- Although vacancy edged up slightly during the year in Greater Tokyo, due to a continuing influx of supply, the market remains tight with sound pre-leasing activity.

- Greater Osaka vacancy continued to tighten as the market enjoys a reprieve after record supply came online in 2017.

- Asking rents have been trending downward in Greater Tokyo, though this partially reflects the fact that bay-side facilities with higher rents are largely occupied and not listed.

- In light of tightening vacancy and less incoming supply, asking rents have been rising in Greater Osaka.

- Developers of geographically disadvantageous properties tend to ratchet up automation features to ease potential tenants' concerns over their low accessibility to labour pools.

- Japan's e-commerce market continues to grow, which is buttressing logistics demand. Home-delivery fees continue to rise, though new delivery modes, such as Amazon Flex, could serve to make the shipping industry more efficient and cost effective.

Logistics demand remains robust

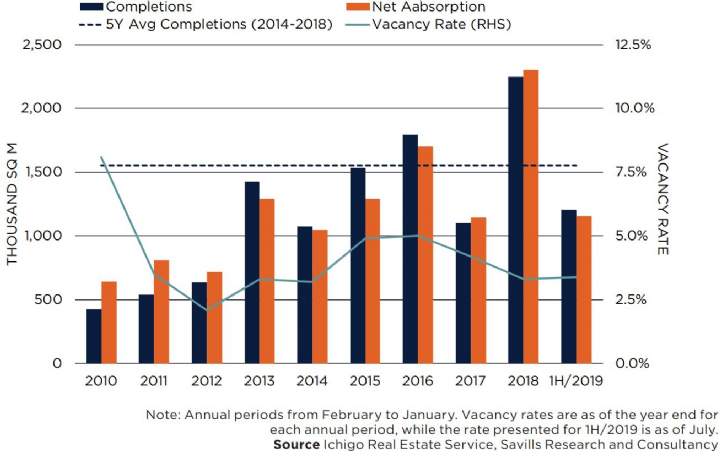

GRAPH 1 | Supply, Take-up And Vacancy In Greater Tokyo, 2010 to 1H/2019

Even amidst historically high supply levels, the logistics market remains strong as tenant demand for conveniently located, high-specification facilities is on the rise. Greater Osaka in particular has been improving performance since the market was disrupted by oversupply in 2017. Property investors have generally adopted a more bullish attitude towards the sector, and investment volumes appear set to rise in the second half of 2019.

Savills Research & Consultancy