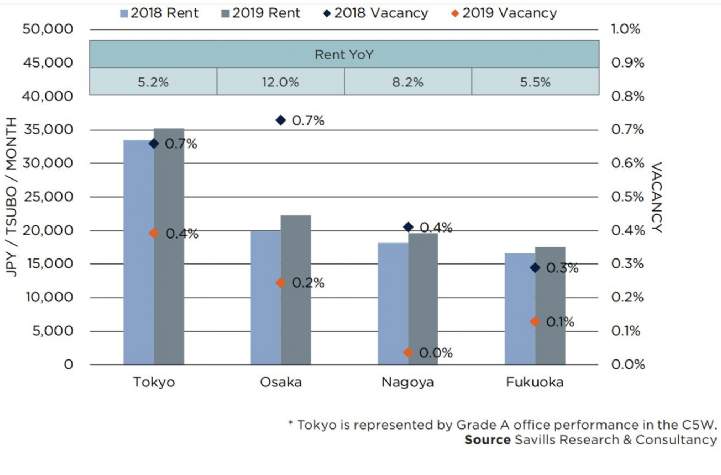

- High-grade office rents continue to post strong overall growth. Average rents in Osaka are up 12.0% YoY, while rents in Nagoya and Fukuoka have increased 8.2% and 5.5%, respectively.

- Average high-grade vacancy in the three major markets is now below 0.5%. All markets saw vacancy fall by at least 0.2ppts YoY, with Osaka posting a drop of 0.5ppts. Availability remains extremely tight and upcoming supply is limited.

- All-grade office rents continue to rise steadily and growth has spread to areas beyond station-front submarkets. Average YoY growth ranges from 1.1% in Sendai to 5.0% in Fukuoka.

- Commercial land prices outside of Japan's top metro areas grew for the second consecutive year. "High-use" locations in major regional cities are now seeing stronger price growth than those in Tokyo.

- With an unprecedented level of tightness in regional office markets, some players are converting space in station-side retail facilities for office use.

Regional office performance remains strong

GRAPH 1 | High-grade Office Performance, 1H/2019

Regional office markets continue to perform well and are attracting more attention from investors. As expected, low tenant turnover has cooled overall rental growth in some top submarkets, though other areas are gaining ground.

Savills Research & Consultancy