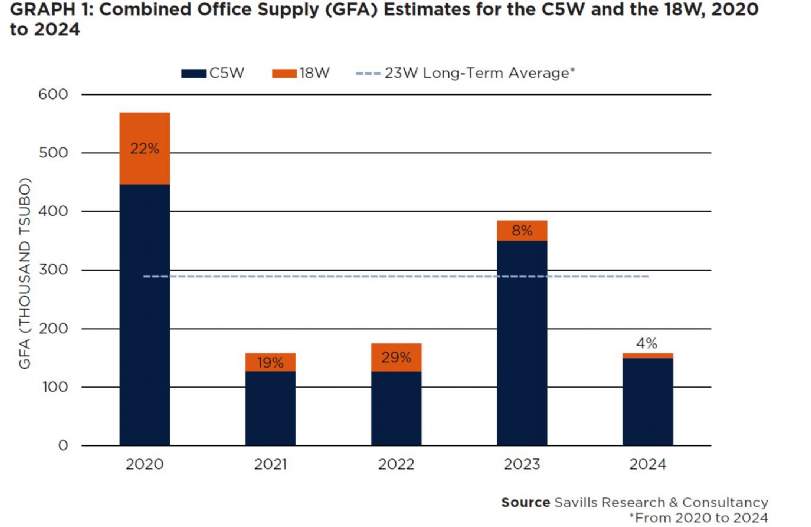

- The large influx of supply that 2020 brought to the Grade A office market has been mostly absorbed. With limited supply expected in 2021 and 2022, the Tokyo office market should have time to cope with the secondary vacancy that is likely to emerge later this year.

- The next milestone for supply in the central five wards (C5W) will be in 2023, with nearly 350,000 tsubo of GFA estimated to come online. Thereafter, 2025 will be in focus with an estimated 500,000 tsubo of GFA coming online.

- Toranomon, Minato will lead the next supply influx in 2023 and 2024 with the completion of the Toranomon-Azabudai project. Other submarkets such as Shibaura & Hamamatsucho and Shibuya will also be seeing large supply.

- Various economic indicators are showing that the economy is undergoing recovery, although the delayed start of vaccinations in Japan may slow the recovery of the overall economy, including the Tokyo office market.

- As the post-pandemic world comes into view, the office market has started to show its ability to adapt by addressing diversifying tenant needs. Location, and to a lesser extent flexibility in leasing, now matter more than ever in order to attract tenants.

Whilst the worst appears to be over, concerns linger over secondary vacancy and future supply

The shift towards teleworking appears manageable for the Tokyo Grade A office market for now. Even so, looming concerns remain over the emergence of secondary vacancy from offices newly supplied during 2020, as well as the elevated supply levels expected in 2023. For the time being, the market has paused, while the acceleration of the vaccine rollout should act as a tailwind for an eventual economic recovery, and by proxy, a revival of office demand.

Savills Research & Consultancy