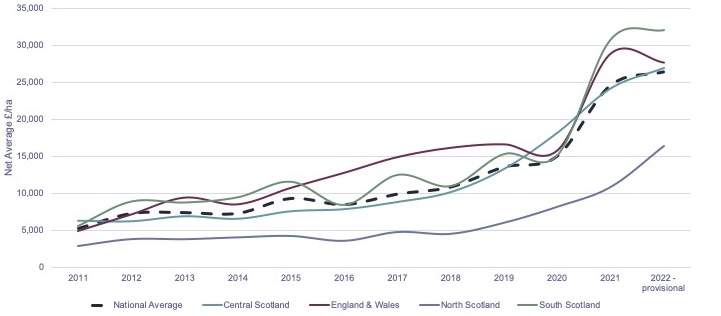

2021 saw extraordinary growth in the commercial forestry sector, with the average price per net productive hectare rising by just over 60 per cent across Great Britain. The catalysts for this remarkable growth were strong timber prices alongside an increased sense of urgency surrounding climate change and biodiversity loss.

Although at the time of writing it is too early to know about every sale completed during the 2022 forest year (1 October 2021–30 September 2022), preliminary research shows there has been a slowdown compared with the average value growth witnessed last year, and indeed single figure percentage growth for the first time in six years.

Some of this is to do with buyers taking a more cautious approach to investment in the knowledge valuations are currently high, but also a large amount of capital has been deployed in the past year. Alongside this there are concerns around the wider economy and war in Europe which undoubtedly have influenced sentiment for much of 2022.

The good news for investors is that prices did continue to rise, albeit more modestly, in times of uncertainty which shows the long-term defensive nature of forestry is still prevalent.

Values

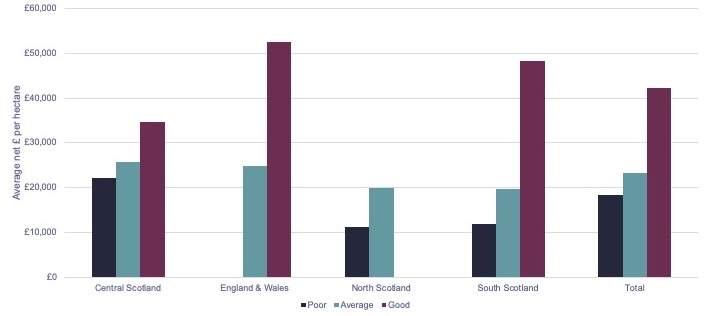

According to Savills database of forest sales, the average net productive value increased by 7.5 per cent across England, Wales and Scotland to around £26,400 per hectare. It’s important to note there can be huge variances in price dependent on region, quality and size of the forest. Additionally, the forest market is a small sample, perhaps only 60 to 80 properties trading a year, therefore these factors can influence the overall average price considerably.

Regionally

Historically, North Scotland may have been seen as less attractive by investors, but this year the region has witnessed significant value growth. Although the values still remain comparatively low at an average of £16,400 per hectare, these have increased by 51 per cent when compared to the previous year, mirroring the increase the other regions experienced in 2021.

Average net values per hectare 2011-2022