Although the market continues to correct, we note signs that the rate of adjustment is slowing.

- For the central five wards (C5W), COVID-19 is still taking a toll on the market and casting a shadow over the market’s future, although the impact appears to be showing signs of alleviation.

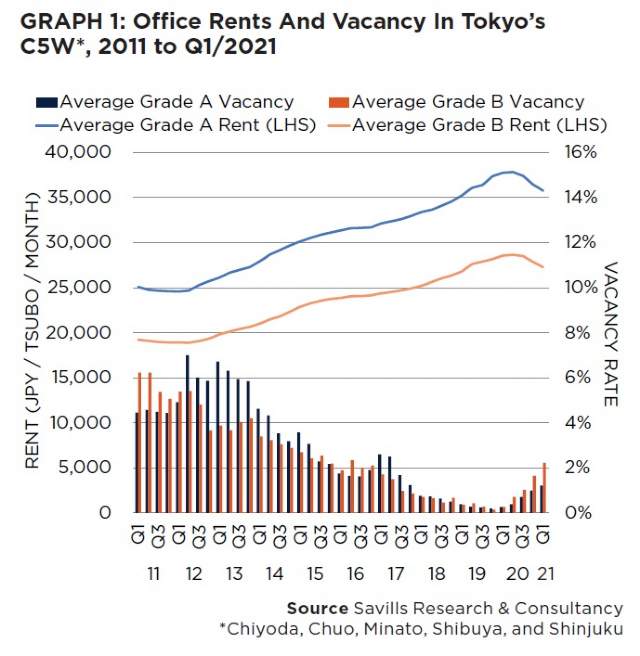

- Average Grade A office market rents in the C5W fell 1.9% quarter-on-quarter (QoQ) and 5.3% year-on-year (YoY), and now stand at JPY35,762 per tsubo per month.

- The average Grade A office vacancy rate in the C5W increased slightly by 0.2 percentage points (ppts) QoQ to 1.2% in Q1/2021.

- Average large-scale Grade B office rents declined to JPY27,275 per tsubo per month – a contraction of 2.1% QoQ and 4.5% YoY.

- The average vacancy rate in the Grade B market lies at 2.2% following a loosening of 0.6ppts QoQ and 2.0ppts YoY.

- With limited supply expected this year and the next, the market should have time to adjust and recover, although secondary vacancy derived from the large supply in 2020 is a concern.

- While prime real estate is expected to hold steady, rents in poorly located and older offices are likely to fall, resulting in an overall market deterioration.

.jpg)