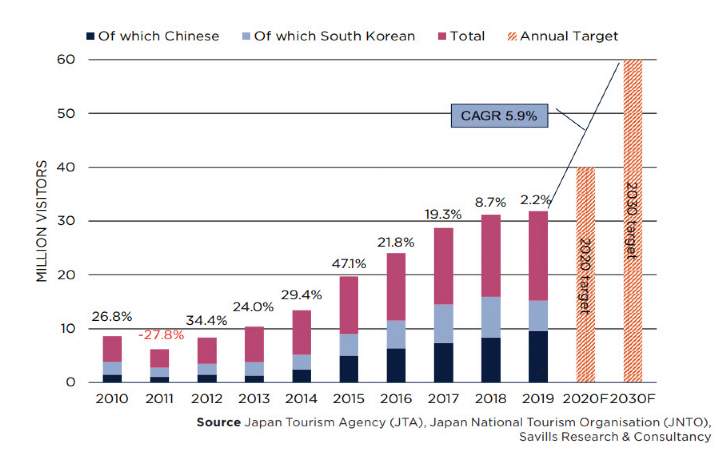

Based on preliminary data from the Japan National Tourism Organization (JNTO), Japan welcomed around 31.9 million visitors in 2019 (Graph 1). This amounted to only a 2.2% increase year-on-year (YoY), despite the boost to inbound tourism in the run-up to the Rugby World Cup in September. In fact, visitor numbers surprisingly fell 0.6% YoY during the tournament as the disruptive impact of Typhoon Hagibis took hold. Although the positive annual change is welcome – the eighth year in a row – it now means that a growth rate of 25% would be required to hit the 2020 target of 40 million. This is certainly a tough ask, with the estimate made in mid-January by JTB Corporation, Japan’s largest travel agency, of 34 million visitors in 2020 being a case in point.

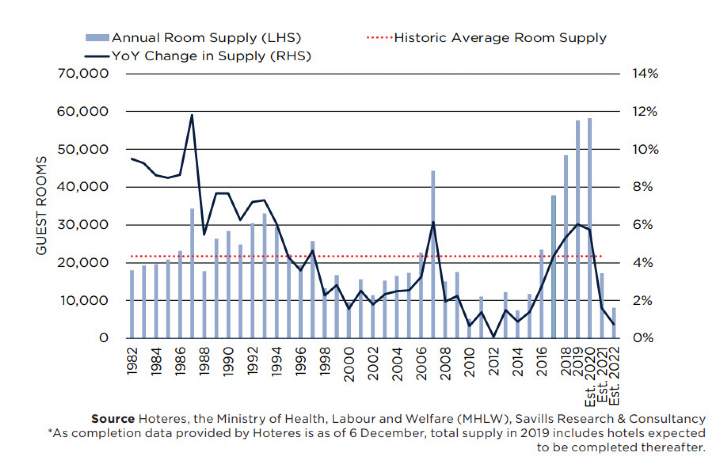

Major concerns include the large hotel supply, as well as the signifi cant drop in Korean visitors to Japan following the breakdown in relations between the two nations since August 2019. Having experienced a slight decline of 4% YoY for the fi rst seven months of 2019, this figure plummeted to a 60% YoY fall during the latter fi ve months. Yet, there appear to be early signs of some recovery. Inbound tourism from South Korea rebounded in November and December, growing 3.9% and 21.0%

.jpg)