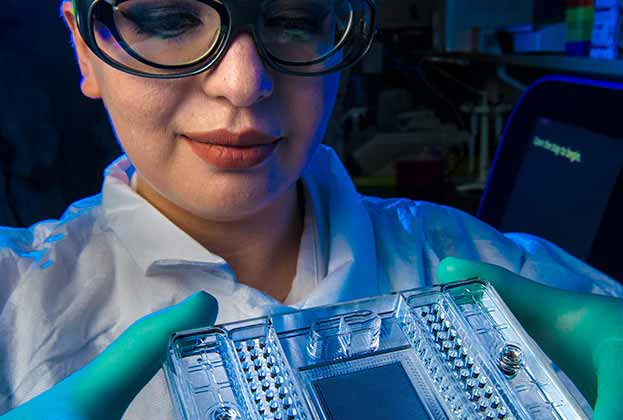

The production of medicines continues to play a pivotal role in the growth of Europe’s life science sector and is creating an increase in demand for manufacturing space across the continent. While R&D is critical, the delivery of products to the market is an essential component, but the rules governing Good Manufacturing Practice (GMP) relies on a specific set of requirements.

With this in mind, certain regions across Europe, in particular Ireland, Switzerland, the Netherlands, Belgium and Germany are now emerging as key hubs for biopharmaceutical manufacturing. This is largely due to a number of top-down government incentives that make these places attractive propositions for many occupiers looking to expand their operations.

What is a GMP facility?

GMP is best described as the set of guidelines and regulations which govern the consistent production and control of pharmaceuticals. These buildings are usually bespoke or built-to-suit, incorporating laboratory and office space, clean rooms, and warehouse space for production, storage and distribution.

Why Europe?

In a post-pandemic world, the spotlight has continued to shine on the life science sector, in particular on the creation and distribution of drugs, globally. The rapid dissemination of the Covid-19 vaccine highlighted the need for seamless delivery, with pharmaceutical companies seeing the benefit of creating product in Europe rather than relying on fragile global supply chains.

The European Medicines Agency (EMA) is another factor. It provides a robust regulatory framework meaning global companies can be assured of quality control and consistency in production.

There are also incentives to consider, with large firms often canvassing Europe to establish the best locations, taking into consideration everything from domestic R&D output and financial incentives to available government grants and access to talent. These are key reasons why, for instance, Bristol Myers Squibb chose to locate to Leiden Bio Science Park in the Netherlands, establishing a European base outside of its existing locations in the US and Asia.

Developer Provast is also building a circa 12,000 sq m GMP facility at Leiden for Batavia Biosciences, a Contract and Development Manufacturing Organisation (CDMO) active in the Netherlands. These schemes often require significant investment, providing a role for the real estate sector which can offer liquidity for costly projects outside of pharma businesses’ main focus and we believe there will be an increase in activity in this space in the coming years. For example, Savills advised CBRE IM on the development funding of this facility in 2022.

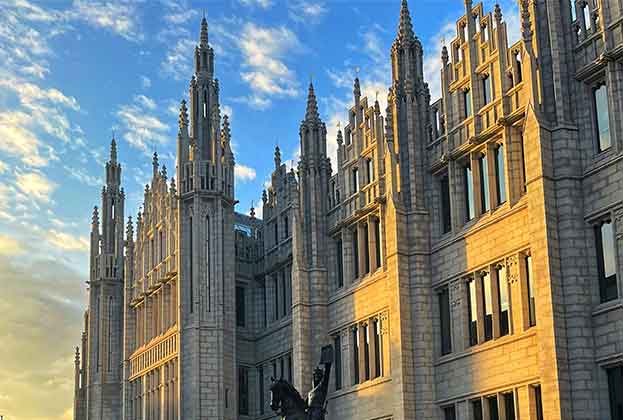

What about the UK?

The UK is another leading global location for biomanufacturing, underpinned by its world leading R&D and the production of technologies such as cell and gene therapy and vaccines. Given its size, it offers close proximity between the research hubs and the eventual development space. There are already a number of emerging UK centres of excellence, such as Stevenage where Autolus Therapeutics recently pre-let 6,967 sq m for a GMP facility to manufacture its T-cell cancer therapies.

What next?

This growth in manufacturing is not just driven by large pharmaceutical firms with their own facilities, but also smaller companies in the drug production phase. Unable to afford their own manufacturing space, they are utilising CDMOs which are in turn looking to the commercial real estate sector to finance their assets.

This will no doubt see further convergence of life sciences and industrial and logistics as we see increased demand for GMP facilities across Europe. This should ultimately mean opportunities for investors as these assets are typically built-to-suit and require funding. This will be essential infrastructure if sciences are to continue to grow across the continent.

Further information

Contact George Coleman

Spotlight: Life Sciences – Trends and Outlook

.jpg)

.jpg)

.jpg)