The rapid growth in e-commerce has led to a record high demand in the European logistics market from occupiers as well as investors.

This development supports climbing rent levels and decreasing yield levels – a trend we also recognise in Denmark.

We have completed an analysis of the European logistics sector. The analysis points out that the Covid-19 pandemic has contributed to an increase in e-commerce, which has resulted in record high activity in the European logistics market. A high level of activity that can be seen among investors as well as occupiers within the sector.

Recovery across the board

In 2021, Europe experienced an economic recovery where the eurozone economy grew by 5.1 % from -6.5 % in 2020. The latest manufacturing PMI[1] in the eurozone reached 58.7 in January 2022. 58.7 indicates continued growth in the logistics sector. The Covid-19 pandemic has provided tailwind to the e-commerce sector. From 2020 to 2021, online retail sales increased from 28% to 29% in the UK. In Denmark, we have seen a similar increase during the Covid-19 pandemic, where the e-commerce share of total turnover increased to 13.3 % by the end of 2021, up from 10.1 % in 2019 [2].

Record low vacancy in 2021

In 2021Q4 more than 40 million square metres of logistics space were let across Europe, according to the analysis. This marks a record year for letting activity in the logistics market. The high activity level is driven by the companies' increased need for storage space as well as a desire to minimise delivery times and avoid delivery delays.

In a fiercely competitive e-commerce market, delivery time is a potential competitive parameter. This has led to further intensified demand for warehouse and logistics properties. 46 % of European companies expect to increase their warehouse space during 2022.

In Denmark, we recognise the same trend in the largest cities with a high demand and an exceedingly limited supply, which has only become more pronounced in the past year.

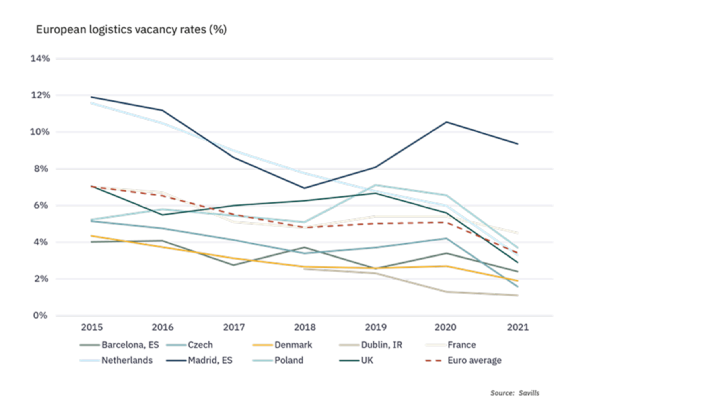

The low vacancy rate is a current issue in the European logistics segment. During 2021, the number of vacant logistics square metres dropped from 5.1 % to 3.5 % - which is a record low. In Denmark, the supply of vacant logistics square metres has been reduced to 1.4 %, which makes it one of the property markets with the largest shortage of supply.

Investment in logistics continue to rise

European investments in logistics properties reached €62 billion in 2021. This is an increase of 79 % compared to the five-year average. The UK has clearly taken the lead, with 31 % of the activity, which corresponds to €19.5 billion. However, Denmark ranks somewhat lower compared to our neighbours Sweden and Norway.

.png)

In light of the Covid-19 pandemic, value-add investors are increasingly looking at European logistics facilities in secondary locations. Similarly, in Denmark, we see more foreign investors broadening their geographical focus to find potential logistics facilities. Older and outdated logistics properties with development potential are typically found outside the largest cities in the country.

[1] The PMI (Purchasing Managers' Index) is used to indicate companies' expectations for economic growth. Numbers below 50 indicate a decrease in economic activity, while numbers above 50 indicate an increase in economic activity.

[2] Source: Retail Institute Scandinavia (2022)

.jpg)