ECONOMIC REVIEW

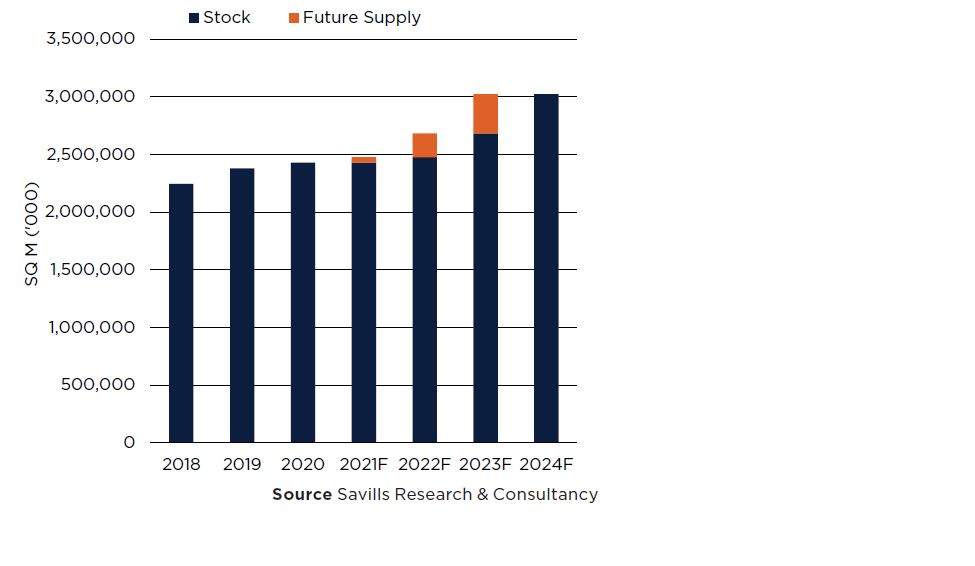

- Bangkok’s total retail supply reached 8.8 million sq m in 2020, of which 2.4 million sq m is considered to be prime.

- Average rents for prime retail in CBD remained stable in Q4/2020 at THB2,550 per sq m per month, a trend that is anticipated to continue through 2021.

- The prime retail occupancy rate increased by 0.8% from the previous quarter.

- Social distancing measures made a return to Bangkok in December 2020, leading to reduced footfall across most prime retail malls, which looks likely to continue through Q1/2021.

“With Bangkok’s retailers having struggled through lockdown and social distancing measures in 2020, 2021 will likely be the year that retailers look to increase their online presence to help recover their lost sales.”

MARKET COMMENTARY

The Bangkok retail environment endured through to the end of 2020 having struggled with reduced foot traffic and lower spending for most of the year. There was some slight optimism to be seen through the rise in the Consumer Confidence Index, which had risen to 52.4 in November, up from a low of 47.2 in April, though this positivity was quickly overwhelmed in December by the news of a return of local COVID-19 transmissions throughout the country.

Total prime retail stock in Q4/2020 equaled 2,429,641 sq m, having increased by 2% YoY with the opening of a new suburban mall earlier in the year, Siam Premium Outlet, a luxury premium outlet mall of 50,000 sq m net lettable area, which was the first joint venture project between Simon Property Group and Siam Piwat Group.

.jpg)