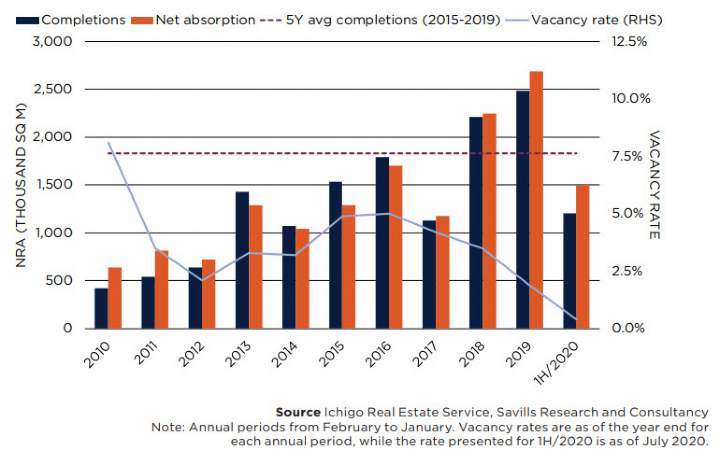

- Despite supply continuing to grow in Greater Tokyo, thanks to solid pre-leasing activity and substantial demand, vacancy rates have dropped to a historic low of 0.4%.

- The vacancy rate in Greater Osaka experienced a slight uptick following the completion of the huge ESR Amagasaki Distribution Center. Even so, a recent stabilisation of market fundamentals should mean that this trend is fleeting.

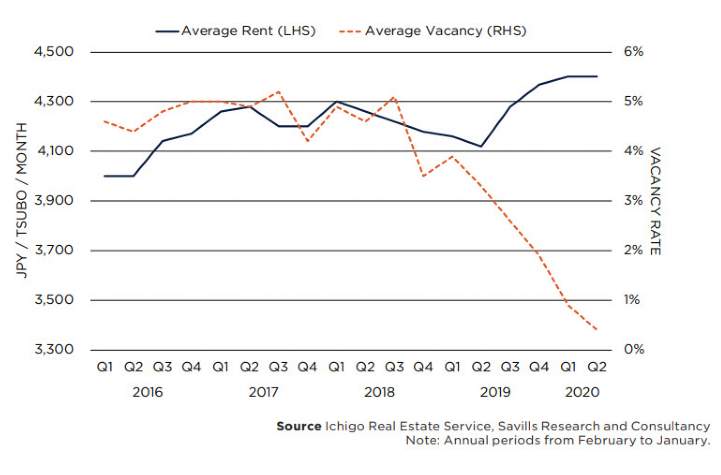

- Given the airtight conditions, rental growth in Greater Tokyo was close to 7% over the year. Facilities along the bay still attract the highest rents and this is unlikely to change going forward.

- Rents in Greater Osaka experienced historical growth of over 10% YoY, and now surpass the highs set before the financial crisis.

- Competition for assets has become even more fierce, leading to valuations appearing more stretched, including in the J-REIT market.

- Facilities in subsectors such as those catering for lastmile delivery services and cold storage capabilities have garnered further attention of late. Even so, these remain a small segment within the broader market.

Logistics sector reigns supreme

Graph 1 | Supply, Take-up And Vacancy In Greater Tokyo, 2010 to 1H/2020

Graph 2 | Greater Tokyo Rent Vs Vacancy, Q1/2016 to Q2/2020

Even amid a global pandemic, the logistics sector appears to be in good shape. Indeed, with demand supported by the proliferation of e-commerce during the outbreak, the sizeable supply expected over the next few years has done little to deter the market. Yet, whilst some turbulence could emerge over the short-term as the financial resilience of some tenants starts to be tested, the long-term prospects of the sector continue to be driven by the structural changes that e-commerce presents, and as such, rents should follow suit.

The global pandemic has reinforced the importance of e-commerce to everyday life, and the logistics sector has been a prime benefi ciary of this trend. As such, market fundamentals appear sound. Whilst the uncertainties surrounding COVID-19 could cause some unrest going forward, the sector continues to be underpinned by structural changes driven by e-commerce. In the meantime, valuations are likely to continue to be put under pressure.

Savills Research & Consultancy