- Average 1F rental growth in Tokyo was sound in 1H/2020, with Shinjuku impressing over the year. Even so, rents have been inflated by the listing of previously in-demand prime assets, and as such, market conditions are very different in reality.

- As in the office sector, asset location and quality will be key in coping with the ongoing uncertainty.

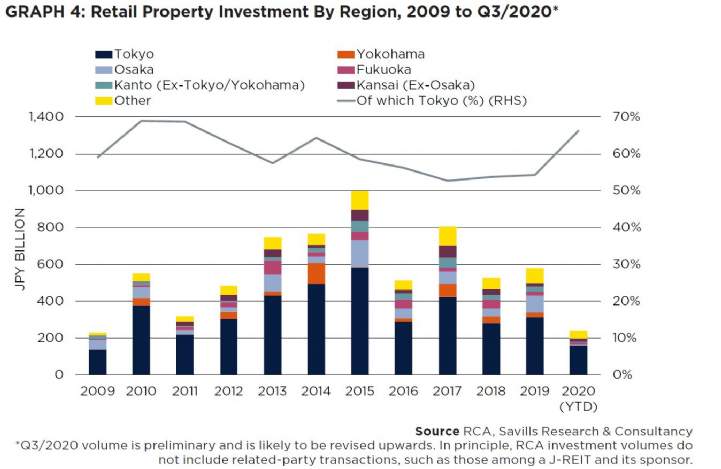

- Equity investors appear to have some faith in the retail sector for the time being, with retail J-REITs performing relatively well. Investment flows, however, remain suppressed.

- Without the end of the pandemic in sight, new consumer behaviours are likely to emerge. For that reason, the outlook for the sector remains downbeat.

Sound rental growth masking reality

Amid the economic hardship, retail rents counter-intuitively experienced solid growth. Much of this, however, was driven by the availability of previously unattainable prime assets – paradoxically boosting listed rents. Going forward, asset location will be critical, whilst early adaptors to the new landscape are likely to become successful retailers.

Savills Research & Consultancy

.jpg)