- Despite the large number of completions during the year, vacancy rates continued to decline in Greater Tokyo as preleasing remained strong.

- Stability has returned to the Greater Osaka submarket, resulting in a second successive year of positive net absorption. Vacancy rates fell sharply once more as a result.

- Asking rents have seen their downtrend stymied in Greater Tokyo and have subsequently bounced back to reach decade highs. With the availability of prime assets scarce, locations outside the capital, particularly those along major expressways, have benefitted.

- A slight adjustment in Q3/2019 notwithstanding, rents have grown impressively over the year in Greater Osaka.

- Interest in the logistics sector is set to intensify considering the sector’s strong fundamentals, higher yield relative to other core assets and the prospect of low inflation for the foreseeable future.

- The ongoing national labour shortage continues to weigh on the sector. That said, steps are being taken to use technology to combat cost-pressures arising from this trend.

- Increased competition, both with entrenched online platforms, as well as in nascent sectors within the e-commerce industry, such as the online food and beverages (F&B) market, implies further growth potential for the logistics sector over the longer term.

Logistics sector carries the day

.jpg)

Graph 1 | Supply, Take-up And Vacancy In Greater Tokyo, 2010 to 2019

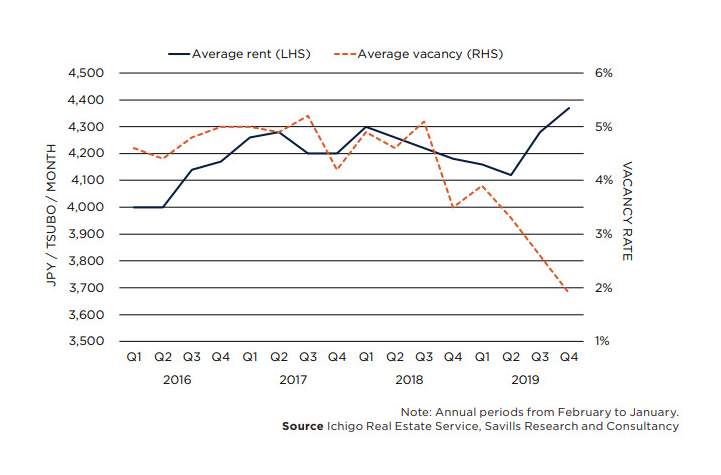

Graph 2 | Greater Tokyo Rent Vs Vacancy, Q1/2016 to Q4/2019

Despite supply increasing significantly in Greater Tokyo, vacancy rates tightened and rents rose, highlighting the solid underlying fundamentals in the submarket. Supply to the Greater Osaka market, on the other hand, has continued to ease. This was expected, however, given the spike in completions experienced in 2017, and has been a necessary condition for the market to stabilise. New supply in both submarkets is expected to be solid this year. As for investors, the sector’s long-term prospects remain attractive, and this is set to continue as technology is adopted in order to counter ongoing labour shortages. For the time being, therefore, rental growth should be steady.

2019 was a year to remember for the logistics sector. With the sector’s potential upside, investors were competing fiercely to get some exposure to the asset class. Investment volumes and completions hit record highs, whilst logistics J-REIT unit prices soared. Looking forward, new initiatives by major retailers, such as Aeon and Nike, may have profound implications not only for the logistics sector, but also for retail.

Savills Research & Consultancy