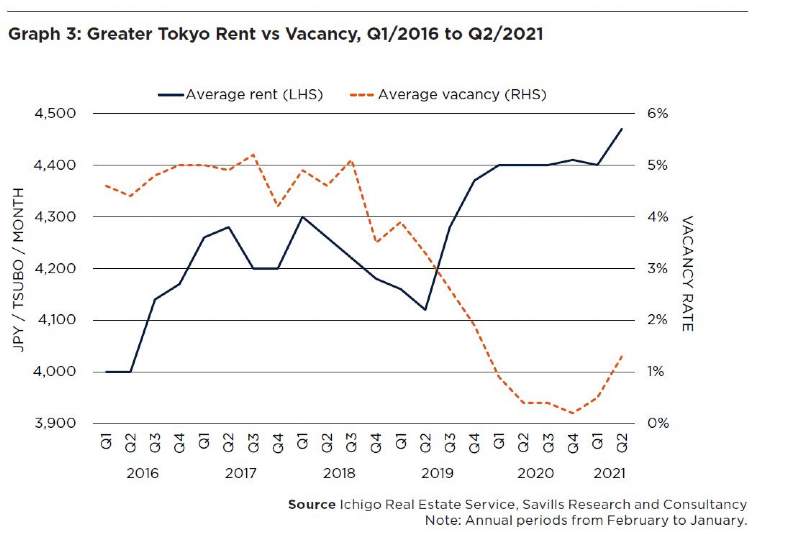

- Demand was unable to fully keep up with the high levels of supply in the first half of 2021 in Greater Tokyo, and as such vacancy rates have loosened to 1.3%.

- Greater Osaka’s vacancy rates have shrunk to 1.9% as the region experienced positive net absorption.

- Rents in Greater Tokyo are now at JPY4,470 per tsubo, increasing 1.6% year-on-year (YoY).

- Greater Osaka has also seen mild growth, with rents rising 1.3% YoY to JPY4,040 per tsubo.

- Investment volumes into the logistics sector have slowed into 2021, although interest in the sector remains abundant with multiple new developments being announced.

- The data centre sector is booming and witnessing multiple large scale development announcements. Meanwhile, the logistics sector has evolved from niche to mainstream and is nearing maturity.

- Fundamentals remain robust, but there may be some concerns over the large upcoming supply and some reversal of the accelerated growth seen in e-commerce.

Logistics sector going strong

Graph 3 | Greater Tokyo Rent vs. Vacancy, Q1/2016 – Q2/2021

For now, the logistics sector is thriving. It does, however, face concerns over its large supply, as well as a potential reversal from e-commerce to brick-and-mortar retail once the pandemic subsides. Nonetheless, its strong fundamentals and long-term stable leasing structure make logistics assets very attractive for prospective investors.

Savills Research & Consultancy

.jpg)