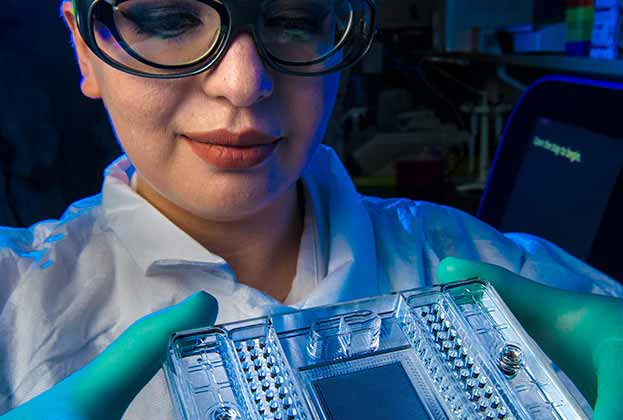

The European life science industry has attracted much attention from investors, developers and occupiers since the Covid-19 pandemic. The latest OECD data shows that the total spending on healthcare as a percentage of GDP has nearly doubled across the continent. The structural shifts required to ensure human health issues and needs are met, such as personalised medicine and an increasingly ageing society, will guarantee a continuation in the need to deliver scientific discovery, resulting in opportunities for the life science industry to grow rapidly in the years ahead.

For the life science industry to seize these opportunities, various types of investments are needed such as the right type of real estate, government support and funding, and finding and securing talent. Although all these investments are crucial for establishing a thriving life science industry, the availability of labour and talent is currently top of the list.

Indeed, a 2022 Randstad survey found that 33 per cent of C-suite and human capital leaders in the life science industry believe a shortage of talent is their biggest challenge. Furthermore, more than half (55 per cent) planned to hire extensively last year to avoid a shortage of staff which would slow their business growth.

Based on LinkedIn data there are at least 61,000 professionals currently active in the life science industry in Europe*. Most of these professionals are located in London (>4,400), Paris (>3,500), Madrid and Barcelona (>3,000), Warsaw (>1,200) and the Randstad region (Amsterdam, Rotterdam, The Hague, and Utrecht) in the Netherlands (>1,200).

These locations are aligned with London being the number one hotspot where the universities of Westminster, UCL, Imperial College and King’s College produce most talent with at least 1,300 professionals attending those universities and more than 285 graduates last year. This is followed by the Université Paris Cité (746 professionals attended the school with 276 graduates last year), Universidad Complutense de Madrid (795 professionals & 185 graduates), Universidad Autónoma de Madrid (607 professionals & 183 graduates), Universitat de Barcelona (651 professionals & 176 recent graduates) and University of Westminster in London (529 professionals & 79 graduates). These locations, the UK and France, reflect the core markets in the life science sector but also highlight the emerging market of Spain.

Real estate is one, albeit not the only, possibility for companies to differentiate themselves from the competition and can help to attract and retain this talent. Those with offices in the right (prime) locations with state-of-the-art equipment and amenities are expected to have an advantage over those with lower quality buildings in less attractive locations.

*LinkedIn data reflects a search for specified job titles related specifically to the life science industry. The used job titles include: Biomedical Scientist, Biotechnologist, Biochemist, Computational Biologist, Microbiologist, Clinical Research Associate, Clinical Research Scientist, Bioinformatician, Bioinformatics Specialist, Director Life Science, and Laboratory Specialist.

Further information

Contact Bram de Rijk

.jpg)

.jpg)

.jpg)

.jpg)