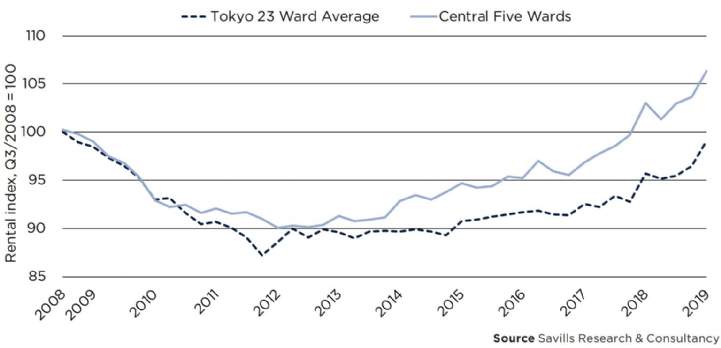

- Average mid-market asking rents in Tokyo's 23 wards (23W) stood at JPY3,927 per sq m at the end of Q1/2019, up 2.7% QoQ and 3.6% YoY.

- Average asking rents in the central five wards (C5W) were JPY4,674 per sq m at the end of Q1/2019, up 2.6% QoQ and 3.2% YoY.

- The C5W's premium over the 23W average has dipped by 0.1ppts to 19%, but is still 2.3ppts higher than the five-year average.

- The Inner North once again recorded the strongest annual growth as its proximity to the centre, coupled with a healthy discount to the C5W, attracts demand.

- The Inner East rents are steadily approaching the 23W average as new supply comes online.

- Smaller size band rents once again command a premium after a strong 2018 for larger size bands. The small sample sizes of larger size bands have been contributing to volatility.

- Occupancy rates remained high in Q1/2019, at 97.0% in the 23W, though small pockets of vacancy generated some volatility.

- High condo prices could tempt prospective buyers to rent for the time being, supporting leasing demand, though wealthy residents still appear interested in luxury properties

Rents are rising across the 23W

GRAPH 1 | Mid-market Apartment Rental Index, Q3/2008 to Q1/2019

Tokyo rents continue to rise steadily as positive net migration bolsters the urban population, average incomes rise, and a steady supply of new stock comes online. Outer wards are posting above-average growth.

Savills Research & Consultancy