2020 was a year of high hopes for the Japanese hospitality market. Emboldened by the Tokyo Olympics and the rapid growth of tourism since 2013, the national government had originally aimed for 40 million overseas visitors for the year. These hopes have undoubtedly been dashed by the COVID-19 pandemic, with just four million visitors entering the country in the fi rst half of the year – a 76.3% decline over the fi rst half of 2019. As would be expected, the vast majority of these visitors entered the country in January and February, prior to any signifi cant border closures, with only 2,600 recorded entries in June. Indeed, Japan is eff ectively as closed off as it was during the isolationist Edo Period, creating an unprecedented challenge for hoteliers.

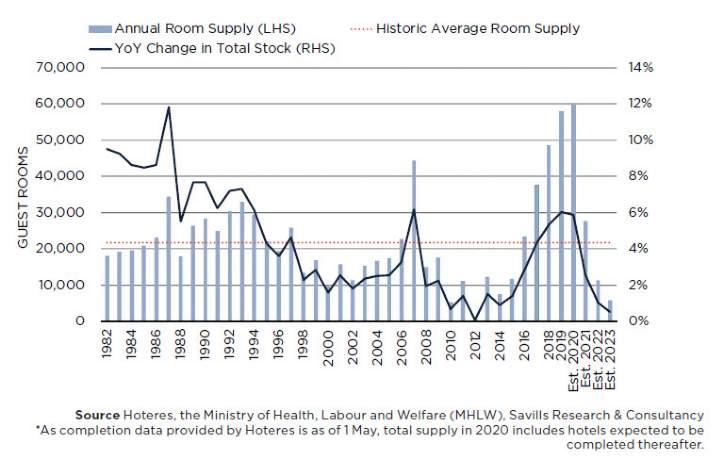

Moreover, with record room supply entering the market in 2019 and 2020, the COVID-19 crisis has arguably come at the worst possible time (Graph 2). Soaring inbound tourism and the upcoming Tokyo Olympics prompted a spate of new developments from 2017 to 2020, mostly in the budget and limited-service hotel subsectors. Fortunately, supply looks set to cool signifi cantly in 2021 and beyond. Operators capable of weathering the storm until then may fi nd themselves in a more advantageous position when the dust settles.