As part of the UK Government’s March Budget, a number of announcements were made regarding support for the country’s burgeoning life science sector including tax cuts for SME’s undertaking research and development (R&D), new vehicles for investment, and the reform of regulation around the creation of new medicines and medical technology.

So what does this mean in practice?

From an investment perspective, to develop the next generation of globally competitive companies that grow and list in the UK, the Government has proposed unlocking Defined Contribution (DC) pension fund investment into innovative businesses. This is something already permitted in the US, which is why the country has seen over £126.39 billion of venture capital investment over the past five years, compared with £9.97 billion in the UK. In fact, pension funds are one of the largest sources of capital for the private equity industry in America.

With this in mind, if UK private sector DC pension assets currently equate to circa £220 billion, just a 1.5 per cent asset allocation could see additional funding of around £3.3 billion. This is equivalent to a third of the VC total invested in UK-headquartered pharma and biotech companies over the past five years. If this figure got close to the US allocation, of around 10 per cent, this would equate to £22 billion - 44 per cent higher than the total recorded life science-related VC raised by UK-headquartered companies in the past 20 years.

Given the tougher funding market life science firms are currently facing, this could make a considerable difference to a business’s ability to make crucial real estate decisions.

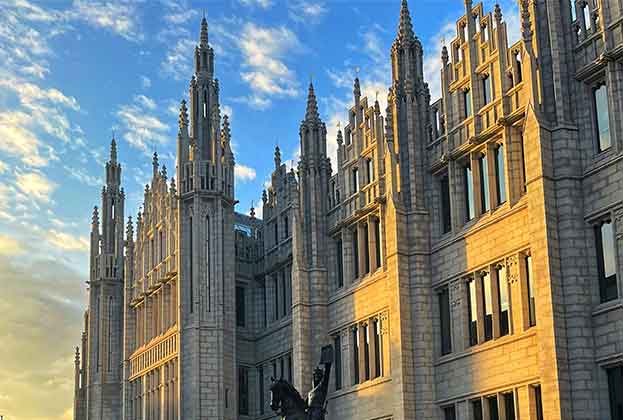

A lot has also been said about the UK’s world-leading R&D hubs. The Budget confirmed the Government’s commitment to the East West Rail, linking Oxford and Cambridge, with further announcements to come in May regarding the Bedford-Cambridge section, along with support from local authorities to develop plans for strategic economic growth around these new stations. With supply constrained in both cities, this interconnectivity should help unlock sites in fringe locations that will still benefit from existing ecosystems.

Boosting the supply of commercial development is therefore a priority with the Government set to release further details following the recent National Planning policy Framework consultation. At present, there’s over 4 million sq ft of science-related real estate requirements across the ‘Golden Triangle’, with new development absolutely critical to the growth of the sector.

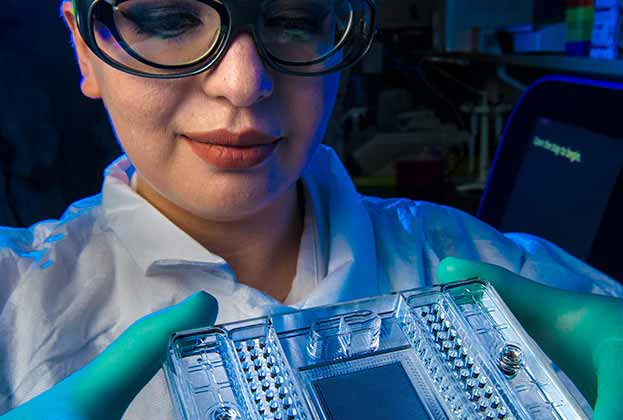

From a science perspective, the Medicines and Healthcare products Regulatory Agency (MHRA), the first drugs regulator in the world to authorise a Covid-19 vaccine, is set to become both faster and nimbler. Along with £10 million of extra funding over the next two years, the MHRA will maximise its use of Brexit freedoms in order to accelerate patient access to treatments.

As of 2024 medicines and therapies will be granted almost automatic regulatory approval for use in the UK if they’ve already been pre-approved elsewhere around the world. This will work in partnership with international agencies across the globe including in the US, Europe and Japan. This will no doubt make the UK an exciting destination for medical research, with the added benefit of attracting further investment.

Naysayers have questioned Britain’s world-leading status, claiming the country’s reputation has been inflated by historic successes, however improved regulation and new investment vehicles should improve its attractiveness and inject confidence back into the UK.

Further information

Contact Steve Chatfield or Steve Lang

.jpg)

.jpg)

.jpg)

.jpg)