- With existing vacancy airtight and new supply in 2020 mostly filled or pre-leased, the Grade A office market, which typically hosts high credit tenants, currently remains on firm ground.

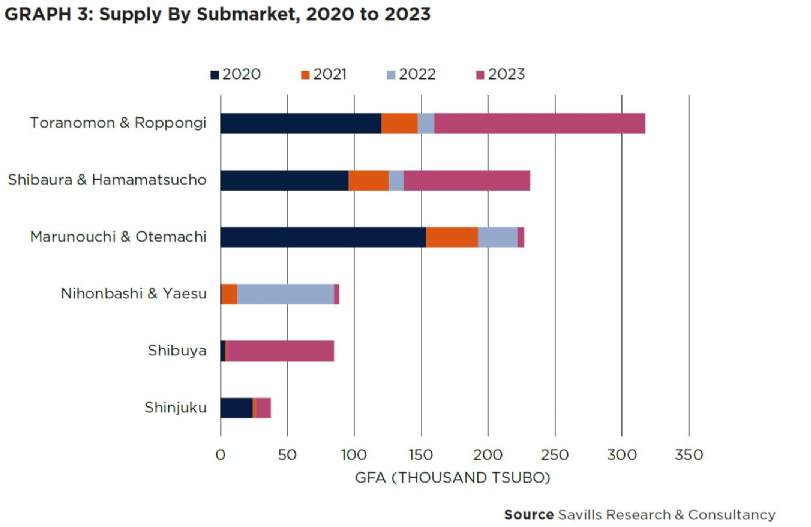

- 2020 is set to be a historic year in terms of office supply, with some 450,000 tsubo of GFA estimated to come online in the central five wards (C5W) alone. After a lull in the two years to follow, 2023 is the next milestone, likely succeeded by 2025 thereafter.

- Although much of the new supply remains concentrated in the C5W, the relative value offered in the 18 outer wards (18W) should lead to a rise in the area’s proportion of projects over the next few years.

- Shibuya, which saw significant levels of new supply in 2019 will be much quieter this time around. Business districts such as Otemachi and Toranomon will instead lead the charge in 2020. Meanwhile, 2023 is likely to be a year to remember for the latter, following the completion of the Toranomon-Azabudai Project.

- COVID-19 has already had a profound impact on daily working life for employees. For landlords, the crisis appears to have made prime assets even more valuable as location now matters more than ever.

- With the transition in work styles notably varying amongst companies of different industries and scale, the landscape of the Grade A office market in the C5W could undergo noticeable change.

- Alternatively, the rapid and widespread distribution of a viable vaccine could see these seismic shifts crimped.

- Uncertainties abound and some market volatility is expected on the path to normalisation, with vacancy rates likely to pick up going forward.

Imminent supply appears manageable but potential paradigm shift awaits

Despite the significant levels of office supply expected this year, any lingering concerns about a glut have been eased with most of it already filled or pre-leased. For now, office fundamentals appear sound, but the long-lasting effects of the pandemic and the resulting acceleration of workplace reform could lead to a paradigm shift in the office market.

Savills Research & Consultancy