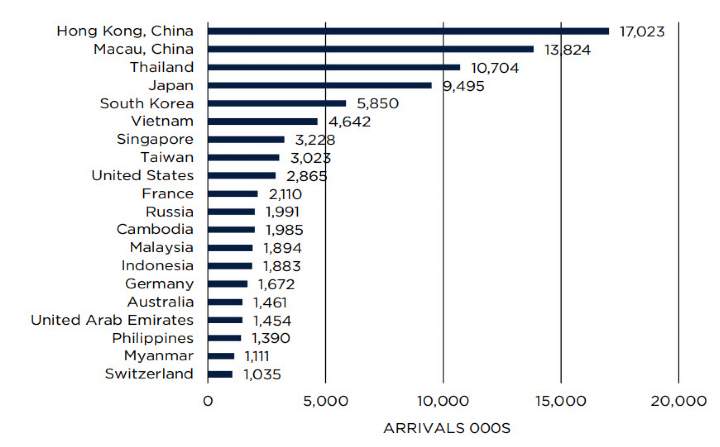

The rapid economic growth of Asia-Pacific has had wide ranging consequences; supply chains have grown to exploit comparative advantages, particularly land and labour costs; investment capital has become better able and more willing to cross borders in search of higher returns and the benefits of diversification; and intra-regional travel and tourism has hit all time highs as more leisure time, higher incomes and substantial improvements in transport infrastructure have encouraged greater regional mobility.

This higher level of integration means that a relatively small disruption can have far reaching consequences, as any student of chaos theory will tell you. Disease in human populations is a very old disruptor and despite advances in medical science, a very unpredictable one. It is unfortunate that this particular virus originated and developed fastest in Asia’s largest economy with implications not just for the region’s economic wellbeing, but also the global economy. China is one of the world’s biggest importers of commodities and a powerhouse exporter of manufactures as well as being a significant destination for overseas capital and an increasingly important source of outbound investment funds. According to the IMF, China accounted for 39% of global economic expansion in 2019. At its peak in 2016, mainland investors invested US$35 billion in overseas real estate markets.

.jpg)